For banking leaders in Germany, the transition to digital for banking is not merely a strategic option; it is a fundamental imperative for survival and growth. This entails a comprehensive re-engineering of the entire business model, embedding digital capabilities into the core operational fabric, rather than appending isolated technology projects. In the current market landscape, this strategic pivot is the sole determinant of sustained relevance and competitive advantage.

The Strategic Imperative of Digital Transformation in Banking

Within the German financial sector, the dialogue has evolved beyond whether to embrace digital transformation to how rapidly it can be executed. Traditional institutions face mounting pressure from two fronts: escalating customer expectations shaped by digital-native experiences and the relentless market encroachment of agile FinTech competitors. Incremental adjustments are no longer sufficient to address these structural shifts.

Authentic success is contingent upon delivering tangible, quantifiable value through the seamless integration of technology, processes, and human capital. The objective is not to digitise existing operations but to fundamentally reimagine how value is created and delivered to clients.

Defining The Modern Digital Mandate

A robust digital transformation strategy aims to build an institution that is resilient and adaptable to future market dynamics. This begins with a rigorous assessment of current capabilities and a bold, forward-looking vision. The core pillars of this mandate are non-negotiable:

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

- Radical Customer-Centricity: The paradigm must shift from a product-push model to one centred on creating hyper-personalised client experiences. This requires leveraging data and AI to anticipate customer needs before they are explicitly articulated.

- Operational Excellence: The strategic automation of critical, resource-intensive back-office functions is paramount. This initiative reduces operational expenditure, mitigates error rates, and liberates high-value talent to focus on strategic, revenue-generating activities.

- Data-Driven Decision-Making: Advanced analytics must be embedded into the decision-making fabric at every organisational level—from shaping corporate strategy and managing enterprise risk to identifying emergent growth opportunities.

It must be understood that this is not an IT initiative; it is a C-level strategic priority requiring unequivocal commitment across the entire organisation. For a foundational understanding of the core concepts, executives may find value in this A Leadership Guide to Financial Digital Transformation.

From Strategic Vision to Value Realisation

Execution requires a disciplined, phased methodology. The process commences with the definition of clear business objectives, followed by the identification of high-impact domains where AI and digital solutions can deliver measurable results. This necessitates moving beyond pilot projects to build scalable, secure, and fully compliant systems that integrate seamlessly into daily workflows.

The ultimate measure of a digital banking strategy is its ability to create a sustainable competitive advantage. This is achieved by architecting an operating model that is demonstrably more agile, efficient, and responsive to market dynamics than that of competitors.

Achieving this state requires a robust framework for strategic prioritisation. For executives tasked with execution, a structured methodology is indispensable. Our guide on creating a prioritization framework for AI MVPs provides a detailed approach for ensuring capital is allocated to initiatives that deliver both immediate and long-term enterprise value.

Decoding Germany’s New Digital Banking Landscape

For banking leaders in Germany, the market presents a strategic paradox. On one hand, customers exhibit a strong proclivity for digital engagement. On the other, most traditional institutions struggle to convert this digital affinity into commercial outcomes, creating a significant opportunity for agile competitors.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

Incremental enhancements to mobile applications or online portals are insufficient. The data indicates an inflection point demanding decisive, strategic action. It is imperative to analyse the fundamental forces reshaping the competitive landscape.

The Forces Compelling a Digital Rethink

Three primary drivers are converging to create a new market reality where digital fluency is a prerequisite for survival and growth. Each demands a strategic response from executive leadership.

- Shifting Customer Behaviours: Consumers are now conditioned by the seamless, intuitive experiences offered by technology and e-commerce leaders. They expect the same level of personalised, on-demand service from their financial institutions—24/7 access, intelligent advisory, and frictionless transactions delivered via mobile platforms.

- Persistent FinTech Disruption: FinTech startups and neobanks operate with inherent agility, unencumbered by legacy systems. They excel at identifying and serving niche customer segments with superior digital products, systematically eroding the market share of established institutions.

