Vendor due diligence is no longer a procedural formality. It has evolved into a strategic imperative for identifying and mitigating third-party risks before they manifest as operational disruptions or reputational damage. What was once a simple compliance check has become a critical executive function. A robust due diligence process is the bedrock upon which organisations safeguard their operations, protect their brand equity, and innovate securely in today's hyper-connected business landscape.

The New Strategic Imperative of Vendor Due Diligence

In an economic environment defined by intricate supply chains and the rapid integration of Artificial Intelligence, vendor due diligence has transitioned from a compliance obligation to a core strategic necessity. For executive leadership within Germany's Mittelstand and major corporations, mastering this process is non-negotiable. It is the mechanism for protecting brand integrity, ensuring operational resilience, and enabling secure innovation. A sophisticated diligence framework is no longer a defense against penalties; it is a distinct competitive advantage.

This strategic shift is propelled by a significantly more stringent regulatory climate. The German Supply Chain Due Diligence Act (LkSG) serves as a prime example. Prior to such legislation, a 2020 study revealed that only 13% to 17% of German companies met the voluntary due diligence standards of the National Action Plan on Business and Human Rights. This significant compliance gap underscored the need for legislation to enforce accountability and elevate standards across industries.

From Compliance Burden to Competitive Edge

Viewing vendor due diligence solely through the lens of compliance is a strategic misstep. Its true value lies in its strategic application. A methodical, intelligence-driven approach enables an organisation to:

- Safeguard Brand Integrity: Mitigate the reputational damage stemming from a partner's security breach or ethical lapse.

- Ensure Operational Resilience: Identify and address latent risks within the supply chain that could disrupt core business functions.

- Enable Secure Innovation: Engage confidently with pioneering AI and technology vendors, with the assurance that their solutions are built upon a secure and compliant foundation.

