For executive leadership in Germany, the digitization of banking is no longer an incremental upgrade—it is a core strategic imperative. This represents a fundamental shift from traditional, branch-centric operating models to a framework predicated on data, advanced technology, and unwavering customer-centricity. The scope extends far beyond migrating services online; it requires a complete re-architecture of how financial institutions create and deliver value.

Why Digital Transformation is a Strategic Imperative

In the German market, the critical question is not if established banks should digitize, but how rapidly they can execute this transformation to defend market share and unlock new avenues for growth. The pressure originates from agile FinTechs and digitally native competitors unencumbered by legacy systems. These challengers are redefining standards for customer experience, compelling incumbents to respond with decisive, strategic action.

This transformation addresses several core business challenges while simultaneously unlocking significant opportunities. For any C-level executive, the business case is anchored on three strategic pillars:

- Market Share Defence and Growth: Digitally mature institutions are better positioned to attract and retain high-value clients who now demand seamless, mobile-first experiences as a baseline expectation.

- New Revenue Stream Generation: Digital platforms enable the rapid development and deployment of new products and embedded finance solutions, creating access to previously unattainable market segments.

- Operational Efficiency Enhancement: The automation of core processes through technologies like AI significantly reduces manual intervention, mitigates human error, and lowers the aggregate cost-to-serve, directly impacting profitability.

Reshaping Competitive Dynamics

Technology is fundamentally redrawing the competitive landscape. To fully appreciate the urgency, consider how leading financial institutions are integrating emerging technologies. An analysis of leading banks embracing stablecoins and digital assets reveals a proactive strategy to move beyond traditional finance and secure a competitive advantage. This forward-looking adoption of novel financial instruments is a clear indicator of market trajectory.

For established institutions, strategic inertia represents the most significant risk. Failure to modernize core systems and client-facing platforms creates vulnerabilities that agile competitors will systematically exploit, leading to a predictable erosion of customer trust and profitability.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

Ultimately, the digitization of banking is an integral component of a broader corporate strategy. As you evaluate your organization's position, it is valuable to consider the wider context of corporate digitalisation in Germany to understand how these trends converge. The objective is unambiguous: to construct a resilient, efficient, and customer-centric organization prepared for the next decade of financial services.

Understanding the Market Forces Driving Digitization

The impetus for banking digitization in Germany is not merely a reaction to technological trends. It is a direct response to a convergence of market forces that are fundamentally altering the industry's structural dynamics. For any leader in the financial sector, a comprehensive understanding of these drivers is a non-negotiable prerequisite for developing a strategy that not only ensures survival but fosters market leadership.

The most significant driver is a seismic shift in customer behaviour. The branch-first model is obsolete. We operate in a mobile-first paradigm where customers expect their bank to function as a seamless, intuitive, and perpetually available application on their smartphone. Banking is no longer a destination; it is an embedded activity.

This is not conjecture; it is substantiated by data. In Germany, the adoption of mobile banking has been exponential. The proportion of account holders managing their finances via smartphone or tablet surged from 28% in 2019 to an estimated 52% by year-end 2024. Mobile is no longer a channel; it is the dominant channel.

The Rise of Digital Challengers

Concurrently, the competitive arena has been completely redefined. Neobanks and specialized FinTech firms, architected on lean, digital foundations, are capturing market share with surgical precision. They are not constrained by the significant overhead of legacy systems or extensive physical branch networks.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

This affords them a fundamentally different cost structure, enabling greater agility, more competitive pricing, and a user experience that renders many traditional banking platforms archaic. This is not a peripheral threat; it exerts intense pressure on profit margins and compels incumbents to critically reassess their value propositions and operational efficiency. A prime example of an incumbent's strategic response is Bank of America's Erica AI, which now handles billions of interactions.

The competitive threat is no longer confined to the institution across the street. It is a multi-front engagement against agile, technology-first companies that are unbundling financial services and selectively targeting the most profitable segments.