- Intensifying Operational Pressures: Legacy IT infrastructure, manual back-office processes, and evolving regulatory complexities create a significant drag on profitability. The mandate to reduce operational costs and enhance efficiency makes intelligent automation a critical competitive lever.

These market forces are not merely altering the rules of engagement; they are fundamentally reshaping the industry. Inaction is tantamount to a strategic concession of market share and long-term relevance.

Key Drivers and Strategic Implications for German Banks

This table outlines the primary forces shaping the German banking sector and the necessary strategic responses for executive leadership.

| Market Driver | Description | Strategic Implication for Leadership |

|---|---|---|

| Evolving Customer Behaviour | Clients demand seamless, intuitive, and personalised digital experiences on par with leading tech and e-commerce platforms. | Shift from a product-centric to a customer-journey-centric model. Invest in UX/UI and data analytics to deliver true personalisation. |

| Persistent FinTech Pressure | Agile, tech-first competitors are capturing niche markets with superior digital offerings, eroding the traditional customer base. | Adopt a "build, buy, or partner" strategy to accelerate digital capabilities. Focus innovation on underserved customer segments. |

| Intensifying Operational Demands | Legacy systems and manual processes drive up costs and slow down service delivery, while regulatory burdens increase. | Prioritise investment in AI and automation to streamline back-office operations, reduce costs, and improve compliance efficiency. |

The challenge is particularly acute in Germany, where a significant gap exists between customer intent and actual behaviour.

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

A critical disconnect exists in German retail banking. While 52% of account holders now manage their finances via mobile devices, and 66% express a willingness to purchase financial products digitally, banks are converting only 41% of sales through these channels.

This "intent-to-conversion" gap is a clear strategic indicator. It signals friction within the digital customer journey at the point of transaction. For a more detailed analysis, McKinsey's 2025 snapshot of German retail banking offers valuable insights. Closing this gap represents one of the most significant near-term growth opportunities available.

Turning Vulnerability into a Strategic Advantage

This challenging landscape also illuminates a clear path forward for institutions prepared to act decisively. The data serves not only as a warning but also as a precise guide for strategic capital allocation. The inherent digital readiness of the German customer base is a significant, yet underleveraged, asset.

The boardroom agenda must shift from debating whether to invest in digital for banking to determining how to execute a transformation that directly addresses these core challenges. This requires a holistic strategy that integrates technology, process re-engineering, and a deeply embedded customer-centric culture.

This imperative is not unique to the financial sector. It reflects a broader economic transformation, mirroring the challenges and opportunities faced by Germany's industrial core. We explore this parallel in our analysis of how AI will really transform the German Mittelstand. The mission is to build an institution that is sufficiently resilient, efficient, and responsive to thrive in an era of perpetual change.

Leveraging AI to Create a Tangible Strategic Advantage

For C-suite executives, the discourse on Artificial Intelligence must transition from the theoretical to a focus on tangible business outcomes. AI is not merely a technology; it is a strategic asset that, when precisely applied, can solve high-stakes challenges and create significant competitive differentiation. It functions as a digital catalyst, enabling solutions to previously intractable operational complexities.

To articulate its value in terms of executive metrics, we must focus on three core domains where AI delivers measurable returns: hyper-personalisation, intelligent automation, and proactive risk management. Each of these directly impacts key performance indicators, from customer lifetime value to operational cost ratios.

Hyper-Personalisation at Scale

Traditional customer segmentation models, based on broad demographic data, are obsolete. Hyper-personalisation utilises AI to analyse vast, unstructured datasets—including transaction histories, digital interactions, and service inquiries—to develop a nuanced understanding of each customer as an individual. It is the distinction between providing a generic map and offering a real-time, personalised navigation system for each client's financial journey.

This depth of insight enables the delivery of precisely the right product or advisory service at the opportune moment. For example, instead of a mass-market mortgage campaign, an AI system can identify a customer exhibiting increased savings behaviour and online property searches, then proactively deliver a customised pre-approval offer. This level of targeted engagement is what drives material improvements in conversion rates and client loyalty.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

By moving beyond basic segmentation, AI enables a transition from being a transactional service provider to an indispensable financial partner. In a saturated market, this strategic shift is critical for increasing customer lifetime value and reducing churn.