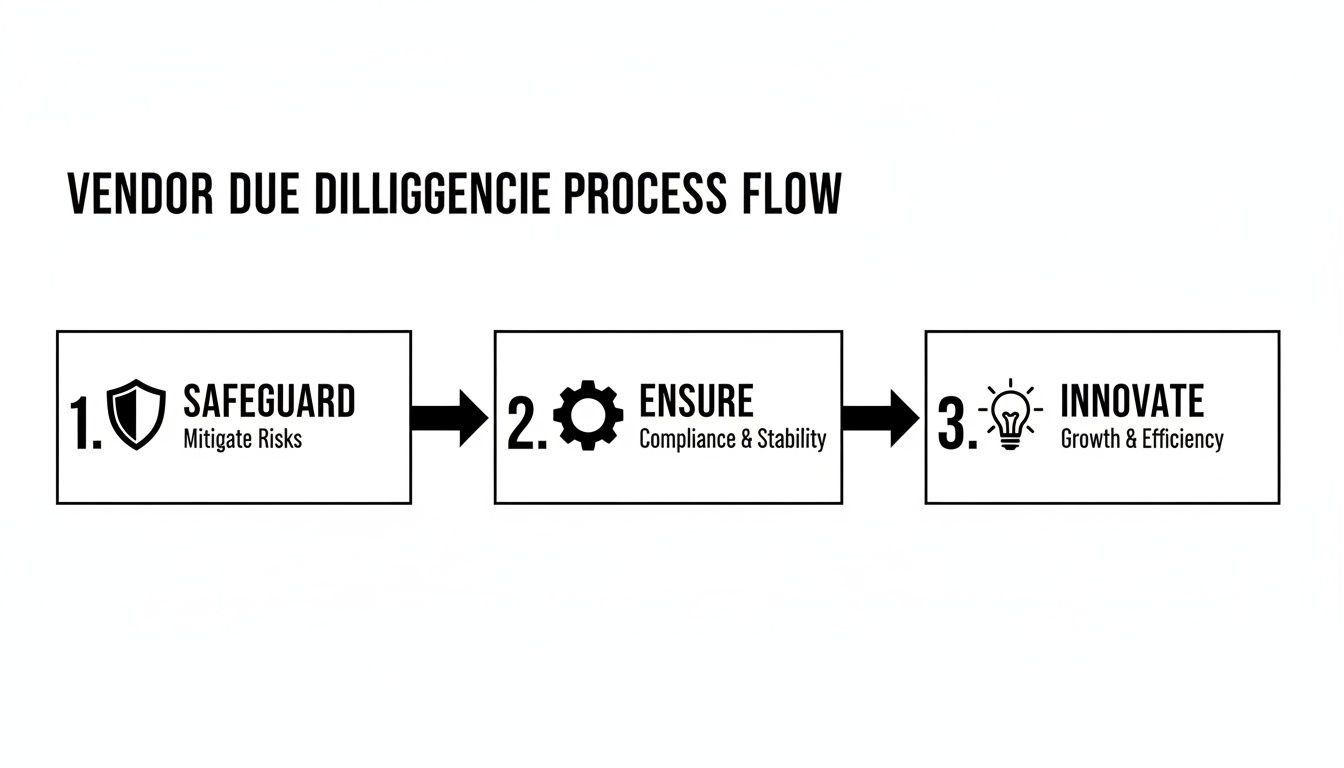

This process flow illustrates how modern diligence has evolved beyond simple audits into a comprehensive strategy to safeguard, ensure, and innovate.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

The central insight is that effective due diligence is not a linear process but a continuous cycle that protects the enterprise today while enabling secure growth tomorrow. It provides the framework to manage complex partnerships and adopt emergent technologies without incurring unacceptable levels of unforeseen liability.

When vendor due diligence is reframed as a strategic enabler rather than a bureaucratic hurdle, it unlocks new avenues for growth and innovation while fortifying the entire organisation against external threats.

To execute this effectively, understanding the top considerations when choosing a security outsourcing partner is a valuable starting point. Expert guidance can help embed these crucial principles deep within the corporate operational DNA.

A Framework for Vendor Risk Segmentation

Not all vendors present an equal level of risk. Applying a uniform, high-intensity level of scrutiny to every third-party relationship is both inefficient and ineffective. This approach consumes valuable resources on low-impact suppliers while creating critical blind spots where they matter most.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

The foundation of a modern, intelligent due diligence program is risk segmentation: a structured methodology for classifying partners based on their potential impact on the organisation.

This requires moving beyond a simple alphabetical vendor list to a dynamic risk model. This ensures that the most rigorous diligence efforts are concentrated on high-stakes partnerships—such as a new AI platform provider—while a more streamlined approach is applied to lower-risk relationships, like an office supply vendor.

Defining Vendor Risk Criteria

Before segmentation can occur, clear, objective criteria must be established. These criteria form the building blocks of a risk matrix, allowing each vendor to be plotted based on their specific relationship with the business. The objective is to replace subjective assessments with a data-driven system.

Core criteria should address three fundamental questions:

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

- How critical is the vendor to our core operations? A partner whose failure would halt production or service delivery (e.g., a cloud infrastructure provider) is inherently high-risk. A partner whose absence would be a minor inconvenience presents a much lower risk profile.

- What level of data access do they possess? A vendor processing sensitive customer data or proprietary intellectual property requires significantly more scrutiny than one with no access to confidential information.

- How deeply are they integrated into our technical systems? A partner with direct API access to a core ERP system presents a fundamentally different risk profile than a standalone software tool.

Answering these questions provides the initial coordinates for placing each vendor within the risk framework. This initial classification is a crucial step, analogous to the strategic evaluation in a make-or-buy analysis for strategic decisions, where the strategic importance and integration depth of a function are rigorously assessed.

Implementing a Tiered Risk Model

Once criteria are defined, the next step is to establish distinct risk tiers. A tiered model is the most effective method for applying differentiated levels of due diligence. Most organisations find a three- or four-tier system provides sufficient granularity without introducing excessive complexity.

