A make-or-buy analysis is a disciplined framework for determining whether a capability should be developed internally (make) or procured from an external provider (buy). While a foundational business concept, its application has grown immensely complex. The framework mandates a rigorous evaluation that extends beyond initial price points to encompass a full spectrum of quantitative costs and qualitative strategic factors, such as market agility and control over intellectual property.

A Strategic Imperative in the German Economy

For leadership within German enterprises, the make-or-buy question transcends tactical cost reduction; it represents a critical strategic instrument. In an economy distinguished by engineering excellence yet confronted by intense global competition, this decision directly impacts financial performance, innovation capacity, and ultimately, market positioning. This analysis is not an operational tactic but a central component of strategic capital allocation and risk management, particularly when applied to core digital and AI capabilities.

The Economic Realities Driving the Decision

This analysis holds particular relevance in Germany's current economic climate. Make-or-buy decisions have become materially more complex over the past decade as rising labour costs and export pressures reshape industrial economics. For context, between 2013 and 2023, average labour costs in the German automotive sector increased by approximately 33%, reaching circa €62 per hour in 2023.

This cost pressure necessitates sophisticated, data-driven models. Executives must carefully weigh high domestic factor costs against the strategic imperative of controlling proprietary AI and core algorithms, all while navigating Germany’s stringent regulatory landscape.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

This new reality compels leadership to address fundamental questions:

- Do we possess the requisite in-house expertise to develop this capability to a world-class standard?

- What is the opportunity cost? Should our most skilled personnel be allocated to this initiative or focused on core business functions?

- How does outsourcing impact our intellectual property and long-term competitive advantage?

Beyond Cost: A Framework for Value

A contemporary make-or-buy analysis evaluates the entire value chain. It requires calculating the total cost of ownership (TCO), which includes frequently overlooked expenditures such as ongoing maintenance, personnel training, and the management overhead inherent in any vendor relationship.

However, a truly robust analysis extends further, assessing non-financial factors like speed to market, access to specialised expertise, and the organisational flexibility required to adapt to technological shifts.

The objective is not merely to identify the lowest-cost option. It is to determine the path that delivers the greatest strategic value and fortifies the company’s long-term market position.

This disciplined methodology ensures that every major decision—from building a proprietary AI platform to licensing a third-party solution—is rigorously vetted. It aligns directly with the principles of effective software and asset management, ensuring every resource is deployed for maximum strategic impact. In today's complex landscape, a data-informed process is an operational necessity.

A Structured Framework for Your Analysis

Translating a make-or-buy decision from a high-level strategic discussion to a concrete, data-driven framework is the critical execution step. For German enterprises, this is not merely best practice—it is an essential tool for de-risking significant capital and operational expenditures. The objective is to construct a clear, defensible business case that balances quantitative financial metrics with qualitative strategic factors.

This disciplined approach ensures the final decision is not only financially sound but also aligned with long-term corporate objectives. It provides clarity, enabling a methodical comparison of the 'make' option—with its associated internal development, CAPEX, and training requirements—against the 'buy' option and its complexities of licensing, integration, and vendor management.

Defining Precise Requirements

The foundation of any credible analysis is a sharply defined set of requirements. Ambiguous objectives render any comparison invalid. It is imperative to articulate not only the technical specifications but also the specific business outcomes the initiative must achieve. Cross-functional input at this stage is non-negotiable.

Consider the evaluation of an AI-powered logistics optimisation tool. The requirements must extend far beyond simple performance metrics.

- Business Requirements: What is the target efficiency gain (e.g., a 15% reduction in delivery times)? What are the non-negotiable system uptime parameters for operations? What are the precise integration points with existing ERP and warehouse management systems?

- Technical Requirements: What are the data processing and throughput specifications? What are the mandatory security protocols for protecting sensitive shipment data? What is the realistic level of customisation required within the first 24 months?

By defining these parameters upfront, you establish a clear benchmark against which both internal build costs and external vendor proposals can be measured. This detailed foundation is a cornerstone of effective system engineering for IT projects and the most effective defence against scope creep.

Constructing a Robust Financial Model

With requirements established, the next phase is to develop a comprehensive financial model based on Total Cost of Ownership (TCO). A common error is to limit the comparison to the upfront development cost ('make') versus the purchase price ('buy'). A rigorous TCO analysis provides a more realistic, long-term perspective on the financial commitment.

