Compliance is no longer a back-office function relegated to checklists; it has evolved into a strategic linchpin that directly determines a bank's resilience, reputation, and competitive standing. For senior leaders in the German banking sector, the mandate has shifted from mere adherence to regulations to the construction of an intelligent, anticipatory compliance framework—one that not only mitigates risk but also unlocks significant operational value.

The New Strategic Imperative of Banking Compliance

Viewing compliance as a cost centre is a dangerously outdated perspective, particularly for executives operating within Germany's rigorous financial landscape. It has become a high-stakes arena where operational stability, client trust, and market leadership are decided. The convergence of intensified regulatory pressure and sophisticated threats demands a fundamental re-engineering of the traditional compliance model.

Legacy systems, reliant on manual processes and static rulebooks, are ill-equipped to counter the velocity and complexity of modern financial crime and cyber threats. This inadequacy creates a dual exposure for financial institutions: an elevated risk of substantial regulatory penalties and the burden of profound operational inefficiencies.

The Intensifying Regulatory Pressure

The regulatory environment continues to tighten, with no sign of abatement. In Germany’s demanding banking sector, new frameworks such as the Digital Operational Resilience Act (DORA) have significantly expanded compliance obligations for both banks and their critical technology partners. BaFin, the federal supervisory authority, enforces some of the world's most stringent standards, particularly concerning Anti-Money Laundering (AML) and ICT risk management.

While these standards present a high barrier to entry, they also cultivate a ‘gold-standard’ reputation that reinforces the global trustworthiness of German-licensed institutions.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

To provide clarity, the primary regulatory pillars shaping the German banking landscape are outlined below. This table summarises key frameworks and their strategic implications for executive decision-making.

Key Regulatory Pillars for German Banks

| Regulatory Framework | Core Focus Area | Strategic Implication for Leadership |

|---|---|---|

| DORA (Digital Operational Resilience Act) | Ensures banks and their critical ICT suppliers can withstand, respond to, and recover from all types of digital disruptions and cyber threats. | IT and security are no longer support functions; they are central to business continuity. Investment in resilient infrastructure is non-negotiable. |

| BaFin's AML/KYC Rules | Enforces rigorous Anti-Money Laundering and Know Your Customer protocols, demanding sophisticated, real-time transaction monitoring. | Requires a shift from reactive reporting to proactive threat detection. This impacts client onboarding, transaction processing, and risk modelling. |

| GDPR & National Data Laws | Governs the processing, storage, and protection of customer data, with severe financial penalties for breaches and non-compliance. | Data governance must be embedded in every process. It is a matter of client trust and avoiding fines that can erode profitability. |

This overview underscores a critical shift: compliance has transcended rote adherence. It now necessitates the development of a dynamic, adaptive defence system capable of responding to new threats and regulatory changes in real time.

The challenge is no longer just about adhering to a checklist of existing rules. It is about building an intelligent, predictive defence system capable of anticipating emerging threats and adapting to regulatory shifts in real time.

From Static Walls to an Intelligent Defence Grid

Traditional compliance functions can be likened to a medieval fortress—its high stone walls are effective against predictable, direct assaults but vulnerable to sophisticated, asymmetric attacks. Modern threats are precisely that: dynamic, complex, and adept at exploiting unforeseen vulnerabilities.

An intelligent, AI-powered compliance function is analogous to upgrading this fortress with a predictive energy shield. It does not merely wait for an attack; it actively scans the horizon, analyses potential threats, and neutralises them long before they can breach the perimeter.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

This is the point at which AI transitions from a technological buzzword to a core strategic instrument. By automating monitoring, predicting risks, and delivering profound insights, AI enables the creation of a compliance function that is both more secure and exponentially more efficient. The objective is to transform compliance from a reactive necessity into a source of operational strength, a journey further explored in our guide on digital strategies for banking. Adopting this proactive stance is the only viable path to securing a bank's future in an increasingly complex global environment.

Deconstructing a Modern Compliance Framework

Navigating the complexities of modern finance requires a new perspective on compliance. It must be viewed not as a disparate list of obligations, but as a single, integrated system. This conceptual shift is what transforms compliance from a necessary cost into a durable strategic advantage.

A robust, modern framework rests upon three core, interdependent pillars, each essential to the institution's integrity.