By tiering vendors, due diligence transforms from a monolithic, time-consuming activity into a flexible, scalable process. This allows for the precise allocation of senior-level attention and security resources to high-stakes partnerships, preventing procurement bottlenecks.

The table below provides a basic framework for categorising vendors, illustrating how strategic importance and data access directly inform the required level of diligence.

Vendor Risk Tiering Matrix

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

| Risk Tier | Strategic Importance | Data Access Level | Diligence Level Required | Example Vendor Type |

|---|---|---|---|---|

| Tier 1 (High) | Mission-critical for operations | Extensive access to sensitive/PII data | Exhaustive (on-site audits, pen tests) | AI Platform, Cloud Provider |

| Tier 2 (Medium) | Important but not critical | Access to non-sensitive business data | Standardised (questionnaires, certs) | CRM Software, Marketing Agency |

| Tier 3 (Low) | Non-essential support function | No access to sensitive data | Lightweight (automated checks, basic forms) | Office Supplies, Catering |

This model ensures that diligence efforts are always proportional to the risk. A Tier 1 vendor warrants exhaustive scrutiny, whereas a Tier 3 vendor can be onboarded via a much simpler, more efficient process.

This is not a static exercise. A vendor's tier must be re-evaluated periodically, particularly if the scope of their services expands or the nature of the relationship changes. This dynamic approach ensures the vendors due diligence framework remains relevant and accurately reflects the organisation's real-time risk exposure.

Executing Technical and AI-Specific Security Audits

Once vendors are segmented into risk tiers, the strategic phase concludes, and the technical validation begins. This stage requires moving beyond questionnaires into hands-on security and competence audits to verify vendor claims.

This is not merely best practice; for organisations in Germany with over 1,000 employees, the German Supply Chain Due Diligence Act (LkSG) mandates it. The act requires comprehensive, annual risk analyses and preventive measures for all suppliers, direct and indirect. This legislation has fundamentally altered the landscape of vendors due diligence, particularly for manufacturing and automotive sectors, compelling a far more rigorous examination of every partner.

The primary objective is to identify latent vulnerabilities before integrating a new technology, ensuring it is built on a secure and compliant foundation. This validation step bridges the gap between a vendor's marketing narrative and the operational reality of their service.

Core Cybersecurity Posture Verification

Before evaluating advanced capabilities like AI, it is imperative to confirm the vendor has mastered cybersecurity fundamentals. A strong security posture is non-negotiable for any partner that will interact with corporate or customer data. The assessment must be methodical and evidence-based.

A logical starting point is requesting key security certifications. An ISO 27001 certificate or a SOC 2 Type II report typically indicates a mature information security management system (ISMS). However, the certificate itself is not sufficient.

- Scrutinise the Scope: Verify that the certification covers the specific services being procured. It is not uncommon for certifications to apply to a limited, irrelevant part of the business.

- Review Audit Findings: Request a summary of audit findings or exception reports. Transparency about known issues and remediation plans is a key indicator of a vendor's security culture.

- Assess Incident Response: Move beyond documentation to test real-world readiness. Present their team with a hypothetical scenario, such as a ransomware attack, and evaluate their documented incident response plan and their ability to articulate a coherent response.

This level of detailed inquiry distinguishes a genuine security partner from a vendor merely leveraging compliance for marketing purposes.

Probing Data Governance and Technical Controls

Robust data governance is the next critical pillar. Absolute clarity is required on how a vendor will handle, segregate, and protect data throughout its lifecycle. This is particularly crucial in multi-tenant cloud environments where the risk of data leakage is ever-present.

Technical teams should demand specifics on data segregation protocols. The vendor must be able to articulate the precise logical and physical controls used to isolate your data from that of other clients. Vague responses are a significant red flag.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

Furthermore, data residency and backup policies must be scrutinised. Ensure storage locations comply with GDPR and that the vendor's recovery point objective (RPO) and recovery time objective (RTO) align with your organisation's business continuity requirements.