Implementing such systems requires a sophisticated data strategy. Leading investment banks are already exploring how these technologies can fundamentally reshape their operations. We examined one such approach in our case study of the generative AI strategy at Goldman Sachs.

Intelligent Process Automation

Many core banking functions, from credit assessment to regulatory reporting, remain burdened by manual processes. These workflows are not only costly and inefficient but also susceptible to human error. Intelligent Process Automation (IPA) transcends basic robotics by leveraging AI to execute complex tasks that require cognitive judgment.

Consider the credit assessment process. An IPA system can analyse thousands of disparate data points—credit histories, income statements, market trends—in seconds to generate a comprehensive risk profile. This does not render the human expert obsolete; it augments their capabilities, enabling faster, more accurate decisions. The operational benefits are immediate and quantifiable:

- Reduced Operational Costs: Automation eliminates the manual labour associated with repetitive tasks.

- Accelerated Service Delivery: Loan approvals that previously required days can be completed in hours.

- Lower Error Rates: AI systems apply business rules with perfect consistency, reducing costly mistakes and compliance breaches.

This application of digital for banking directly addresses the urgent need for greater operational efficiency, freeing both capital and human resources for strategic growth initiatives.

Proactive Risk Management

In finance, risk is a constant. The challenge is that threats, particularly sophisticated financial crime, are dynamic and continuously evolving. AI-powered risk management shifts the paradigm from a reactive to a proactive posture, enabling the identification of potential threats before they materialise into significant financial or reputational damage.

These algorithms are trained to detect subtle anomalies and complex patterns within transaction data that are invisible to human analysts. For instance, an AI can identify the faint signals of a coordinated fraud attack distributed across thousands of accounts, flagging it for immediate intervention.

The application extends beyond fraud detection. AI models are increasingly used for advanced credit risk scoring and regulatory compliance monitoring. By continuously analysing portfolios and market data, these systems provide early warnings of potential defaults or compliance issues. This enhances institutional resilience, protecting both the bottom line and the bank's reputation. Integrating AI into the risk management framework is no longer optional—it is a strategic necessity.

Building a Secure and Compliant Digital Foundation

Embarking on a digital-first transformation creates significant opportunities for growth and efficiency. However, this shift fundamentally alters an institution's risk profile and expands the potential threat surface. For any C-level executive, the future of digital for banking must be constructed upon an unassailable foundation of advanced security and rigorous compliance.

This is not a matter of retrofitting legacy systems. It requires designing a new, proactive security architecture from the ground up. The era of reactive threat response is over. The objective now is to anticipate and neutralise threats before they can inflict financial or reputational damage. Security must be intrinsically woven into the digital fabric, functioning as an enabler of innovation, not an impediment.

Confronting the Evolving Threat Landscape

The sophistication of digital financial crime is escalating at an alarming rate. Organised criminal networks are deploying advanced tactics, including AI-driven methods, specifically engineered to bypass traditional security measures, posing a significant challenge for German financial institutions.

This new generation of threats, such as hyper-realistic synthetic identities and complex account takeover schemes, often circumvents legacy detection systems. As a recent report on digital banking fraud indicates, German banks are at the forefront of combating these advanced tactics. You can explore the findings and discover more insights about German fraud trends on BioCatch.com.

True digital leadership requires recognising that customer trust is the most valuable corporate asset. In an environment of escalating threats, preserving that trust necessitates investment in security frameworks as advanced as the products they are designed to protect.

To effectively counter these threats, banks must transition to next-generation security frameworks capable of real-time adaptation.

Architecting a Proactive Defence

A modern, proactive security posture is built on intelligent, data-driven technologies designed for continuous identity verification and anomaly detection. Two pillars are essential for this new foundation.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

- AI-Powered Fraud Detection: These systems analyse millions of transactions and user interactions in real-time to identify the subtle, often imperceptible, patterns indicative of fraudulent activity. Unlike legacy rule-based systems, AI models learn and adapt, continuously improving their ability to detect novel attack vectors.

