Vendor due diligence is the systematic process of evaluating potential third-party vendors before formal engagement. It is a critical risk management function designed to ensure any prospective partner aligns with an organisation's financial, operational, security, and ethical standards. Executed with precision, this process prevents costly operational disruptions and safeguards corporate reputation.

Why Modern Vendor Due Diligence Is a Strategic Imperative

In today's interconnected global economy, vendor partnerships are catalysts for innovation and growth. For senior leaders in German enterprises, however, legacy approaches to due diligence—static, checklist-driven exercises managed solely within procurement—are no longer sufficient. They represent a significant source of unmanaged risk.

This outdated model fails to address the dynamic nature of modern threats, from sophisticated cyberattacks originating within the supply chain to sudden geopolitical shifts that can halt production. A partner assessed as low-risk one quarter can become a primary liability in the next. Consequently, vendor due diligence must evolve from a tactical, compliance-focused task into a core strategic function of the enterprise.

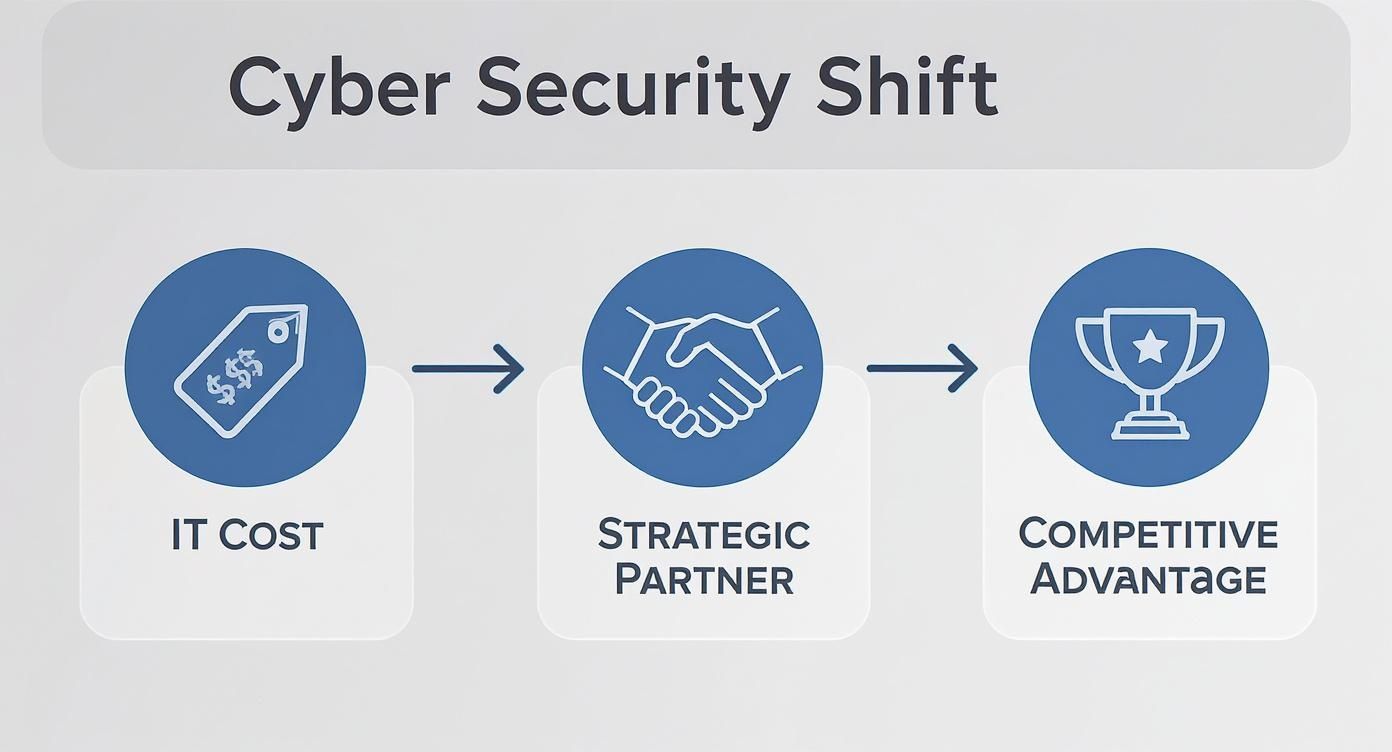

From Cost Centre to Competitive Advantage

Perceiving due diligence as a mere operational cost is a fundamental strategic error. A modern, robust framework serves as a powerful engine for corporate resilience and a distinct competitive advantage. By proactively identifying and mitigating risks within the vendor ecosystem, leadership not only protects operational integrity but also safeguards enterprise value.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