Consider the analogy of architectural design. Regulatory Adherence forms the foundation and the blueprint—the non-negotiable codes and laws governing construction. Governance and Risk Management is the structural frame, providing strength, form, and resilience against external pressures. Operational Execution represents the critical infrastructure—the plumbing, wiring, and daily functions that make the blueprint a functional reality. A failure in any one of these components compromises the entire structure.

The First Pillar: Regulatory Adherence

This pillar represents the 'what' of compliance—the universe of laws, regulations, and standards to which an institution must strictly adhere. For a bank in Germany, this involves managing a complex web of requirements from BaFin, the ECB, and the EU, covering everything from capital adequacy to data privacy.

The key components are foundational:

- Anti-Money Laundering (AML) and Know Your Customer (KYC): The bedrock of identity verification and transaction monitoring to prevent financial crime. There is zero tolerance for error.

- GDPR and Data Privacy: These are not mere guidelines but strict mandates on handling customer data, with severe financial consequences for non-compliance.

- Sector-Specific Regulations: This includes frameworks like DORA, which governs digital operational resilience, and the Basel III/IV standards for managing credit and market risk.

This pillar is dynamic, demanding constant vigilance and horizon-scanning to anticipate regulatory shifts and adapt proactively.

The Second Pillar: Governance and Risk Management

This pillar addresses the 'who and why'. It defines the internal architecture of roles, responsibilities, and control structures that ensure compliance is actively managed, not passively acknowledged. It is here that strategic oversight is established to identify, assess, and mitigate risks across the entire enterprise. A siloed approach is a direct route to systemic failure.

A strong governance structure turns compliance from a back-office chore into an organisation-wide mission. It makes it crystal clear who is accountable for what, from the boardroom right down to the front line.

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

This is where the bank's risk appetite is defined and its internal controls are designed. It involves creating a clear chain of command for compliance decisions, establishing ethical parameters, and ensuring every employee understands their role in safeguarding the institution. We delve deeper into building these oversight structures in our guide to integrated risk management and compliance.

The Third Pillar: Operational Execution

This pillar constitutes the 'how'—where policy meets practice. Operational execution encompasses the daily activities, technologies, and procedures that translate compliance strategy into tangible action. It bridges the gap between the regulations of the first pillar and the oversight of the second. Without it, the most sophisticated policies remain inert.

This involves the hands-on work of implementation:

- Transaction Monitoring Systems: The technology and processes that flag suspicious activity in real time.

- Reporting and Auditing: The mechanisms for generating accurate regulatory reports and conducting internal reviews to validate control effectiveness.

- Employee Training: Ensuring every team member possesses the requisite knowledge to perform their duties without incurring regulatory risk.

These three pillars—Adherence, Governance, and Execution—operate as a tightly integrated system. Strong governance is ineffective without robust operational controls, and a sophisticated monitoring system is useless if not aligned with current regulations. Only a holistic, integrated framework can build the institutional integrity required to earn and maintain client trust.

The Business Case for AI in Compliance

Compliance has historically been categorised as a "cost of doing business"—a necessary and expensive function. However, as regulatory pressures intensify and legacy manual processes falter, this perspective is no longer tenable. The traditional approach, mired in paperwork and manual checks, has become a significant drain on resources and a direct impediment to performance.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

The data is clear. Many German retail banks operate with cost-to-income ratios (CIRs) averaging over 60%, while more agile international competitors maintain CIRs below 45%. This is not merely a gap; it is a competitive chasm. Further insights into the industry's future can be found in this 2025 outlook on Bankinghub.eu.

A significant driver of this disparity is labour-intensive compliance work. With new regulations like Basel IV (implemented through CRD/CRR) introducing greater complexity to lending and risk management, the manual workload is becoming unsustainable. Maintaining the status quo is not just inefficient—it is a direct threat to profitability.

From Cost Centre to Competitive Edge

This is where AI transitions from an abstract concept to a concrete business solution. It provides a clear pathway to dismantle inefficient, costly processes and transform compliance from a mandatory expenditure into a source of operational strength. The primary benefit extends beyond cost reduction; it lies in architecting a more intelligent and resilient compliance function.