- Behavioural Biometrics: This technology moves beyond static credentials like passwords. It analyses how a user interacts with their device—their typing cadence, mouse movements, and swipe patterns—to build a unique, dynamic behavioural profile. This profile is nearly impossible for a fraudster to replicate, even with stolen login credentials.

Integrating these frameworks is not merely a technical upgrade; it is a strategic imperative to embed security seamlessly within the customer experience. When implemented correctly, these protections operate invisibly in the background, providing robust security without creating friction for legitimate customers. This fusion of security and convenience is a hallmark of market leaders.

For a detailed examination of this integrated approach, please refer to our overview of AI security and compliance for the finance and insurance sector. Ultimately, a secure and compliant digital foundation is the prerequisite for sustainable innovation.

A Phased Roadmap for Digital Implementation

Undertaking a comprehensive digital transformation can appear to be an insurmountable challenge. The solution lies not in a single, high-risk "big bang" launch, but in a disciplined, phased approach that manages risk, delivers early successes, and builds organisational momentum. For leadership, this involves guiding a methodical journey from strategic planning to full-scale enterprise integration.

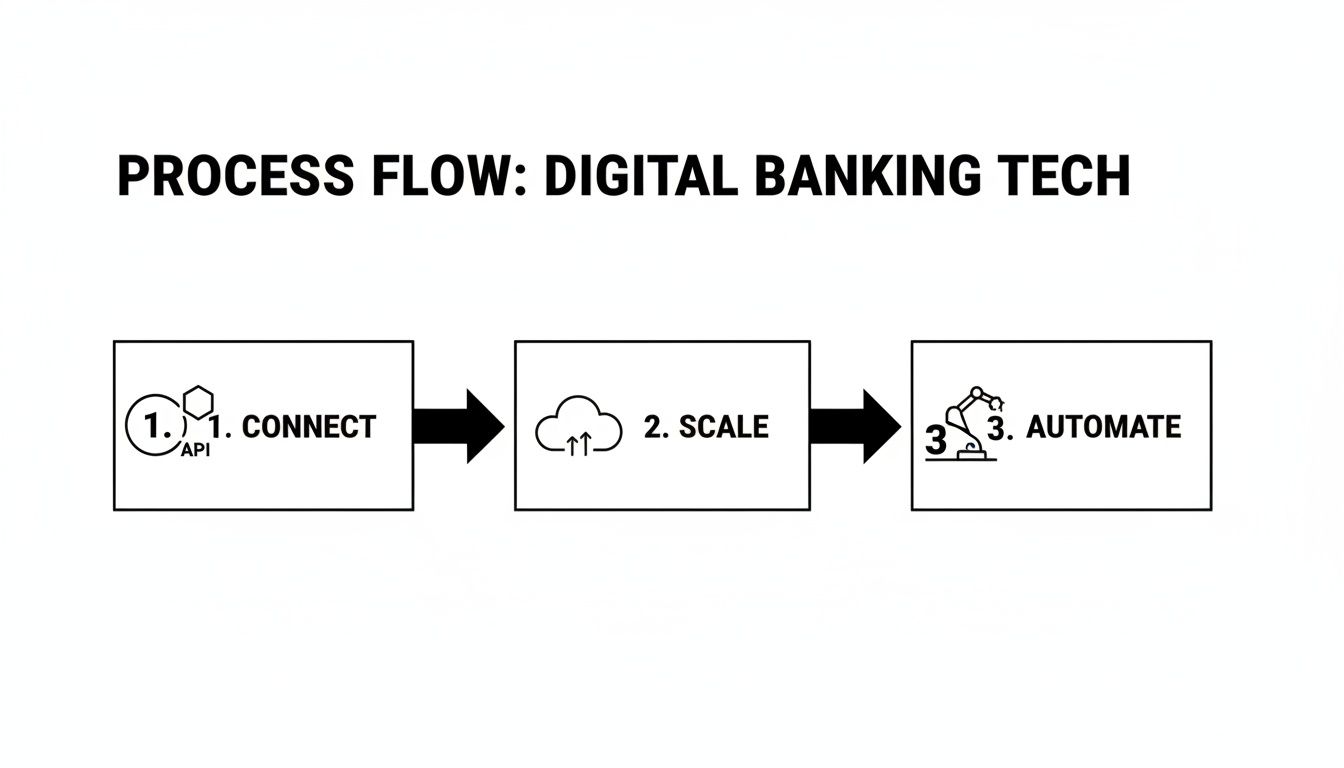

This roadmap deconstructs the process into three distinct, manageable stages. Each phase has a clear objective and a specific set of executive actions, ensuring that all capital invested is tied to a measurable business outcome. This structure renders the initiative achievable, even for large, established institutions managing complex legacy environments.