This strategic reorientation delivers tangible benefits:

- Enhanced Operational Stability: Ensures critical suppliers are financially solvent, operationally sound, and secure, thereby preventing disruptions.

- Improved Strategic Decision-Making: Equips leadership with the intelligence required to forge partnerships that align with long-term strategic objectives.

- Strengthened Corporate Reputation: Protects the brand by verifying that partners adhere to the same high ethical, social, and governance (ESG) standards.

- Accelerated Innovation: Provides the confidence to engage with emerging technology providers, such as AI firms, by thoroughly vetting their capabilities and associated risks upfront.

The Rise of the AI Co-Pilot

The complexity of assessing a global vendor network now exceeds the capacity of manual review. This is where Artificial Intelligence (AI) becomes an indispensable tool. Forward-thinking leaders are leveraging AI not merely for efficiency gains but as a strategic co-pilot for risk management. The intersection of strategy and technology in our detailed article provides further context on this synergy.

AI transforms vendor due diligence from a periodic, reactive snapshot into a continuous, predictive system. It analyzes vast datasets in real time—from financial reports to dark web chatter—to identify patterns and anomalies that signal emerging risks long before they escalate.

By integrating AI, this essential function transitions from a reactive, administrative burden to a proactive source of actionable intelligence. This new paradigm empowers organisations not only to protect themselves but also to seize market opportunities with greater speed and confidence, turning a compliance exercise into a strategic asset.

Navigating the German Regulatory and M&A Landscape

Leaders in Germany’s industrial and manufacturing sectors must navigate two powerful, intersecting forces that shape vendor relationships: stringent regulations and a dynamic M&A market. A misstep in one domain can trigger significant liabilities in the other. Mastering this landscape is no longer a compliance task but a core component of strategic planning and a true test of corporate resilience.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

A reactive posture is untenable. A forward-looking approach is required—one that anticipates future shifts and builds adaptive systems. Simply responding to new legislation or market trends consigns an organisation to a defensive position, which is ultimately a losing strategy.