By automating repetitive tasks and augmenting the capabilities of human experts, AI directly addresses the drivers of high CIRs. It allows highly skilled personnel to shift their focus from routine checks to high-value strategic analysis, enabling the compliance department to evolve from a reactive to a proactive posture.

The goal is to flip the script: move from a reactive, manual compliance model to a predictive, automated one. AI is the engine that makes this happen, turning regulatory burdens into real, measurable efficiency gains.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

Where AI Delivers the Most Value

AI is not a monolithic solution but a portfolio of targeted tools that create compounding value when deployed strategically. Consider the immediate impact of AI in these critical areas:

- Automated Regulatory Reporting: AI systems can automatically aggregate, validate, and format data for regulatory submissions. This eliminates thousands of manual hours and substantially reduces the risk of costly human error.

- Smarter Risk Modelling: In place of static models, AI can process vast datasets in real time to identify emerging risk patterns. This delivers the dynamic, precise risk assessments mandated by regulations such as Basel IV.

- Slashing Manual Overhead: AI tools can perform initial triage on alerts, client documentation, and communications. They filter out noise and escalate only the most critical items for human review, freeing compliance officers to concentrate on complex investigations.

Ultimately, integrating AI is a strategic move to re-engineer compliance operations for the modern era. This not only enhances risk management but also unlocks significant operational efficiencies. For a closer look at leveraging data for strategic advantage, our guide on the role of a business intelligence consultant may be instructive. This is how leading institutions will build the competitive advantage that defines market leadership in the years ahead.

Practical AI Applications for Banking Compliance

Let us translate high-level strategy into tangible operational impact. It is at the implementation level that AI delivers its most immediate and powerful results. For banking leaders in Germany, the key to success lies in understanding how specific technologies address concrete, daily compliance challenges. These are not futuristic concepts but practical tools that can be deployed today to de-risk innovation and generate rapid value.

A core principle for implementation is to begin with a focused proof-of-concept. Rather than pursuing a large-scale, bank-wide overhaul, a targeted pilot project can demonstrate its value within weeks, not months. This approach builds internal momentum and establishes a solid business case for broader adoption.

Automating AML and Fraud Detection

Anti-Money Laundering (AML) investigations are among the most resource-intensive activities in banking. Traditional systems are notorious for generating a high volume of false positives—legitimate transactions erroneously flagged as suspicious. This consumes countless hours of manual review from compliance teams.

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

AI-powered transaction monitoring fundamentally changes this dynamic. By analysing thousands of data points in real time, these systems learn the subtle patterns of normal customer behaviour. They can identify genuinely anomalous activity with a precision unattainable by legacy systems. This significantly reduces noise, allowing expert analysts to concentrate their efforts on the highest-risk cases.

AI is also a formidable tool in real-time fraud detection. Cyber fraud represents a major and growing compliance challenge for German banks, with sophisticated digital threats now constituting a primary risk. This environment, shaped by BaFin's stringent AML rules and DORA's emphasis on ICT resilience, demands robust defences. With upcoming regulations like PSD3/PSR and the Instant Payments Regulation, this pressure will only escalate. AI can identify complex fraud patterns invisible to human analysis, thereby protecting both the bank and its clients.

Streamlining Regulatory Analysis with NLP

The task of keeping pace with regulatory change is a significant operational burden. When a regulator like BaFin or the ECB issues new guidance, compliance teams must manually analyse hundreds of pages of dense legal text to interpret the implications.

This is where Natural Language Processing (NLP), a branch of AI that understands human language, provides a solution. An NLP model can ingest new regulatory documents and perform the following functions almost instantaneously:

- Summarise key changes: It distils complex legal language into a concise overview of new requirements.

- Identify impacted policies: The model maps the new rules directly to the bank's existing internal policies and procedures.

- Flag required actions: It highlights the specific tasks the bank must undertake to ensure compliance.

A process that once took weeks can now be completed in hours. This enables the institution to adapt to a constantly evolving regulatory environment with greater speed and accuracy. For a powerful example of AI's effectiveness at scale, consider the case of how Visa's Generative AI blocked a massive fraud surge.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

The following table maps these technologies to specific, real-world problems.