Auditing AI Vendors: A Deeper Level of Scrutiny

For vendors offering AI-powered services, technical due diligence must extend significantly deeper. The unique characteristics of AI models introduce a new class of complex risks that traditional security audits fail to address. Inquiries must probe the core of their technology.

The focus shifts to AI model governance, data provenance, and algorithmic transparency. These are not merely technical buzzwords; they are fundamental concepts for ensuring an AI solution is ethical, compliant, and operationally sound.

For an AI vendor, the integrity of their training data is as critical as the security of their infrastructure. If the data foundation is flawed, biased, or legally questionable, the entire solution built upon it is inherently high-risk.

Begin by demanding to know the origin of their training data and whether they possess the legal rights for its use. A clear chain of custody is essential. It is critical to confirm that they have secured the appropriate rights to use the data for training a commercial model to avoid future legal and reputational entanglements.

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

Next, challenge them on model explainability and bias mitigation. How do they test for and prevent discriminatory outcomes? A mature AI vendor should provide clear documentation of their fairness-testing methodologies. To learn more, explore our guide on establishing robust AI security and compliance frameworks.

Navigating the Modern Legal and Compliance Landscape

Following technical and security audits, the process moves to the legal and compliance framework—the bedrock of any robust vendors due diligence program. For businesses operating in Germany, the legal environment is increasingly complex. Success requires more than a cursory legal review; it demands strategic contracting and a deep understanding of evolving obligations.

The regulatory landscape is in constant flux. Regulations like the General Data Protection Regulation (GDPR) and Germany's Supply Chain Due Diligence Act (LkSG) have fundamentally reshaped corporate accountability. The forthcoming EU AI Act will introduce another layer of complexity, mandating transparency and risk management for deployed AI systems. Failure to integrate these requirements into vendor contracts constitutes a direct threat to the business.

This sustained regulatory pressure has fueled demand for specialised professional services. Germany's due diligence market is a key component of Europe's burgeoning sector, which is projected to reach $85 billion globally by 2033, with much of this growth driven by new ESG and regulatory mandates.

Architecting Ironclad Contractual Controls

Vendor contracts are the first line of defense. They must be more than standard templates; they must translate complex legal requirements into clear, enforceable obligations. In the current compliance environment, a bulletproof contract for supplier agreements is non-negotiable.

Three contractual elements are indispensable:

- Right-to-Audit Clauses: These provisions grant the explicit authority to inspect a vendor's controls, processes, and documentation. This is an essential tool for verifying compliance, particularly for high-risk partners.

- Robust Data Processing Agreements (DPAs): A DPA is mandatory under GDPR for any vendor processing personal data. It must specify the nature, purpose, and duration of processing, along with the required technical and organisational security measures.

- Explicit Liability Frameworks: The contract must clearly define financial responsibility in the event of a failure. This includes establishing liability caps and indemnification clauses that protect your organisation from vendor-induced data breaches or regulatory fines.

A contract is not a static document to be filed away. It is a living governance instrument that must be revisited and updated as regulations evolve and the partnership matures.

Verifying ESG Commitments and Supply Chain Accountability

Modern compliance extends far beyond data security. Stakeholders, from the board of directors to customers, now demand demonstrable commitment to Environmental, Social, and Governance (ESG) principles. Due diligence must therefore validate a vendor's ESG claims with concrete evidence.

This involves seeking tangible proof. Does the vendor publish a sustainability report? Do they hold certifications such as ISO 14001 for environmental management? Can they provide verifiable metrics on their carbon footprint or diversity and inclusion initiatives?