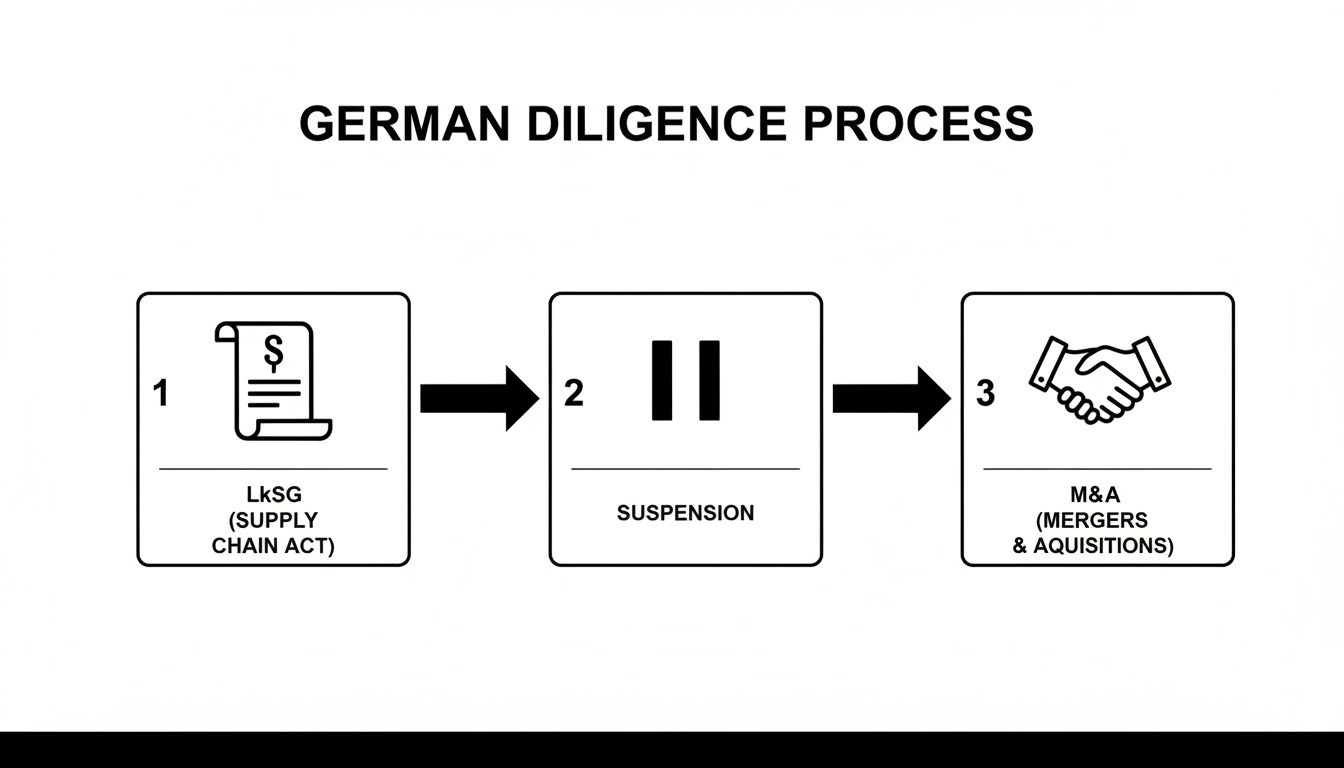

The LkSG: A Strategic Pause

The German Supply Chain Due Diligence Act (Lieferkettensorgfaltspflichtengesetz, or LkSG) exemplifies this challenge. As one of Europe's most demanding vendor compliance frameworks, it directly impacts over 4,000 German companies. However, in early 2025, a political decision was made to pause its full implementation. Harmonisation with its European counterpart now appears unlikely before 2028.

This delay should not be viewed as a reprieve but as a critical strategic window. It presents a rare opportunity to move beyond reactive compliance and build a truly future-proof vendor due diligence system. This is the moment to implement robust processes and intelligent, AI-driven tools, ensuring your organisation is not merely prepared but positioned as a leader when regulatory enforcement resumes.

The suspension of the LkSG offers a unique opportunity to transform due diligence from a cost centre into a source of competitive intelligence and operational stability. It is about preparing the organisation for the regulatory and market realities of tomorrow.

Waiting until the new deadline approaches will inevitably lead to an inefficient, last-minute scramble. The prudent course of action is to build these capabilities now, converting a regulatory challenge into a foundational business strength.

M&A Activity: The Commercial Accelerator

Parallel to regulatory pressures, the velocity of Germany's M&A market acts as a powerful commercial driver for robust vendor due diligence. An acquisition includes not only a target's assets but its entire vendor ecosystem, complete with latent risks. A slow, manual, or inadequate due diligence process can jeopardise deal valuations, delay closure, and create significant post-merger integration challenges.

The table below delineates these two key drivers. The regulatory "stick" and the M&A "carrot" both underscore the same strategic imperative: a modern, efficient due diligence process is non-negotiable.

Key Due Diligence Drivers in the German Market

| Driver | Strategic Implication For the Enterprise | Operational Requirement |

|---|---|---|

| Regulatory Compliance (e.g., LkSG) | Mitigation of legal and reputational risk is paramount. Non-compliance can result in substantial fines and brand erosion. | A systematic, auditable process for vetting all suppliers against human rights and environmental standards is essential. |

| Mergers & Acquisitions (M&A) | Speed and accuracy are critical to deal success. Delays or undiscovered risks can derail transactions and destroy shareholder value. | A rapid, scalable framework to assess a target's vendor portfolio for hidden liabilities, dependencies, and integration costs is required. |

Whether the motivation is satisfying regulators or accelerating a strategic acquisition, the underlying need is identical: a robust, data-driven system for achieving a comprehensive understanding of the vendor landscape.