Regulatory Mandates as Catalysts for Change

The third principal force is the regulatory environment itself. Directives such as the Second Payment Services Directive (PSD2) are not merely compliance exercises. They are powerful catalysts, actively propelling the industry toward a more open and interconnected ecosystem.

PSD2, for instance, mandates that banks provide secure access to customer account data for authorized third-party providers. This single directive effectively dismantled the traditional banking data monopoly and established the foundation for a new ecosystem of financial services. In practice, such regulations achieve two objectives:

- They stimulate innovation by enabling new entities to build services upon existing banking infrastructure.

- They empower consumers by affording them greater control over their financial data and expanding their choice of providers.

For German banks, this means strategic inaction is untenable. Navigating this regulatory landscape necessitates a proactive digital strategy—one architected around APIs, robust data security, and a commitment to strategic partnerships. The confluence of evolving customer demands, intensified competition, and regulatory pressure creates an undeniable mandate for decisive action.

The Core Technologies Enabling Digital Banking

The digital transformation of banking is not an abstract strategic objective; it is the direct outcome of deploying a specific suite of powerful technologies. For leaders guiding this transition, understanding these foundational pillars—the "how" that enables the "why"—is essential. This is not merely an IT upgrade; it is about architecting a new, agile operating model.

Consider Application Programming Interfaces (APIs) as the central nervous system of modern finance. They are the secure protocols that enable seamless communication between your bank's internal systems and, critically, with external partners. This connectivity unlocks integrated customer experiences and facilitates business models that were previously inconceivable.

A Foundation of Agility and Intelligence

With robust connectivity established, Cloud Computing provides the foundational layer for speed and scalability. Migrating from rigid, on-premise data centers allows for dynamic resource allocation, a significant reduction in capital expenditure on hardware, and accelerated deployment of new applications. This delivers the operational flexibility required to compete with agile FinTech challengers.

Layered atop this infrastructure is the intelligence engine: Artificial Intelligence (AI) and Machine Learning (ML). This is the inflection point where data transitions from a storage liability to a strategic asset. AI and ML algorithms analyze vast datasets in real time to power a range of functions, from hyper-personalized product recommendations to sophisticated fraud detection systems that identify threats proactively.

AI is the cognitive engine of the digital bank. It automates complex decision-making, uncovers latent patterns in customer behaviour, and delivers the insights necessary to create tangible value and competitive differentiation in a saturated market.

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

These are not theoretical concepts. The German FinTech sector, a key driver of banking digitization, attracted $8.2 billion in startup funding in 2024. This represents a 4% increase from 2023, solidifying Berlin and Frankfurt as hubs for AI-driven finance. Further insights can be found in the analysis of the German fintech and banking market on Financexmagazine.com.

Automating Operations and Creating New Value

While AI handles complex analytical tasks, Robotic Process Automation (RPA) addresses a different but equally critical function: optimizing back-office operations. RPA utilizes software "bots" to execute high-volume, repetitive tasks such as data entry, account reconciliation, and customer onboarding. This reallocates human capital to higher-value activities, reduces operational risk, and significantly lowers processing costs. A well-architected IT infrastructure is paramount for this, a topic detailed in our article on system engineering for modern enterprises.

Finally, these technologies converge under the framework of Open Banking. Mandated by regulations like PSD2, Open Banking leverages APIs to enable secure data sharing between banks and trusted third-party providers. This should be viewed not as a compliance burden, but as a significant strategic opportunity. By partnering with FinTechs, you can embed your services into external platforms, creating a financial ecosystem that delivers superior customer convenience and reinforces your institution's central role in their financial lives.

To synthesize, the following table outlines how these technologies translate directly into business value.