AI Use Case Mapping to Compliance Challenges

| Compliance Challenge | AI Technology Solution | Primary Business Benefit |

|---|---|---|

| High volume of false positives in AML alerts | Machine Learning (ML) models for transaction monitoring that learn baseline customer behaviour. | Reduced operational cost and allows compliance analysts to focus on genuinely high-risk investigations. |

| Manual review of new regulatory documents | Natural Language Processing (NLP) to analyse, summarise, and map new regulations to internal policies. | Accelerated response time to regulatory changes, ensuring faster, more accurate implementation and reduced risk. |

| Complex, evolving fraud patterns (e.g., synthetic IDs) | Deep Learning and anomaly detection algorithms that identify subtle deviations from normal patterns. | Lower fraud losses and improved customer trust by stopping sophisticated threats in real-time. |

| Inconsistent and slow Suspicious Activity Reporting | Generative AI assistants (Copilots) to auto-populate reports with data and ensure template adherence. | Increased efficiency and accuracy in regulatory reporting, freeing up officer time for strategic analysis. |

This table illustrates the direct link between a specific operational pain point and a targeted AI solution. The key is to match the appropriate tool to the task at hand.

Empowering Teams with Generative AI Copilots

Beyond pure automation, AI is emerging as a powerful assistant for compliance officers. Generative AI copilots can be securely deployed to augment a team's capabilities, delivering significant improvements in both speed and accuracy.

Consider a compliance officer drafting a Suspicious Activity Report (SAR). A copilot can instantly aggregate relevant customer data, summarise transaction histories, and structure the report according to regulatory templates. The officer remains in full control, but the time-consuming administrative work is completed in seconds. This leads to higher-quality reporting and allows experts to dedicate their time to more strategic analysis. For concrete examples of how AI can support various banking functions, the capabilities of the SupportGPT platform may offer valuable insights.

The true value of AI in banking compliance isn’t about replacing human experts. It’s about empowering them. By automating the repetitive tasks and serving up deep analytical insights, AI transforms the compliance function from a reactive cost centre into a proactive, strategic asset.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

These tangible use cases demonstrate that AI is no longer a future concept but a present-day solution. Each application offers a clear path to enhanced efficiency, reduced risk, and a significantly stronger compliance posture.

A Phased Roadmap for AI Implementation

Integrating AI into the heavily regulated banking sector requires a deliberate, structured approach, not a speculative leap. A large-scale, "big bang" implementation introduces unacceptable risk and often fails to secure executive sponsorship. A phased roadmap is a superior strategy. It de-risks the process by delivering measurable value at each stage, building organisational momentum and confidence.

A four-phase framework has proven most effective for achieving rapid results while maintaining rigorous control. This approach transforms a daunting initiative into a clear sequence of manageable steps, ensuring the development of a robust, compliant, and valuable AI capability.

Phase 1: Foundational Assessment

The initial step is not technological; it is diagnostic. The objective is to identify a high-impact, low-complexity problem suitable for a pilot project. Key questions to address include: where is the compliance team expending the most effort for the least strategic return?

Focus on areas such as AML alert reviews, which are prone to false positives, or the labour-intensive process of compiling regulatory reports. The goal is to define a tightly scoped pilot with a clear success metric, such as achieving a 20% reduction in manual review time. This foundational assessment provides the strategic focus required to ensure the initial project delivers undeniable proof of value.

Phase 2: Pilot and Validation

With a clear target defined, this phase prioritises speed and execution. Partnering with an expert AI implementation firm is invaluable here, as it accelerates development and helps circumvent common pitfalls. The objective is to deliver a functional proof-of-concept (PoC) to the team that directly addresses the pain point identified in Phase 1.

This is not a theoretical exercise but a working prototype that the compliance team can test with real (anonymised) data. The PoC must produce tangible results, demonstrating not only the technology's efficacy but also its financial viability for scaling. A successful pilot provides the empirical evidence needed to justify further investment. For a detailed look at structuring such rapid cycles, our guide on the 21-day AI delivery framework offers a proven model.

The purpose of a pilot is not just to test technology, but to validate a business hypothesis. A successful PoC proves, with data, that AI can solve a specific compliance problem more efficiently and effectively than the current manual process.