For any senior manager involved in corporate development, the benefits of a streamlined process are clear. An effective vendor due diligence framework enables the M&A team to:

- Rapidly Assess Target Risk: Gain a clear, swift understanding of the operational, financial, and compliance health of a target's key suppliers.

- Identify Hidden Liabilities: Uncover risks such as single-supplier dependencies or contracts with adverse clauses before they become post-acquisition problems.

- Ensure Seamless Integration: Facilitate the smooth consolidation of the acquired vendor portfolio, avoiding business disruption.

A well-architected vendor assessment process is fundamental to successful corporate transactions. For a broader perspective, our guide on transaction advisory services and how they support strategic acquisitions is a valuable resource. By treating vendor due diligence as a core component of M&A strategy, deal flow can be accelerated and shareholder value protected with greater confidence.

A Strategic Framework For End-to-End Vendor Due Diligence

Effective vendor due diligence is not a generic checklist; it is a structured, end-to-end process that must be both rigorous and scalable. It should be conceptualised not as a series of disconnected checks but as a cohesive system for managing risk across the entire vendor lifecycle. For senior leadership in Germany, implementing such a framework is essential for navigating complex regulations and the velocity of modern business.

A foundational element of any robust framework is certainty of identity. Implementing robust identity verification processes at the outset confirms the legitimacy of the vendor entity and its key principals, ensuring engagement with a credible, legally sound partner from day one.

Phase 1: Risk Profiling and Scoping

Before commencing deep-dive analysis, the initial action is strategic triage. It is imperative to define the organisation's risk appetite and then categorise vendors accordingly. Not all partners warrant the same level of scrutiny. A supplier of critical manufacturing components demands a more intensive investigation than a provider of office stationery.

This initial scoping involves two key actions:

- Defining Risk Tiers: Segment vendors into logical tiers—such as Critical, High, Medium, and Low—based on their operational importance, the sensitivity of data they access, and the potential financial or reputational impact of a failure.

- Tailoring the Scope: Align the depth of due diligence with the vendor's assigned risk tier. This ensures resources are concentrated where they are most needed, reserving intensive efforts for high-stakes relationships.

AI can provide an immediate advantage in this phase. Predictive analytics can process initial vendor data to generate a preliminary risk score, flagging high-risk entities for immediate attention and streamlining the segmentation process.

Phase 2: Information Gathering and Verification

With the scope defined, the next phase is intelligence gathering. This involves the systematic collection and, critically, verification of information to build a complete, fact-based profile of the potential partner. The objective is to move beyond marketing claims to validate their actual standing through objective, third-party sources.

Key activities in this phase include:

- Deploying Custom Questionnaires: Distribute detailed questionnaires tailored to the vendor's risk level and service scope, covering areas from security protocols to compliance policies and operational resilience.

- Verifying Certifications: Independently confirm the validity of key certifications, such as ISO 27001 for information security or other industry-specific quality standards.

- Conducting Financial Health Checks: Assess long-term viability by analyzing financial statements and conducting credit checks to gain a clear picture of economic stability.

AI tools, particularly those leveraging Natural Language Processing (NLP), can significantly enhance this phase. They can automatically scan and extract key data points from lengthy contracts and policy documents, instantly highlighting potential red flags for expert human review.

This flowchart illustrates the primary external pressures shaping diligence processes for German companies, from regulatory mandates to the persistent drive of M&A activity.

The process flows from regulatory drivers like the Supply Chain Act, through strategic pauses such as the current LkSG suspension, and into the high-stakes environment of mergers and acquisitions, where speed and precision are paramount.

Phase 3: In-Depth Assessment and Reporting

This is the core analytical phase, where all collected data is synthesised into a holistic risk assessment. It requires a collaborative effort from experts in Legal, IT, Finance, and Procurement to evaluate the findings. The final output must be a clear, actionable report for decision-makers, providing a firm recommendation on engagement and outlining any necessary remediation steps.