Key Enabling Technologies and Their Business Impact

| Technology | Primary Function | Strategic Business Impact |

|---|---|---|

| APIs | Securely connects internal systems and external services. | Enables ecosystem partnerships, new revenue streams, and integrated customer journeys. |

| Cloud Computing | Provides on-demand, scalable computing resources. | Reduces infrastructure costs, increases operational agility, and accelerates time-to-market for new services. |

| AI & Machine Learning | Analyses data to automate decisions and uncover insights. | Drives personalisation, enhances fraud detection, improves risk management, and informs strategic decisions. |

| RPA | Automates high-volume, rules-based back-office tasks. | Increases efficiency, reduces human error, lowers operational costs, and improves compliance. |

| Open Banking | Uses APIs to facilitate secure data sharing with third parties. | Unlocks new business models, expands service offerings through partnerships, and improves customer experience. |

Each technology addresses a distinct component of the digital challenge. When integrated, they form a powerful engine for constructing the bank of the future—one that is intelligent, efficient, and deeply embedded in the customer's world.

A Pragmatic Roadmap for Implementation

Embarking on the digitization of banking is not merely a technology procurement exercise. It demands a strategic, phased approach designed to minimize risk while accelerating value creation.

The most effective roadmaps avoid "big bang" implementations. Instead, they prioritize iterative progress, accumulating small wins to build organizational momentum. The objective is to move methodically from identifying high-impact opportunities to scaling proven solutions across the enterprise.

This path is defined by clear, measurable outcomes, not ambiguous digital projects. It is a disciplined process that ensures every euro invested in technology is directly linked to a tangible business result—be it reducing operational costs, enhancing customer satisfaction, or generating new revenue.