Phase One: Strategic Discovery

This initial phase is foundational. Before any code is written or infrastructure is provisioned, absolute clarity and stakeholder alignment are paramount. The objective is not to discuss technology, but to define the specific business problems that need to be solved.

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

Key executive actions during discovery include:

- Defining Business Objectives: Articulate precise, quantifiable definitions of success. Examples include reducing operational costs by 15%, increasing customer retention by 10%, or penetrating a new market segment.

- Identifying High-Impact Use Cases: Convene cross-functional teams to pinpoint areas where digital tools and AI can deliver the most significant and immediate value. Examples include automated credit underwriting or a personalised client onboarding journey.

- Securing Executive Buy-In: Develop a robust business case that clearly articulates the expected ROI, resource requirements, and strategic criticality. This ensures unified commitment from the entire leadership team.

Successful execution of this phase ensures the initiative is grounded in business reality, rather than technological novelty, answering the critical question: "Where can we generate the greatest impact first?"

Phase Two: Agile Prototyping

With a clear strategy established, the second phase focuses on speed, learning, and delivering a tangible product. The goal of agile prototyping is to launch small-scale pilots to test hypotheses, gather empirical data, and validate the concept's value rapidly. This approach minimises risk by avoiding large, upfront investments in unproven ideas.

Consider prototypes as controlled experiments. A small, focused team could develop a minimum viable product (MVP) for an AI-powered fraud detection tool and deploy it in a limited, controlled environment. The objective is to learn quickly, fail inexpensively, and validate the business case with empirical data.

This agile, iterative methodology fosters a culture of institutional learning. It shifts the organisation from theoretical planning to practical execution, building confidence and providing concrete data to inform large-scale investment decisions.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

Transitioning from concept to a working prototype requires a structured methodology. For a practical guide, our article on the 21-Day AI Delivery Framework details a process for delivering productive AI systems in an accelerated timeframe.

Phase Three: Strategic Scaling

Once a prototype has proven its value, the final phase involves scaling the solution across the enterprise. This stage is less about technology and more about building the organisational capacity to support digital solutions at scale. It requires establishing the right infrastructure, talent pipelines, and governance frameworks.

The visual below illustrates the critical path to building digital trust—a non-negotiable element when transitioning a new technology from a limited pilot to full production deployment.

As depicted, scaling innovation is a deliberate process of identifying risks, implementing robust security, and earning the trust of customers and regulators. Key executive actions include establishing clear governance for data and AI, investing in upskilling programs to develop internal talent, and executing a strategic change management plan to drive adoption. This ensures that proven solutions deliver their full potential across the entire institution.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

This entire journey can be summarised into a clear, actionable plan.

Three-Phase Digital Implementation Roadmap

A summary of the key stages, objectives, and executive actions required for a successful digital transformation journey.

| Phase | Primary Objective | Key Executive Actions |

|---|---|---|

| 1. Strategic Discovery | Achieve strategic clarity and stakeholder alignment. | Define measurable business goals, identify high-impact use cases, and secure unified executive buy-in. |

| 2. Agile Prototyping | Validate business cases and demonstrate value quickly. | Launch small-scale pilots (MVPs), gather real-world data, and use learnings to inform scaling decisions. |

| 3. Strategic Scaling | Integrate proven solutions across the enterprise. | Establish governance, invest in upskilling, implement robust security, and drive organisation-wide adoption. |

By following this phased approach, leadership can steer the organisation through digital transformation with confidence, converting a daunting initiative into a series of calculated, value-driven steps.