The objective of the in-depth assessment is not merely to identify risks, but to quantify their potential impact and determine if they fall within the organisation’s accepted tolerance levels.

This phase is particularly critical in Germany's current M&A environment. In 2024, transactions in the DACH region increased by 15%, outpacing global trends. The average diligence timeframe for these deals was a substantial 169 days, highlighting the intensity of the process. This landscape provides a compelling business case for intelligent, AI-driven solutions that can accelerate vendor risk assessment without compromising rigour.

Phase 4: Continuous Monitoring and Offboarding

Vendor due diligence does not conclude with contract execution. Risk is dynamic; a vendor's security posture, financial health, or compliance status can change rapidly. A mature framework incorporates continuous monitoring throughout the relationship lifecycle.

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

This involves using automated tools to monitor public records, news reports, and security ratings for emerging red flags. When a partnership concludes, a formal offboarding process is equally vital. This ensures the termination of all data access, the return of company assets, and the fulfilment of final compliance obligations, securely closing the relationship loop.

Using AI to Augment Your Due Diligence Process

Executing vendor due diligence manually is akin to navigating the autobahn during rush hour with a paper map. It is slow, prone to error, and incapable of keeping pace with the real-time flow of risk.

Artificial intelligence fundamentally alters this equation. It functions as a sophisticated GPS, constantly recalculating the safest, most efficient route based on live data.

AI does not replace human judgment; it augments it with superior intelligence. This enables an organisation to shift from reacting to past problems to proactively anticipating future threats across its entire vendor ecosystem.

Accelerating Data Collection and Analysis

The most immediate benefit of AI is its capacity for speed and scale. It can process information in ways that are impossible for human teams. An AI platform acts as a tireless analyst, capable of interpreting thousands of documents, news articles, and financial reports in minutes rather than weeks.

This provides a truly comprehensive view of a potential partner.

AI tools excel in several key areas:

- Automated Data Aggregation: They autonomously pull information from myriad sources, including public databases, regulatory filings, financial reports, and adverse media scans.

- Intelligent Document Processing: Using Natural Language Processing (NLP), AI can analyse complex legal contracts and dense policy documents, instantly extracting critical clauses, identifying non-standard terms, and flagging potential compliance gaps.

- Pattern Recognition: Sophisticated algorithms can detect subtle patterns and correlations across vast datasets that are invisible to the human eye, identifying latent risks before they materialise.

This level of automation liberates experts from the manual labour of data gathering, allowing them to focus on high-value strategic analysis and decision-making. As these technologies are integrated, it is beneficial to revisit the fundamentals of risk management and compliance to ensure strategic alignment.

From Pilot to Enterprise-Wide Platform

Integrating AI into your vendor due diligence process does not require a massive, disruptive overhaul. A phased, strategic approach is most effective, delivering rapid value and building internal stakeholder support.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

A practical implementation roadmap typically follows these steps:

- Pilot Programme: Begin with a focused pilot project. Select a specific, high-risk vendor category—such as new SaaS providers or critical component suppliers—and use an AI tool to augment the existing process.

- Performance Measurement: Track key metrics rigorously. Quantify time saved in data collection, the number of new risks identified, and the improvement in assessment accuracy compared to manual methods.

- Scaled Integration: Leverage the success and learnings from the pilot to build a business case for a broader rollout. Gradually expand AI application to other vendor categories and integrate it with existing procurement and GRC systems.

- Continuous Optimisation: An AI platform is not a static tool. Continuously refine its performance by feeding it new data and incorporating team feedback to enhance the accuracy of its predictive models.

The strategic objective is to build an intelligent, enterprise-wide system that provides a single, real-time source of truth for the entire vendor network. This becomes a powerful asset for managing risk and enabling smarter decisions.

This methodical approach de-risks implementation and ensures a clear return on investment at each stage. Parallels can be drawn from other business functions; for instance, understanding how to actually use AI in sales offers a blueprint for leveraging data to make faster, more informed decisions. By integrating AI, you equip your organisation with the foresight needed to navigate the complexities of modern business with confidence.

Assessing High-Risk Vendor Categories

A one-size-fits-all approach to vendor due diligence is inefficient and exposes the organisation to unacceptable risk. The level of scrutiny must be proportional to the potential impact a vendor could have on operations, data, and reputation.