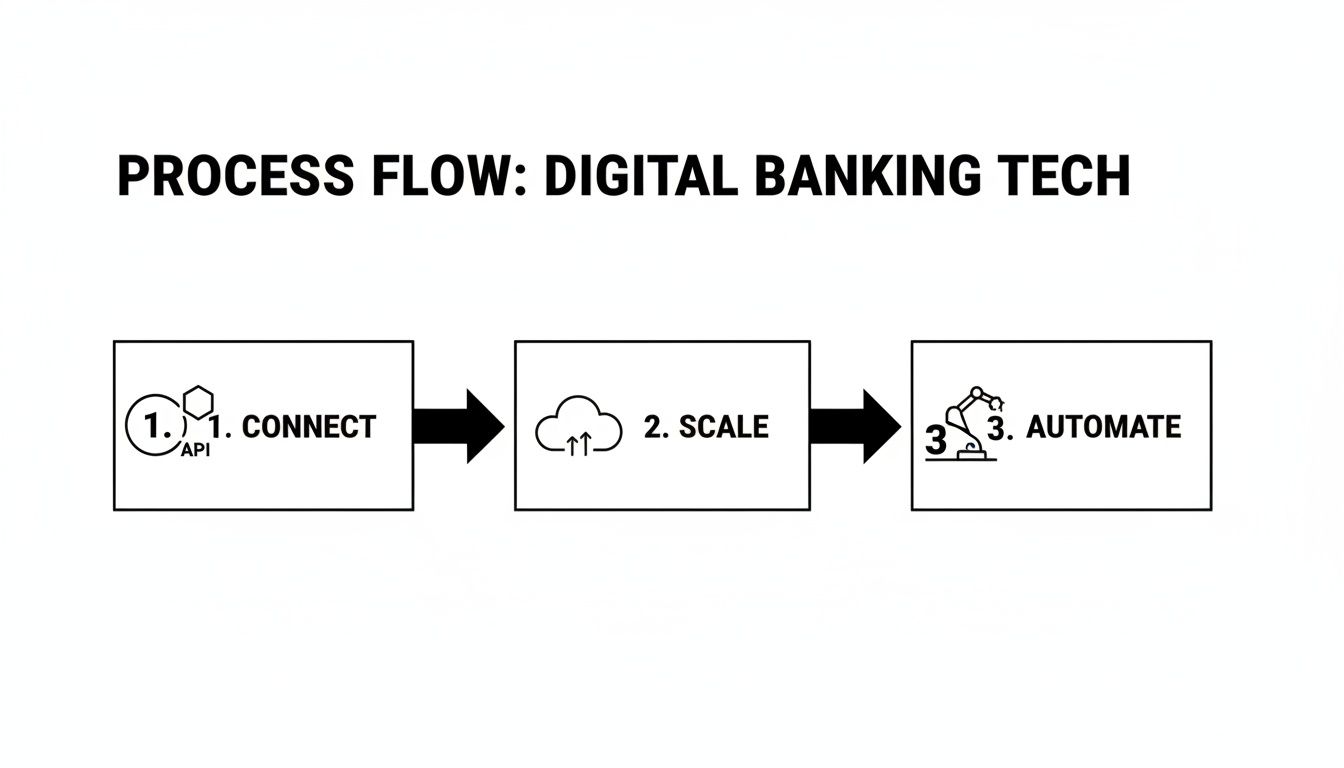

The following visual outlines the core stages, progressing from foundational integration to enterprise-wide automation.

As illustrated, genuine transformation begins with connecting systems via APIs. Subsequently, the cloud provides the necessary scalability, and finally, intelligent automation delivers profound efficiency gains.

Stage 1: Strategic Use-Case Discovery

The journey commences with strategy, not technology. The initial step is to identify and prioritize specific business problems or opportunities where a digital solution can deliver maximum impact with minimal initial risk.

This requires convening cross-functional stakeholders—from client-facing relationship managers to back-office operations teams—to pinpoint the most acute pain points.

A practical methodology involves mapping potential use cases against two axes: business value and implementation complexity. The optimal starting point lies in the high-value, manageable-complexity quadrant. These are the early wins that secure critical stakeholder buy-in. Examples include automating client onboarding verification or deploying a simple AI tool for internal compliance inquiries.

Stage 2: Prototyping and the Minimum Viable Ecosystem

Once a priority use case is selected, the focus shifts to rapid prototyping and the development of a Proof-of-Concept (PoC). The objective here is speed and learning, not perfection. A small, agile team should be empowered to build a functional model that demonstrates the core concept to a limited user group. This phase is designed to test assumptions quickly and cost-effectively.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

A successful prototype is not a finished product. It is a learning instrument designed to answer one critical question: does this solution effectively address a real problem in a manner that encourages user adoption? Answering this early prevents significant investment in flawed concepts.

If the PoC proves successful, the next step is the Minimum Viable Ecosystem (MVE). This extends beyond a single product. It involves integrating the new solution with a minimal set of existing systems (such as the core banking platform or CRM) to test its real-world viability and gather performance data.

Stage 3: Scaling and Enterprise Integration

With a validated MVE, the final stage is to plan the broader organizational rollout. This phase addresses more complex challenges: full integration with legacy systems, ensuring robust security and compliance, and cultivating an agile culture capable of continuous improvement. Effective scaling requires a clear governance framework and dedicated resources.

Critical considerations include:

- Legacy System Management: A clear strategy is required for either integrating with or systematically decommissioning outdated infrastructure. APIs often serve as the crucial bridge.

- Fostering an Agile Culture: Transition from traditional, siloed project management to cross-functional teams that can adapt and iterate rapidly.

- Talent Acquisition and Development: Invest in upskilling current employees and recruit specialists in areas such as data science, AI engineering, and cybersecurity.

This phased roadmap provides a robust framework for navigating the complexities of digital transformation. For organizations seeking to accelerate this journey, a co-preneurial partnership can provide the requisite expertise and momentum. Learn more about how a tailored AI strategy for finance and insurance can de-risk implementation and drive superior results.

Measuring Success with Strategic KPIs

The deployment of a new application or the automation of a legacy process is a milestone, not the destination. To sustain momentum and justify investment, every digital banking initiative must be linked to a measurable outcome.

True success is not defined by the adoption of new technology, but by a clear, data-driven return on investment. This requires moving beyond superficial metrics to focus on Key Performance Indicators (KPIs) that directly reflect strategic objectives.

Defining Core Measurement Domains

The most valuable KPIs can be categorized into three domains. Each provides a different perspective on the transformation, from customer response to direct financial impact.

Customer Engagement: This domain measures the effectiveness of your digital tools in attracting and retaining customers. Key metrics include the Digital Adoption Rate (the percentage of your customer base actively using digital channels) and Monthly Active Users (MAU). These indicators reveal the relevance and usability of your platform.