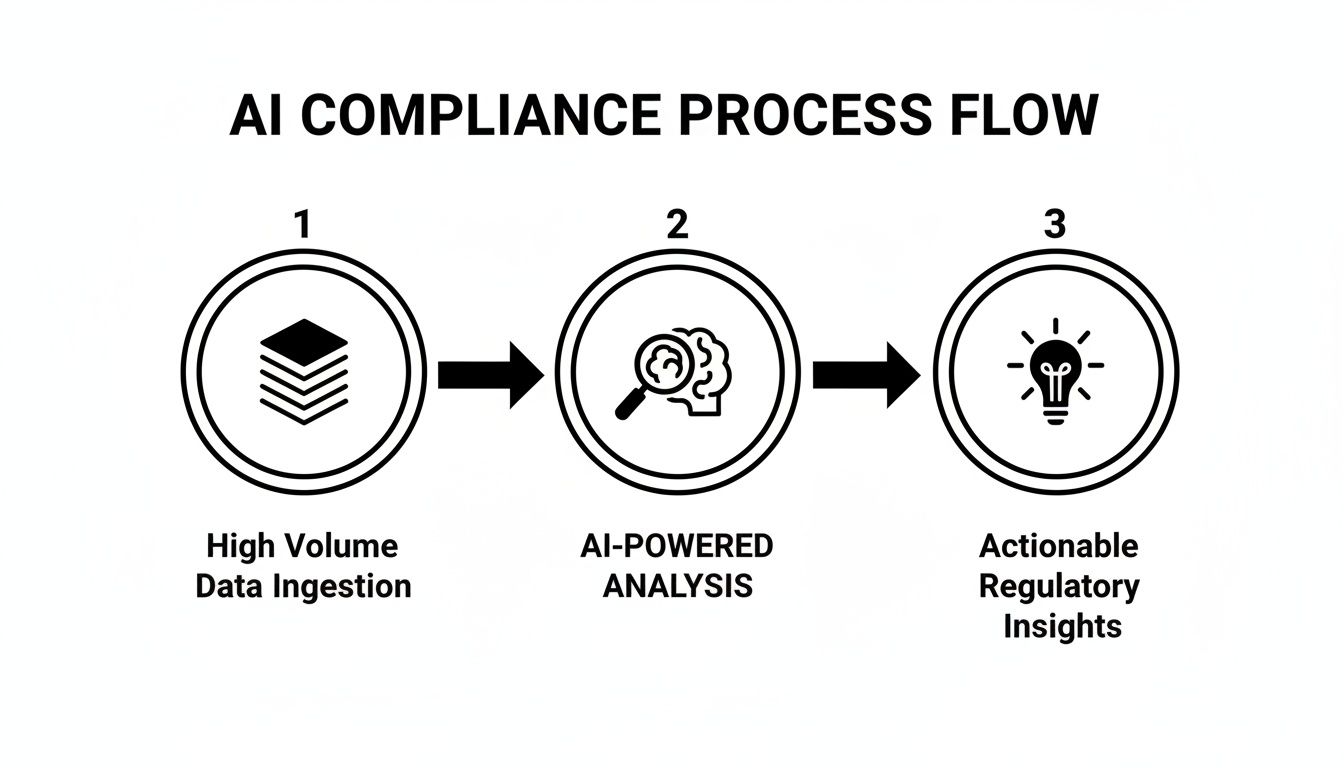

This process flow illustrates how AI transforms a high volume of compliance tasks into actionable strategic intelligence.

As the diagram shows, there is a clear path from raw data overload to valuable insights that strengthen compliance in banks.

Phase 3: Scaled Integration

Following a successful pilot, the focus shifts from a standalone project to strategic integration. This phase involves embedding the validated solution into existing compliance workflows and systems. It requires meticulous planning around data governance, system interoperability, and change management.

Key activities include:

- Developing an expanded AI strategy: Use insights from the pilot to identify the next set of high-value tasks suitable for automation.

- Executing technical integration: Collaborate closely with IT to connect the AI solution with core banking systems for seamless data flow.

- Facilitating training and adoption: Equip the compliance team with the skills and confidence to work effectively with their new AI tools.

This is the stage where the initial success is replicated across the compliance function, creating a powerful compounding effect.

Phase 4: Continuous Optimisation

AI systems are not static assets; they are dynamic capabilities that improve over time. This final phase involves a continuous loop of refining and expanding the AI's functionality. By constantly analysing performance data, models can be fine-tuned to enhance accuracy and efficiency.