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

Furthermore, laws like the LkSG impose direct responsibility for the entire supply chain. Contracts must cascade these obligations downward. It is essential to contractually require primary vendors to conduct their own due diligence on their suppliers. This "flow-down" provision is the only way to build a resilient and compliant supply chain, a cornerstone of any effective risk management and compliance strategy. Without it, the organisation remains exposed to risks buried deep within its value chain, which can result in significant financial penalties and lasting reputational harm.

From Analysis to Action: A Structured Decision Framework

The diligence process—spanning technical audits and legal reviews—generates a substantial volume of data. However, this information is inert without a structured framework to translate findings into clear, decisive action.

Many due diligence programs falter at this stage. Lacking a structured method for interpreting findings, decisions often devolve into a subjective mix of intuition and opinion, leading to inconsistent and ineffective risk management.

Turning Findings into a Clear Score

A formal scoring model is essential for systematically weighing diverse risk factors and consolidating them into a single, actionable risk score for each vendor. This transforms a complex set of qualitative and quantitative data into a comparable metric.

A weighted scoring system is the most effective tool for this purpose. By assigning specific weights to each diligence category—such as cybersecurity posture, financial stability, or regulatory compliance—the final score accurately reflects the organisation's strategic priorities.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

For example, when evaluating an AI platform that will handle sensitive customer data, the cybersecurity score might be weighted at 40%. For a logistics partner, this weight might shift toward operational resilience. This customisation makes the model both powerful and relevant.

The process is straightforward: evaluate a vendor against predefined Key Performance Indicators (KPIs) in each category, typically on a 1-5 scale. These scores are then multiplied by the category weight to derive a final risk score.

An effective scoring model functions as a universal translator, converting complex diligence findings into a common language understood by all stakeholders, from security engineers to the C-suite. It elevates the conversation from subjective opinion to data-driven decision-making.

The framework below provides a basic, repeatable structure for standardising vendor evaluations, ensuring consistent measurement against a common yardstick.

Sample Vendor Scoring Framework

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

| Diligence Category | Weighting (%) | Key Performance Indicators (KPIs) | Scoring Method (1-5) |

|---|---|---|---|

| Cybersecurity Posture | 40% | ISO 27001 certification; Incident response plan maturity; Penetration test results | 1 = Major gaps, 5 = Exceeds standards |

| Regulatory Compliance | 30% | Documented GDPR/LkSG adherence; Data Processing Agreement robustness | 1 = Non-compliant, 5 = Fully compliant |

| Financial Stability | 15% | Credit rating; Revenue trends; Profitability analysis | 1 = High financial risk, 5 = Very stable |

| Operational Resilience | 15% | Documented business continuity plan; Service Level Agreement (SLA) strength | 1 = Poor resilience, 5 = Robust plan |

This type of objective scoring facilitates defensible decisions and enables direct, "apples-to-apples" comparison between vendors.

From Red Flags to Remediation Plans

Not every identified risk is a disqualifier. A strategically important vendor may present moderate, manageable risks. In such cases, a formal remediation plan is the appropriate response.

This documented agreement specifies the precise actions a vendor must undertake to address identified deficiencies, complete with clear timelines and verification criteria. While the process is collaborative, the requirements must be firm.

A robust remediation plan must include:

- Specific Findings: A detailed, itemised list of each risk or control gap.

- Required Actions: The concrete steps the vendor must take to resolve each issue.

- Accountable Owners: Named individuals on both sides responsible for execution.

- Defined Timelines: Realistic but non-negotiable deadlines for completion.

- Verification Methods: Explicit criteria for confirming resolution (e.g., a re-test, documentation review).

This transforms a potential rejection into a conditional approval, allowing the organisation to proceed with a valuable partner while actively managing the associated risks.

Making Governance an Ongoing Habit

Finally, best-in-class vendors due diligence is not a one-time event conducted during onboarding. The risk landscape is dynamic. A vendor's security posture, financial health, or compliance status can change rapidly. Governance must therefore shift from a static check to continuous monitoring.