Operational Efficiency: This assesses the internal impact of technology. Metrics such as Cost-to-Serve Reduction (the decrease in cost per customer interaction) and Process Automation Rate (the percentage of tasks executed without human intervention) demonstrate the tangible operational benefits.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

Financial Performance: Ultimately, all initiatives must contribute to the bottom line. KPIs like Customer Lifetime Value (CLV) for digitally-active clients and Digital Channel Revenue (income generated exclusively through digital platforms) establish a direct link between digital initiatives and profitability.

A common pitfall is the focus on 'vanity metrics.' High download numbers may appear impressive but offer little insight. Truly meaningful KPIs track significant actions—such as completed transactions or reduced customer service call volumes—that correlate directly with strategic goals.

The German ‘Intent-to-Conversion Gap’

For German banks, a particularly revealing metric is emerging. While the German retail banking landscape is evolving, a significant disconnect persists. A substantial 66% of customers are willing to purchase banking products online and already prefer digital over physical channels. The challenge is that banks have digitized only 41% of their sales processes. This data is available in the German retail banking snapshot on McKinsey.com.

This discrepancy is termed the ‘intent-to-conversion gap’. It is a powerful KPI that highlights precisely where legacy systems and strategic hesitation result in lost revenue. Optimizing the digital sales journey to close this gap is one of the most direct ways to unlock immediate value from digitization efforts.

To assist in tracking what matters, the following table summarizes essential KPIs across key business domains.

Essential KPIs for Tracking Digital Transformation

This table summarises key performance indicators across different business domains to measure the tangible impact of digitisation initiatives.

| Domain | Key Performance Indicator (KPI) | What It Measures |

|---|---|---|

| Customer Experience | Digital Adoption Rate | The percentage of customers actively using digital channels (web, mobile). |

| Net Promoter Score (NPS) | Customer loyalty and satisfaction with digital services. | |

| Customer Effort Score (CES) | The ease of completing a task or resolving an issue via digital channels. | |

| Operational Efficiency | Cost-to-Serve Reduction | The decrease in the average cost to service a customer through digital vs. traditional channels. |

| Process Automation Rate | The percentage of manual tasks that have been successfully automated. | |

| Time to Resolution | The average time it takes to resolve a customer query or complete a process digitally. | |

| Financial & Business | Customer Lifetime Value (CLV) | The total net profit a bank can expect from a digitally-engaged customer over their entire relationship. |

| Digital Channel Revenue | The portion of total revenue generated directly through digital platforms. | |

| Intent-to-Conversion Gap | The difference between customers willing to buy digitally and the bank's ability to facilitate that sale. |

Vigilant monitoring of these specific metrics provides the clarity required to steer your strategy effectively. It fosters accountability, optimizes resource allocation, and builds a robust business case for continued investment. Discover more about leveraging such data as a strategic asset in our guide to analytics and business insights.

Navigating Governance, Security, and Compliance in Digital Banking

Advancing the digitization of banking creates significant opportunities for efficiency and growth. However, it concurrently elevates the stakes in governance, security, and compliance. For German business leaders, these are not administrative tasks; they are the foundational pillars of any sustainable digital strategy. A failure in any of these domains can irrevocably damage customer trust and result in severe financial and reputational consequences.

Effective governance provides strategic direction to digital initiatives. It is the framework that ensures every project and platform aligns with overarching business objectives. Without it, organizations risk siloed efforts and squandered investment. A robust governance model clarifies authority, defines risk appetite, and standardizes decision-making processes for technology adoption.

Fortifying the Digital Perimeter

As banking shifts from physical vaults to distributed networks, the concept of a "security perimeter" becomes infinitely more complex and critical. A digital-first model demands a proactive, multi-layered security posture that anticipates future threats rather than reacting to past incidents. This extends far beyond conventional firewalls and antivirus software.