For German companies, particularly within the industrial and technology sectors, certain vendor categories present unique and elevated risks. They demand a deeper, more specialised assessment. Differentiating between a low-risk office supplier and a high-risk AI provider is the critical first step. This allows for the precise allocation of resources, focusing the most intensive efforts where they are most impactful and building a robust defence against the most significant threats.

Evaluating AI and LLM Providers

Engaging with providers of Artificial Intelligence (AI) and Large Language Models (LLMs) offers significant strategic potential but introduces novel and complex risks. The assessment must extend far beyond standard security checklists to probe the underlying technology itself.

Model-specific diligence questions are essential:

- Data Privacy and Training Data: What was the provenance of the model's training data? It is critical to determine if it contained proprietary or personal information and, crucially, whether appropriate consents were obtained in accordance with GDPR. A clear data lineage is necessary to avoid inheriting compliance liabilities.

- Intellectual Property (IP) Risks: Who owns the output generated by the AI? The contract must state unequivocally that the client organisation owns the IP created through its use of the service. This clause can prevent significant legal and commercial disputes.

- Model Bias and Reliability: Has the model undergone rigorous testing for biases (e.g., demographic, cultural) that could produce discriminatory or inaccurate results? Request documentation on testing methodologies and performance metrics to validate its reliability for the intended business application.

Scrutinising Cloud and SaaS Vendors

Cloud and Software-as-a-Service (SaaS) vendors are integral components of the modern corporate infrastructure, often hosting vast quantities of sensitive corporate and customer data. Their security and operational stability are, therefore, a direct extension of your own.

When you onboard a SaaS provider, you are effectively outsourcing a portion of your security and compliance responsibility. Their failure becomes your failure. Deep due diligence is not advisable; it is non-negotiable.

Focus scrutiny on these key areas:

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

- Data Security and Sovereignty: Determine the precise physical location of data storage. For any German enterprise, ensuring data remains within the EU to comply with GDPR is paramount. Verify data encryption standards, both in transit and at rest.

- Infrastructure Resilience and Disaster Recovery: What are the guaranteed uptime commitments in their Service Level Agreements (SLAs)? Scrutinise their business continuity and disaster recovery plans and request evidence of regular testing.

- Compliance and Certifications: Confirm their adherence to standards like ISO 27001 and whether they undergo regular SOC 2 audits. These independent attestations provide critical assurance of their internal controls.

Assessing Critical Component Suppliers

For Germany's world-class manufacturing and automotive industries, the supply chain is the lifeblood of the business. The failure of a single component from a critical supplier can halt production lines, resulting in millions in losses. Here, vendor due diligence must be laser-focused on operational resilience and continuity.

The investigation must rigorously address these points:

- Supply Chain Continuity: Assess their reliance on their own single-source suppliers ("fourth-party" risk). Evaluate their contingency plans for geopolitical instability, natural disasters, or significant logistical disruptions.

- Quality Control Systems: Obtain detailed documentation of their quality assurance processes and review historical performance data. For the most critical components, an on-site audit may be necessary to verify that documented practices are implemented effectively.

- Geopolitical and Financial Stability: Conduct a thorough analysis of the political stability of the supplier's operating region and their own financial health. A reliable partner today can become a high-risk liability tomorrow due to regional volatility or impending financial distress.

By adopting this category-specific approach, vendor due diligence evolves from a procedural exercise into a sharp, strategic instrument. For a deeper analysis of strengthening operational resilience, you can explore supply chain consulting strategies in our comprehensive guide. This focused methodology enables confident vendor partnerships, secure in the knowledge that the unique risks of each relationship have been properly addressed.

Building a Governance Model for Due Diligence Excellence

A superior vendor due diligence framework is only as effective as the organisational structure that supports it. Without clear ownership and executive sponsorship, even the most sophisticated processes will falter. To embed due diligence into the corporate DNA, it must be treated as an ongoing strategic function, not a one-off project. It requires visible leadership and a formal governance structure.