Recent German industrial statistics underscore this point. As of early 2024, industrial production continued to lag behind pre-pandemic levels, with capital goods output being a notable exception. This indicates that firms are making highly selective investments in advanced equipment rather than broad capacity expansion. In this climate, a miscalculated make-or-buy decision—such as investing millions in underutilised in-house capacity—can encumber the balance sheet with underperforming assets for years.

The TCO model must meticulously map every conceivable cost over a three-to-five-year horizon.

Quantitative Cost Comparison Model: Make vs. Buy

The following structure provides a framework for a detailed cost breakdown. The objective is to capture the complete financial picture over the solution's lifecycle, not just the initial expenditure.

| Cost Component | Make (In-House) | Buy (External Vendor) | Notes & Considerations |

|---|---|---|---|

| Initial Investment | R&D, development labour, hardware procurement (CAPEX) | Licence fees, initial setup & configuration costs | CAPEX vs. OPEX implications for the balance sheet. |

| Implementation | Project management, internal integration team costs | Professional services fees for integration, data migration | Never underestimate internal resource allocation, even for a 'buy' solution. |

| Operating Costs | Ongoing maintenance, salaries for support staff, hosting | Annual subscription/licence fees, support contracts | Factor in potential vendor price increases and service level agreements. |

| Training & Support | Internal training development, employee ramp-up time | Vendor-provided training, ongoing internal support | The opportunity cost of employee downtime during training is often missed. |

This level of detailed modelling elevates the analysis from an estimate to a financially rigorous comparison.

Integrating Qualitative and Risk Assessments

While the TCO provides the financial foundation of the analysis, it is one-dimensional without a thorough qualitative assessment. These non-financial factors often determine the long-term success or failure of the decision. The framework must include a robust process for vetting business process outsourcing providers as a key component of this review.

This is the stage where the analysis moves beyond spreadsheets to evaluate strategic fit and potential risks.

Astute leaders understand that the lowest-cost option is not always the highest-value one. Strategic control, market agility, and risk mitigation are assets that must be deliberately weighed in any make-or-buy analysis.

Key qualitative factors to score include:

- Strategic Control: Does this capability constitute a core component of your competitive advantage? In-house development ensures total control over the intellectual property (IP) and the future product roadmap.

- Speed to Market: Can a vendor provide a solution significantly faster than an internal build? In dynamic industries, this velocity can be a decisive advantage.

- Resource Availability: Does your organisation currently possess the required talent, such as specialised AI engineers? If not, the 'make' option introduces significant hiring and retention risk.

- Vendor Lock-in: How disruptive would it be to transition away from a provider if the solution underperforms or the vendor's business strategy shifts?

By systematically scoring these factors and integrating them with the financial model, a multi-dimensional view emerges. This structured approach transforms the decision from an intuitive judgment to a defensible, strategic conclusion that allocates capital effectively.

Navigating the Decision in the German Mittelstand

For Germany's Mittelstand, the make-or-buy decision is one of the most powerful economic levers available. These organisations are typically agile but often operate with constrained resources. The choice between building an in-house AI team and partnering with a specialist can define their competitive trajectory for the next decade.

Innovation leaders in these companies face a dual mandate. They must fiercely protect core, knowledge-intensive processes—the engineering and operational DNA that underpins their competitive advantage. Concurrently, they must strategically outsource non-core functions to improve efficiency and access specialised skills that are prohibitively expensive and difficult to develop internally.

This is not a theoretical exercise; it has a direct P&L impact. Official business statistics reveal the centrality of these decisions. In 2022, SMEs constituted 99.8% of all German businesses, generating approximately 50.2% of total value added. When a mid-market manufacturer outsources even 10-20% of its value chain, it can shift hundreds of millions of euros in annual spending, fundamentally reshaping its cost structure and supply chain.