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

This ongoing process also involves identifying new opportunities. As the technology matures and the team's proficiency grows, more advanced applications, such as predictive risk modelling or proactive threat intelligence, can be explored. This ensures the compliance function not only keeps pace but stays ahead of the curve, solidifying the bank’s resilience against emerging risks and future regulations.

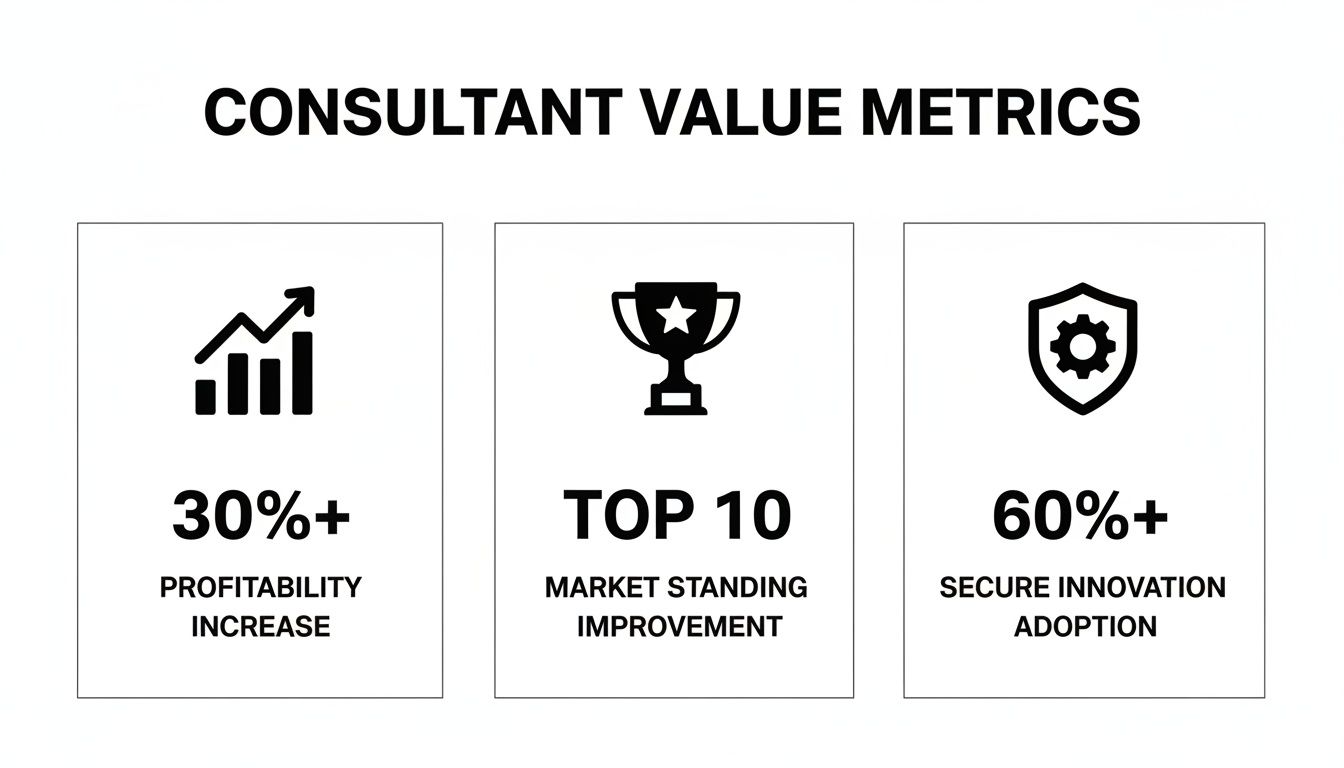

Measuring Success and Building Intelligent Compliance

Integrating AI into the compliance function is a major strategic investment, and like any investment, it must demonstrate a clear return. To secure executive buy-in and maintain project momentum, it is essential to present quantitative evidence, not abstract promises. The connection between the technology and the bank's bottom line must be explicit.

This requires moving beyond vanity metrics to focus on Key Performance Indicators (KPIs) that reflect tangible improvements in operational efficiency and risk management. These are the metrics that substantiate the strategic value of AI-driven compliance in banks.