This necessitates moving beyond siloed departmental checks to establish a cohesive governance model. For German enterprises, this structure is the engine that drives consistency, accountability, and resilience across the entire vendor ecosystem. It ensures that gathered insights are not merely archived but are actively used to inform critical business decisions, transforming risk management from a defensive necessity into a dynamic, value-creating capability.

Establishing Clear Ownership and a Cross-Functional Committee

The foundation of any robust governance model is unambiguous accountability. Vague responsibility is its primary adversary. Leading organisations define specific roles and responsibilities for each key function, ensuring all stakeholders understand their part in the due diligence lifecycle.

This typically involves establishing a cross-functional oversight committee, a central command comprised of senior leaders from:

- Procurement: Manages frontline vendor communication and initial screening.

- Legal and Compliance: Navigates regulatory complexities, assesses contractual risks, and ensures adherence to all applicable laws.

- Information Technology and Security: Conducts deep-dive assessments of cybersecurity posture, data handling practices, and technical infrastructure.

- Finance: Evaluates financial stability and long-term viability.

This committee is responsible for setting the strategic direction. It defines the organisation's risk appetite, provides final approval on high-stakes assessments, and resolves any cross-departmental conflicts, thereby creating a unified, enterprise-wide approach.

Integrating Due Diligence into the Procurement Lifecycle

The marker of a mature programme is the seamless integration of due diligence into the entire procurement lifecycle—from initial vendor consideration to final offboarding. It should not be a final hurdle but a series of embedded checkpoints at every stage.

The ultimate objective of a governance model is to make rigorous due diligence an automatic, non-negotiable step in every vendor interaction. It becomes simply 'the way we do business', safeguarding the organisation by default.

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

When this is achieved, the process becomes cyclical rather than linear. Data from continuous monitoring feeds directly into contract renewals and performance reviews. A change in a key supplier's risk profile automatically triggers a reassessment, enabling the organisation to respond swiftly to emerging threats.