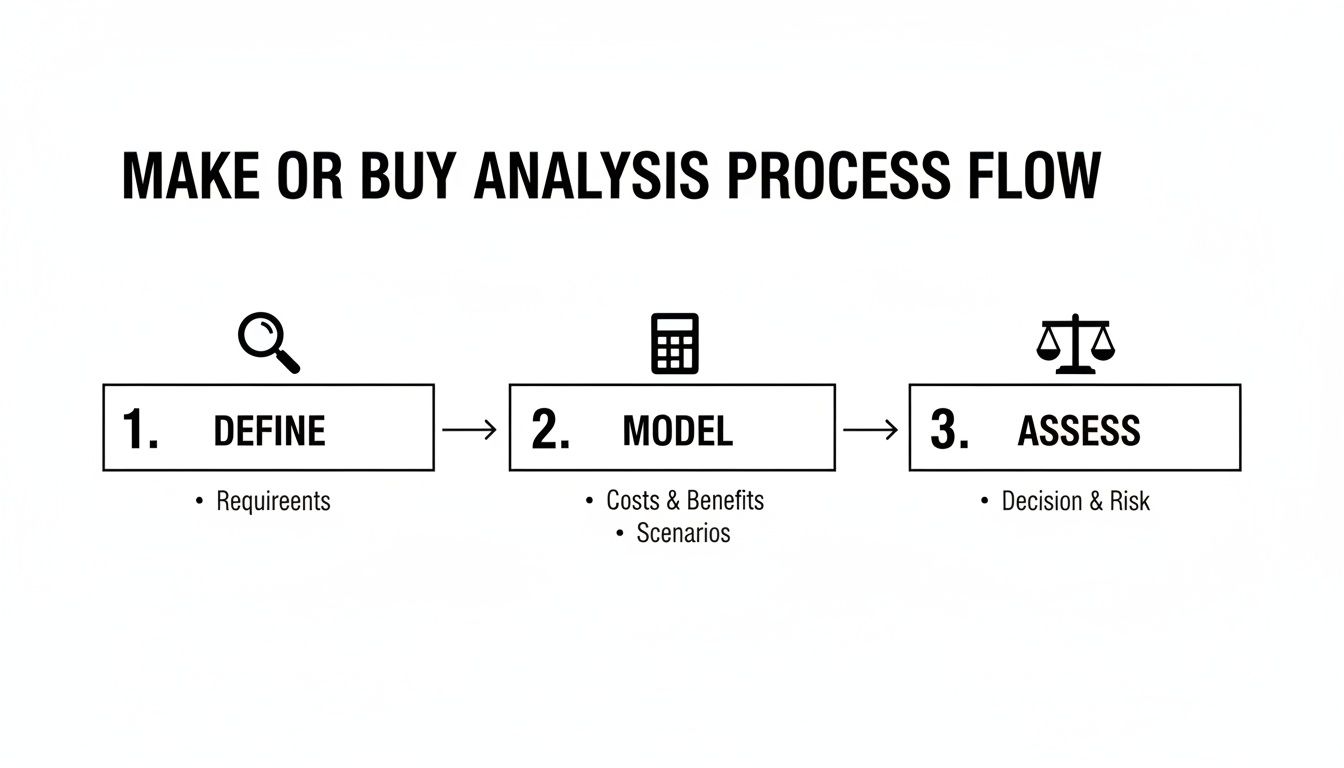

At its core, the analysis follows a clear, logical sequence.

The process begins with defining precise requirements, proceeds to detailed financial modelling, and concludes with a balanced strategic assessment. It is a framework designed to ensure no critical variable is overlooked.

Protecting Core Differentiating Capabilities

Consider a scenario from the manufacturing sector. A leading automotive supplier has a proprietary quality control process leveraging machine vision. This system represents a core differentiator, reducing defect rates to levels well below the industry average. The data it generates is highly sensitive and integral to future R&D.

Here, the decision leans heavily toward 'make'. Developing the next iteration of this system in-house, perhaps with a dedicated AI team, is the only viable path to protect this invaluable intellectual property. It also ensures the capability evolves in lockstep with the company’s core strategy, a critical consideration given how AI will transform the German Mittelstand. Outsourcing this function would be equivalent to ceding a primary competitive advantage.

Outsourcing for Speed and Specialisation

Conversely, consider a professional services firm, such as a mid-sized law practice. The firm requires an AI-powered document review tool to accelerate due diligence processes. The underlying technology is complex, demanding deep expertise in Natural Language Processing (NLP) that the firm does not possess.

In this instance, 'buy' is almost certainly the optimal decision. The rationale is clear:

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

- Speed to Market: A vendor solution can be operational within weeks, whereas an internal build would require years.

- Access to Expertise: The firm gains immediate access to a world-class AI engine that is continuously updated and improved by the vendor.