Current best practice is predicated on ‘security by design’. This principle involves embedding robust security controls into the architecture of digital products from their inception. Key areas of focus must include:

- Advanced Threat Detection: Utilizing AI-powered systems to monitor network traffic and user behaviour in real-time, identifying anomalous activity indicative of sophisticated cyberattacks.

- Data Protection and Encryption: Implementing end-to-end encryption for all data—both in transit and at rest—to render sensitive customer information useless in the event of a breach.

- Proactive Fraud Prevention: Leveraging machine learning to identify unusual transaction patterns, enabling accurate fraud detection while minimizing false positives that inconvenience legitimate customers.

For leadership, the critical mindset shift is to view security not as a cost center, but as a business enabler. In the digital economy, demonstrable security is a powerful differentiator that builds the trust necessary for growth.

Embedding Compliance into the Digital DNA

The regulatory landscape in Germany and across Europe is stringent. Navigating regulations such as the General Data Protection Regulation (GDPR) and meeting the requirements of the Federal Financial Supervisory Authority (BaFin) is non-negotiable. In a digital context, compliance cannot be an afterthought.

It must be integrated into the design of products and processes from day one. This requires the early and continuous involvement of compliance experts in all development projects. They ensure that principles like data privacy, transparency, and consumer protection are core features, not subsequent additions. For example, when developing a new mobile application, GDPR principles such as data minimization must inform every decision regarding the collection and processing of customer data.

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

To aid teams in managing payment security, resources like a quick PCI DSS compliance checklist can be highly beneficial. By adopting this integrated approach, you can innovate with confidence, assured that you are building upon a resilient and fully compliant foundation.

Frequently Asked Questions About Banking Digitisation

It is imperative for leadership to address key questions when navigating a transformation of this complexity. Here, we address common inquiries from executives in Germany, providing clarity on strategic challenges and pragmatic initial actions.

What Is the Biggest Challenge for Large German Banks?

The single greatest obstacle is legacy IT infrastructure. These are typically complex, monolithic systems, often decades old, which are inflexible, difficult to maintain, and were not designed for integration with modern APIs and cloud services.

This technical debt acts as a significant impediment to innovation. It delays the launch of new digital products and inflates the cost-income ratio, particularly when benchmarked against agile FinTech competitors. A successful transformation requires a phased, strategic plan to modernize this core infrastructure without disrupting daily operations.

The primary challenge is not a lack of strategic vision, but the significant inertia of outdated technology. Meaningful progress begins with a deliberate, piece-by-piece modernization of the technical foundation.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

How Can We Balance Innovation with German Data Privacy Expectations?

The only viable approach is the adoption of a ‘Privacy by Design’ framework. This is not a final compliance check; it is the proactive integration of data protection principles into the architecture of any new digital service from its inception.

For German customers, transparency is a critical component of trust. It is essential to communicate clearly what data is being collected, the rationale for its collection, and the direct benefit it provides to the customer—be it enhanced personalization or improved security. Technologies such as federated learning and advanced data anonymization are valuable tools in this context. They enable data-driven innovation while adhering to strict GDPR mandates and, crucially, reinforcing customer trust.

What Is a Realistic First Step for a Large Company?

Begin with a focused pilot project targeting a high-impact, low-complexity use case. Defer the large-scale, "big-bang" overhaul in favor of identifying a specific customer pain point or an internal process ripe for digital optimization.

Consider the following initial steps:

- Automate a back-office process, such as client onboarding verification, using Robotic Process Automation (RPA).

- Develop a simple digital tool to assist SME clients with short-term cash flow management.

- Deploy a small-scale AI chatbot to address common internal compliance questions from staff.

This approach enables the organization to build new capabilities, demonstrate ROI quickly, and derive valuable lessons before committing to larger, more complex initiatives. It is the most effective method for proving the value of banking digitization in a controlled and measurable manner.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

At Reruption GmbH, we function as your co-preneurs to transform these initial steps into scalable, market-leading innovations. We partner with you to navigate the complexities of AI implementation, ensuring your digital initiatives deliver tangible business outcomes. Begin your transformation journey and build a sustainable competitive advantage by visiting us at https://www.reruption.com.