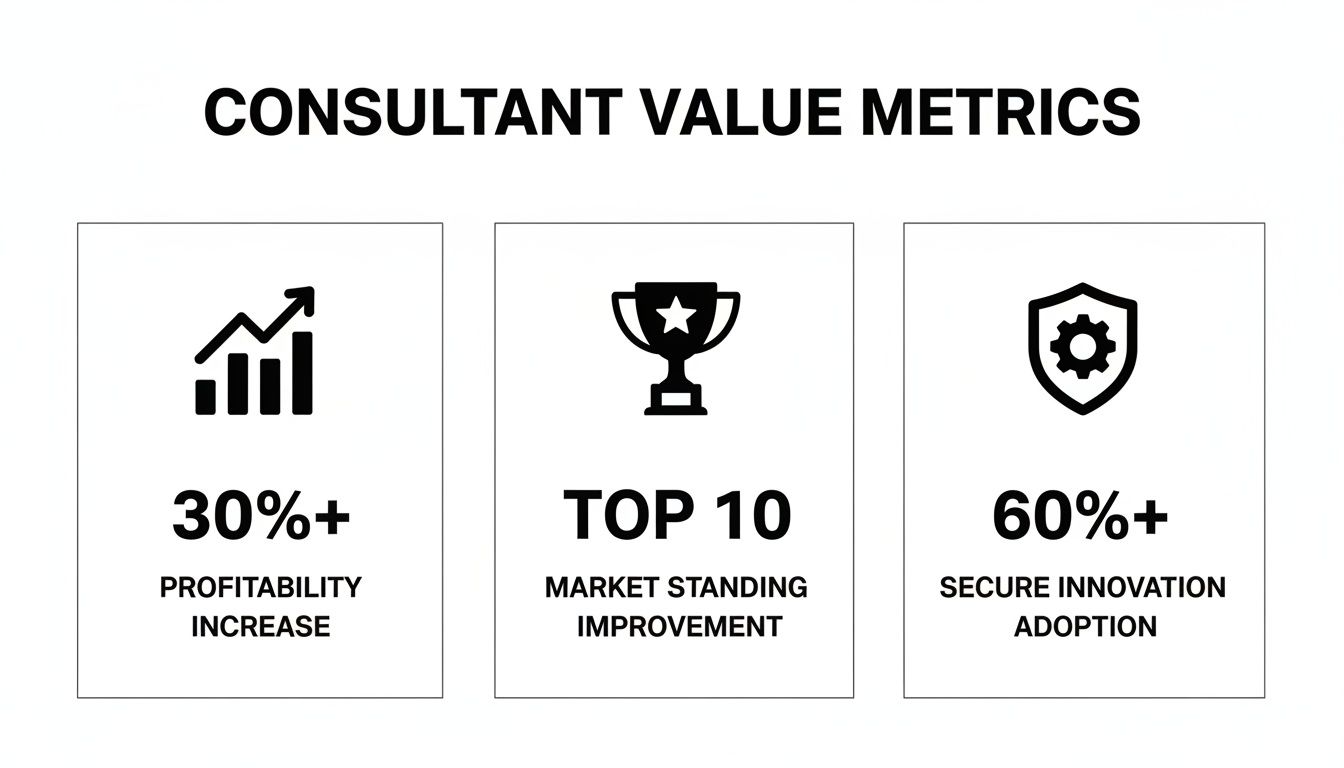

The demand for this expertise is substantial. Germany's management consulting market reached €47.7 billion in 2026, with over 90,000 firms competing to offer guidance on compliance and risk. Further details are available on the German consulting market at IBISWorld. This data underscores the immense pressure on businesses to establish effective governance.

Ultimately, a strong governance model, supported by executive leadership and enabled by appropriate technology, builds a lasting internal capability. It transforms vendor due diligence from a reactive burden into a proactive strategic advantage that protects the business and creates sustained value.

Frequently Asked Questions About Vendor Due Diligence

As organisations modernise their vendor due diligence programmes, numerous practical questions arise. Below are some of the most common inquiries from executives and managers, with direct answers to guide strategic thinking.

How Can We Justify Investing in an AI-Driven Platform?

The business case for an AI platform rests on three pillars: efficiency, depth, and foresight. Consider the thousands of expert hours currently dedicated to manually reviewing vendor contracts, financial reports, and compliance documents. AI automates this labour-intensive work, reducing assessment timelines from weeks to days. This reallocates your top talent from administrative tasks to strategic analysis.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

More importantly, AI identifies risks that human analysis can miss. By processing vast datasets, it detects subtle patterns and latent risks that would otherwise go unnoticed. This elevates due diligence from a retrospective, compliance-driven exercise to a forward-looking, predictive shield. The ROI is realised not just in time savings, but in the prevention of security breaches, the avoidance of costly supply chain disruptions, and the ability to innovate faster without assuming unquantified risk.

What Is the First Practical Step to Improve Our Current Process?

The single most effective initial action is to implement risk-based tiering. Many organisations apply a uniform approach to all vendors, which is a significant misallocation of resources. Not every partner presents the same level of risk.

Begin by segmenting your vendors into simple tiers—such as Critical, High, Medium, and Low—based on their operational importance and the sensitivity of the data they access. This act of strategic prioritisation allows you to focus your most intensive scrutiny where it matters most. It is a quick win that immediately enhances the intelligence of your process and ensures your highest-risk relationships receive the appropriate level of attention. This same logic is a cornerstone of other strategic decisions, as seen in a make-or-buy analysis in our related guide.

How Should We Handle Existing Versus New Vendors?

A bifurcated approach is necessary. For new vendors, robust due diligence must be a non-negotiable, integrated component of the procurement and onboarding process. This establishes high standards from the outset of the relationship.

For your existing, long-term vendors, a retrospective assessment is required, prioritised by risk tier. Begin with your most critical partners and re-evaluate them against your new, more rigorous framework. It is common to uncover legacy risks or compliance gaps that have emerged over time. This initiative ensures that the entire vendor ecosystem is held to a consistent, defensible standard.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

At Reruption GmbH, we do not just advise; we act as your co-preneurs to build and implement AI-native solutions. We transform due diligence from a cost centre into a strategic advantage by engineering production-ready systems that deliver measurable results. We are here to make your organisation more resilient and prepared for the challenges of tomorrow. Learn more about our approach.