- Focus on Core Business: Legal experts can concentrate on high-value legal work rather than being diverted to manage a software development project.

Attempting an internal build would represent a significant strategic and financial risk. It would divert capital and talent from the firm’s core competency—providing legal counsel—to create a tool that would likely be inferior to existing market solutions.

In the Mittelstand, a rigorous make-or-buy analysis is more than a cost-cutting tool. It is a strategic instrument for directing finite resources—capital, talent, and leadership focus—toward activities that create durable value and sustain competitive advantage.

By institutionalising this analysis, German firms can navigate the complexities of new technologies, protecting their unique differentiators while leveraging external innovation to enhance resilience and efficiency. This balanced approach is essential for securing long-term prosperity.

Applying the Framework to AI and Digital Capabilities

When the make-or-buy analysis addresses Artificial Intelligence, the standard framework requires significant adaptation. Traditional metrics of cost and capability are insufficient. AI is a distinct category defined by exponential technological change, a systemic scarcity of elite talent, and the immense strategic value of proprietary data.

Evaluating an AI initiative requires a shift in perspective from that of a procurement manager to that of a venture capitalist. The analysis becomes an exercise in balancing current expenditures against future strategic control and market position. The framework must evolve from a simple numerical calculation to a tool for navigating profound strategic complexity.

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

Weighing Strategic Value and Technological Volatility

The primary adaptation is in assessing the strategic value of an AI capability. The critical question is: does this algorithm or dataset constitute a core component of our unique competitive advantage? If the answer is unequivocally affirmative, the strategic bias should be heavily toward an internal build. Owning the intellectual property provides the autonomy to iterate and customise the capability indefinitely, while denying competitors access to a powerful strategic asset.

However, the rapid pace of AI development introduces a significant counterargument. Off-the-shelf APIs and platforms from specialised vendors can be extremely compelling. A model that is state-of-the-art today may be obsolete in 18 months. The 'buy' option offers a direct path to leveraging the relentless innovation of these specialised firms, thereby avoiding the substantial internal investment required merely to maintain parity.

This is the central tension in any AI-related make-or-buy decision: a continuous trade-off between the long-term control of a proprietary system and the immediate access to cutting-edge performance offered by external partners.

The Talent and Data Equation

The next critical variables are talent and data. The high cost and scarcity of top-tier AI talent are material constraints. Building an in-house AI team is not simply a recruitment exercise; it requires cultivating a distinct corporate culture capable of attracting and retaining premier data scientists and machine learning engineers. For many traditional German enterprises, this represents a formidable challenge. The ‘make’ option is thus laden with a human capital risk that must be explicitly quantified in the cost model.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

Data, in this context, is an asset of paramount importance. When considering a 'buy' solution, particularly one hosted by a vendor, data governance immediately becomes the top priority.

A series of rigorous questions must be addressed:

- Data Sovereignty: Where will our data be stored and processed? Does this comply with GDPR and other relevant local regulations?

- Data Security: What are the vendor’s specific security protocols? How do they guarantee the segregation and protection of our data from that of other clients?

- Model Training: Does the vendor's policy permit the use of our data to train their general models? This could result in inadvertently improving the capabilities of our competitors.

These are not merely technical details; they are critical business risks. It is therefore imperative to embed robust risk management and compliance protocols into the vendor evaluation process from its inception.

Decision Matrix: AI Capability Make vs. Buy

To structure the evaluation of these qualitative factors, a weighted decision matrix is an invaluable tool. It enforces a disciplined assessment of strategic priorities, moving the analysis beyond a simple cost-benefit calculation.

| Evaluation Criterion | Make (Weight) | Make (Score) | Buy (Weight) | Buy (Score) |

|---|---|---|---|---|

| Strategic Control (IP Ownership) | 0.30 | 9 | 0.30 | 2 |

| Time to Market | 0.15 | 3 | 0.15 | 8 |

| Talent Availability & Cost | 0.20 | 4 | 0.20 | 7 |

| Data Security & Governance | 0.25 | 8 | 0.25 | 5 |

| Long-term Scalability & Innovation | 0.10 | 6 | 0.10 | 9 |

| Weighted Total | 6.15 | 5.40 |

This example illustrates that while the 'buy' option scores higher on speed and talent access, the 'make' option prevails due to superior strategic control and data governance—the factors assigned the highest strategic weight for this hypothetical initiative.