Defining Tangible KPIs for AI in Compliance

To construct a compelling business case, it is crucial to track a focused set of KPIs. These metrics should draw a direct line from the AI implementation to measurable performance gains and cost savings.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

Consider the following core metrics:

- Reduction in False Positive Rates: This is a critical metric for any AML system. A significant decrease—for example, a 30% reduction within six months—directly translates into thousands of saved analyst hours, freeing skilled personnel to focus on genuinely high-risk cases.

- Decreased Audit and Reporting Time: Measure the end-to-end cycle time for completing regulatory audits or generating key reports. AI automation can compress these cycles from weeks to days, reducing overhead and enhancing organisational agility.

- Direct Impact on Cost-to-Income Ratio (CIR): This is the ultimate measure of efficiency. By directly linking reduced manual effort and fewer compliance errors to the bottom line, you can quantify AI's contribution to the bank's profitability.

The most powerful argument for investing in AI isn't its technical wizardry, but its quantifiable impact on the P&L. It's about building a compliance function that is not just more effective, but fundamentally more efficient and resilient.

The Vision of Intelligent Compliance

Tracking these KPIs is the starting point. The ultimate objective is to achieve what is known as intelligent compliance—a state where the organisation is not merely reacting to events but actively predicting them. It is here that AI unlocks its full strategic potential.

Intelligent compliance utilises predictive analytics to anticipate regulatory changes and model their potential impact before they are enacted. It scans global data to identify emerging risk patterns, allowing the bank to adapt its controls dynamically. This forward-looking capability transforms compliance from a defensive cost centre into a source of genuine strategic insight.

Therefore, investing in AI is not merely about satisfying current audit requirements or streamlining existing processes. It is about building a more competitive, agile, and future-proof institution. By embedding intelligence into the core of the compliance framework, you are architecting a bank prepared for the challenges of tomorrow.

Frequently Asked Questions

When artificial intelligence intersects with banking compliance, numerous questions arise for any leadership team. Here are our answers to some of the most pressing concerns from German banking executives, designed to provide direct, practical guidance.

How Can We Ensure an AI System Aligns with BaFin and ECB Rules?

Ensuring AI systems comply with regulatory standards requires a structured and transparent approach. Explainability (XAI) is a foundational requirement. Auditors and regulators must be able to understand precisely why a system made a specific decision. For BaFin, this is non-negotiable.

Robust data governance is the next imperative. All data used to train and operate AI models must be managed in strict accordance with GDPR and German data privacy laws.

Finally, engaging an implementation partner with deep expertise in regulated industries is critical. They can provide the necessary frameworks for model validation, ongoing monitoring, and the detailed documentation that regulators demand. The objective is not to deploy a "black box," but to build an intelligent, auditable system that strengthens compliance.

What Is the Typical Timeframe to See ROI from an AI Compliance Project?

A return on investment (ROI) can often be realised more quickly than anticipated. By adopting an agile methodology and starting with a focused proof-of-concept (PoC), tangible efficiency gains can be demonstrated within weeks. For instance, automating specific aspects of Suspicious Activity Report (SAR) filing can yield immediate results.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

A tangible ROI, measured by things like lower operational costs or a sharp drop in false positives, is often achievable within 6 to 12 months.

The key is to start small by solving a well-defined problem where AI provides a clear, measurable advantage. This phased approach builds momentum and secures stakeholder support, avoiding the risks of a large-scale, enterprise-wide overhaul.

Is It Better to Build In-House or Partner with a Specialist?

For most financial institutions, partnering with a specialist firm offers the optimal blend of speed, expertise, and risk management. Assembling a dedicated in-house AI compliance team is a significant, long-term investment in talent that is both scarce and costly.

A specialist partner brings proven experience in both AI engineering and the specific nuances of financial regulation. This allows an institution to bypass a steep and expensive learning curve.

A "co-creation" model is often most effective. Internal teams provide their core banking and compliance expertise, while the external specialists manage the technical implementation. This ensures the adoption of best practices for security, data governance, and regulatory adherence from day one, leading to a superior outcome for your compliance in banks strategy.

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

At Reruption GmbH, we act as your co-entrepreneurs, turning AI concepts into production-ready systems that deliver measurable business value. We specialise in building secure, compliant AI solutions that strengthen your operational core. Discover how we can help you build your intelligent compliance function.