Leading The Human Element of Digital Transformation

The acquisition of technology is the simplest component of digital transformation. The definitive factor for success is the organisation's people and culture. At its core, genuine transformation is a human challenge, demanding profound and often difficult organisational shifts to realise the full value of technology investments.

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

This requires a deliberate dismantling of legacy mindsets and antiquated organisational structures. The objective is to cultivate an organisation that is as agile and data-centric as the platforms it employs. This involves fostering a culture where decisions are rigorously informed by data, not solely by institutional intuition.

Architecting a Digital-First Organisation

Achieving this cultural shift necessitates the deconstruction of the internal silos that have historically defined banking operations. These rigid departmental barriers stifle collaboration, impede decision-making, and make it impossible to respond to market dynamics with sufficient velocity.

The solution is the implementation of agile, cross-functional teams. These are small, empowered units comprising experts from IT, product development, marketing, and compliance, who assume end-to-end ownership of a specific customer journey or business outcome. This model not only accelerates innovation but also fosters a powerful sense of shared accountability for results.

The most advanced technology is rendered ineffective if the organisation is not structured to leverage it. The critical insight for executives is that a commitment to digital transformation must be, first and foremost, a commitment to leading profound organisational change.

Navigating this transition requires a clear strategic framework. Understanding and applying proven methodologies for change management in digital transformation is essential for guiding teams through this complex but vital evolution.

Reallocating Capital from Physical Infrastructure to Human Capital

This internal reorganisation coincides with a major secular trend across Germany’s banking sector: the rapid consolidation of physical branch networks. This strategic shift from physical to digital presence is undeniable.

In 2023 alone, Germany witnessed the closure of 944 domestic branches, contributing to a 38% decline since 2009. This is not merely a cost-reduction exercise; it is a strategic response to evolving customer behaviour and an imperative to reallocate capital to areas of future growth.

This transition liberates significant resources that must be reinvested into the most critical asset for a digital-first future: human capital. It demands a focused investment in upskilling and reskilling the existing workforce for new, high-value roles.

Key areas for talent development include:

- Data Science and Analytics: Building teams capable of translating raw data into actionable business intelligence.

- Digital Product Management: Cultivating leaders who can manage the entire lifecycle of a digital product, from ideation to launch and continuous iteration.

- Cybersecurity Expertise: Deepening the bench of security professionals capable of defending the bank's expanding digital perimeter.

Ultimately, leading the human dimension of this transformation is about building an organisation where technology empowers people, and those empowered people drive the next wave of innovation.

Addressing Common Questions from Banking Leadership

We consistently address these inquiries from banking executives in Germany navigating the complexities of digital change. Here is our direct, actionable counsel.

How can we justify the significant upfront investment required for an AI project?

Reframe the expenditure not as a cost, but as a strategic investment in the institution's future viability. The business case must articulate a compelling narrative of long-term value creation, not merely short-term expense.

Your financial model should quantify concrete outcomes:

- Operational Efficiency: Calculate the projected cost savings from automating high-volume, manual back-office processes such as credit assessment or compliance monitoring.

- Enhanced Customer Value: Project the revenue uplift from delivering hyper-personalised product offerings that improve conversion rates and client retention.

- Risk Mitigation: Quantify the value of loss avoidance. AI-powered fraud detection not only prevents financial loss but also safeguards invaluable brand reputation.

We are prepared to proceed, but where should we begin?

Avoid a broad, unfocused strategy. Instead, select a single, high-impact pilot project that can be successfully executed within one business quarter to demonstrate value and build momentum.

The optimal starting point for digital for banking is typically a high-volume, repetitive process that is a current source of operational friction. Automating loan application verification or accelerating new customer onboarding are classic initial use cases because they deliver a clear, measurable ROI and generate internal support for subsequent initiatives.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

This targeted approach mitigates risk and provides a powerful success case to secure the buy-in required for more ambitious, large-scale projects.

At Reruption GmbH, we operate as co-preneurs, not consultants. We partner with you to identify and build the AI solutions that deliver tangible business impact. Let's turn your ideas into real innovation.