A Real-World Example: Custom LLM Application

Consider a German automotive supplier aiming to develop an AI-powered copilot for its engineering teams. The objective is to enable engineers to instantly query millions of highly technical documents—such as blueprints, material specifications, and R&D test results—to accelerate innovation.

The make-or-buy decision rests on several critical factors:

- Core IP: The primary asset is not the Large Language Model (LLM) itself, but the decades of proprietary engineering data. Building a custom application is the only way to ensure this highly sensitive IP remains within the company's secure environment.

- Specialisation: The AI must comprehend extremely technical, domain-specific terminology. A generic, off-the-shelf model would fail to grasp the necessary nuance, delivering suboptimal results.

- Integration: The copilot must be deeply and securely integrated with the company’s internal Product Lifecycle Management (PLM) and CAD systems. A 'buy' solution would necessitate navigating a complex and potentially insecure network of APIs.

In such a case, a hybrid approach often presents the most intelligent strategy. The company might 'buy' the foundational LLM from a major provider but 'make' the custom application layer, the fine-tuning process, and the secure data integration pipelines. This strategy balances absolute control over core data with the scale and innovation of external AI leaders.

When applying the make-or-buy framework to AI, consider emerging options like integrating no-code backend AI solutions. These can offer a compelling middle ground, providing a blend of speed and custom control without the necessity of a full-scale internal development team.

Ultimately, for digital capabilities, the make-or-buy analysis is rarely a simple binary choice. It is a strategic tool that forces a clear-eyed assessment of what truly differentiates the business and where it is more prudent to partner with the broader technology ecosystem.

From Analysis to Execution: A Governance Imperative

The analysis is complete, and the decision is made: make or buy. However, the analysis represents the initial phase. The true test lies in translating that decision into a successful outcome.

Transitioning from a decision to an operational reality requires fundamentally different governance structures and mindsets, contingent on the chosen path. This is the critical juncture where strategic intent meets operational execution.

Executing the ‘Make’ Decision

Opting to build in-house is a significant commitment. This is not merely another internal project; it is the creation of a new corporate asset, and it must be managed as such. Success hinges on establishing robust project governance from day one.

The first requirement is a crystal-clear project charter. This document serves as the guiding mandate, explicitly defining the scope, objectives, budget, timeline, and the KPIs for measuring success. Critically, it must designate a project sponsor—a senior leader with the authority to remove obstacles and ensure the project remains aligned with strategic priorities. Projects with active executive sponsorship have a demonstrably higher success rate.

For complex initiatives, particularly in AI or software, development must be de-risked. A monolithic, long-duration development cycle is ill-advised. A rapid prototyping approach is superior.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

- Test Assumptions Early: Develop a Minimum Viable Product (MVP). Deploy it to a select group of end-users with real data to validate core hypotheses. It is far more cost-effective to identify flaws at this stage than after a year of development.

- Ensure Cross-Functional Engagement: From the initial sprint, end-users, IT security, and operations teams must be integrated into the process. This ensures the final product is not only technically sound but also usable and secure.

- Iterate, Don't Dictate: Employ an agile framework. Build, measure, learn, and repeat in short cycles. This maintains project flexibility and ensures the final output meets evolving business needs, not an outdated initial plan.

Executing the ‘Buy’ Decision

When the analysis indicates a 'buy' decision, the primary role shifts from project manager to relationship manager. The organisation is not merely purchasing a product; it is entering into a strategic partnership. This process begins with a vendor selection methodology that extends far beyond marketing materials.

Conduct exhaustive due diligence. Evaluate not only the vendor's technical capabilities but also their financial stability. Request and contact client references. A vendor lacking an understanding of the specific pressures or regulatory requirements of your industry represents a significant risk, regardless of their technology's quality.

The objective is not a simple transaction but a strategic partnership where the vendor is invested in your success. Consider shared-risk models or performance-based incentives to ensure goal alignment.

The contract is your primary risk mitigation tool. Legal and procurement teams must collaborate to draft an agreement that provides protection while allowing for operational flexibility.

Essential Clauses for a ‘Buy’ Contract:

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

- Service Level Agreements (SLAs): Be precise. Define measurable metrics for uptime, response times, and issue resolution. Include financial penalties for non-performance.