This involves establishing a schedule for regular reassessments, with frequency determined by the vendor's risk tier. High-risk, Tier 1 partners may require an annual deep-dive review. Low-risk, Tier 3 suppliers may only need a lightweight check-in every two years.

Technology can automate aspects of this process, such as setting up alerts for changes in a vendor's public security rating or for negative media coverage. This enables a proactive, rather than reactive, risk management posture. This is how due diligence is transformed from a pre-contract checkpoint into a living, integrated component of the organisation's day-to-day risk management strategy.

Frequently Asked Questions About Vendor Due Diligence

Even with a robust framework, senior leaders often have pointed questions about the practical application of modern vendors due diligence. The process can seem daunting, particularly when balancing the need for speed with effective risk management. This section addresses the most common inquiries from executives navigating new technologies and complex supply chains.

How Can We Implement Rigorous Due Diligence Without Slowing Innovation?

This is the classic tension every executive faces. The solution is to integrate due diligence into the procurement and project initiation phases, not append it as a final hurdle before contract execution. A reactive process will always create a bottleneck.

A proactive, tiered risk assessment framework is the key to efficiency.

- Low-risk vendors should pass through a streamlined, largely automated review, enabling teams to move quickly with pre-vetted or non-critical partners.

- High-risk partners, such as a new AI platform or a critical logistics supplier, should automatically trigger a comprehensive review involving key stakeholders from IT, legal, and operations from the outset.

By aligning the level of effort with the level of risk, senior resources are focused where they provide the most value. Risk management thus becomes an enabler of agile, strategic decision-making, not an impediment.

What Is the Biggest Process Change Required by the LkSG?

The most significant process shift mandated by the German Supply Chain Due Diligence Act (LkSG) is the extension of responsibility beyond direct suppliers to encompass the entire supply chain. For years, most companies focused exclusively on their Tier 1 relationships. The LkSG fundamentally alters this paradigm.

The law requires companies to act on human rights or environmental risks involving indirect suppliers as soon as they become aware of them. This necessitates a pivot from basic supplier management to achieving deep transparency and accountability across the entire value chain.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

Processes must now incorporate methods for value chain mapping, proactive risk analysis beyond immediate partners, and the establishment of grievance mechanisms accessible to workers deep within the supply network. Managing direct contracts is no longer sufficient; a clear line of sight into suppliers' suppliers is now required. For further reading, consult our articles on effective vendor selection strategies.

What Specific Questions Should We Ask a Potential AI Vendor?

When evaluating AI vendors, standard cybersecurity inquiries are merely a starting point. AI introduces a unique set of ethical, legal, and operational risks that demand a more specific line of questioning focused on model integrity and the entire data lifecycle.

Beyond standard security controls, AI vendor diligence must validate the foundational integrity of the model itself. If the training data is biased or its provenance is legally questionable, the entire solution is built on a high-risk foundation, regardless of the vendor's infrastructure security.

Here are four non-negotiable questions for any potential AI partner:

- Data Provenance: Can you provide auditable proof of the origin of your training data? Crucially, can you demonstrate the legal right to use this data to build and commercialise an AI model?

- Model Explainability: How do you validate that your model does not produce biased or discriminatory outcomes? What is the level of transparency and auditability of its outputs, especially in regulated industries?

- MLOps Security: What specific measures are in place to secure the machine learning pipeline against threats such as model theft, data poisoning, and adversarial attacks?

- Data Isolation: In your multi-tenant environment, what specific architectural and technical controls guarantee the complete logical and physical segregation of our data from that of other clients?

These questions elevate the discussion beyond generic security assurances to address the unique risks inherent in artificial intelligence. Obtaining clear, confident answers is essential before integrating any AI solution into core business operations.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

At Reruption GmbH, we act as "Co-Preneurs for the AI Era," helping organisations navigate the complexities of AI adoption with P&L accountability and methodical de-risking. We turn ideas into secure, compliant innovations.

Discover how we can help you build your next AI-powered solution.