- Data Ownership and Security: State explicitly that your organisation retains ownership of its data. The contract must detail the vendor’s security obligations, including GDPR compliance.

- A Clear Exit Strategy: How is the relationship terminated if it proves unsuccessful? The contract must outline a clear process for disengagement, including the procedures for data retrieval, to prevent vendor lock-in.

Whether you make or buy, the transition from analysis to execution is a critical shift. A 'make' decision demands internal discipline and agile delivery. A 'buy' decision requires intelligent sourcing and professional partnership management. Both paths necessitate strong governance to ensure the strategic rationale behind your make or buy analysis translates into tangible value.

Answering Your Toughest Make-or-Buy Questions

Even with a robust framework, a make-or-buy analysis invariably presents challenging questions for the leadership team. This is expected. These decisions carry significant weight, dictating capital allocation, team focus, and long-term strategic direction.

Let's address some of the most common questions posed by German executives to facilitate a final, confident decision.

How Often Should We Revisit the Decision?

A make-or-buy decision is not a permanent state; it is a strategic checkpoint. For major 'buy' decisions, particularly for business-critical software or services, a review should be a mandatory component of the annual strategic planning cycle. This is the only way to ensure the vendor’s performance, cost structure, and technology roadmap remain aligned with your business objectives.

For 'make' projects, the trigger for re-evaluation is different. A reassessment should occur in response to a significant market shift, the emergence of a disruptive new technology, or a change in corporate strategy. In a rapidly evolving field like AI, this cadence must be accelerated. We strongly recommend reassessing internal AI initiatives every six to nine months to validate their continued strategic relevance and cost-effectiveness.

What is the Most Common Mistake in This Analysis?

The single most prevalent error is focusing excessively on quantitative financial data while neglecting the strategic, qualitative dimensions of the decision. It is tempting to simply compare a vendor's price against internal development estimates and conclude the analysis. This is a critical mistake. This narrow view fails to account for hidden costs, such as internal integration efforts, continuous training, and long-term maintenance.

More importantly, it overlooks the strategic questions that ultimately determine long-term success:

- Speed to Market: What is the opportunity cost of delaying market entry by building a capability internally?

- Long-term IP Control: Is it acceptable for a third party to control a capability that is core to our business model?

- Core Competency: Does developing this capability internally build a new, valuable organisational skill set?

- Vendor Lock-in: How disruptive and costly would it be to switch vendors in the future?

The objective is not merely to find the cheapest option. An effective analysis balances immediate P&L impact with the critical long-term goals of maintaining strategic control and organisational agility.

How Can We Reduce the Risk of a 'Buy' Decision?

The risks associated with a 'buy' decision can be mitigated through three key actions. First is exhaustive due diligence. You must investigate beyond the sales demonstration to assess a potential partner's financial health, security certifications, and cultural alignment with your organisation.

Second is a robust, enforceable contract. This legal document is your primary line of defence. Insist on detailed Service Level Agreements (SLAs), explicit terms regarding data ownership and sovereignty (a non-negotiable under GDPR), and a clearly defined exit strategy that outlines the process for disengagement.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

Finally, cultivate a genuine partnership rather than a transactional vendor relationship. Seek partners who are demonstrably invested in your success, potentially through shared-risk or performance-based commercial models. This fosters a more resilient and collaborative dynamic where both parties are aligned toward a common objective.

When Is It a Clear Decision to 'Make' an AI Capability?

An organisation should almost always choose to build an AI capability internally when it is directly linked to its core competitive advantage and leverages proprietary data to generate unique insights. This is a critical principle for leaders in data-intensive industries.

If the algorithm itself—or the unique dataset it enables you to create—is what differentiates you from the competition, outsourcing it constitutes an unacceptable long-term strategic risk. In-house development provides complete control over the intellectual property. It allows you to tailor the capability to your precise needs, evolve it in line with business growth, and cultivate it into a core corporate asset that defends your market position. A deep understanding of your data is the foundation for this; our data analytics guide for trainees and managers is a good starting point for upskilling your teams.

At Reruption GmbH, we act as your "Co-Preneurs for the AI Era." We help you navigate complex make-or-buy decisions and execute on them with entrepreneurial velocity. We partner with you to transform strategic concepts into production-ready innovations, ensuring your AI investments build a durable competitive advantage.

Discover how we can help you accelerate your AI initiatives by visiting us at https://www.reruption.com.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.