A make-vs-buy analysis is a foundational strategic framework for determining whether to develop a capability internally or procure it from an external provider. In the context of Artificial Intelligence, this decision transcends mere cost-benefit calculations. It is a critical determinant of competitive advantage, resource allocation, and speed-to-market, fundamentally shaping an enterprise's future trajectory.

The Strategic Imperative of AI Sourcing

The decision to build a proprietary AI solution versus purchasing a third-party platform represents a significant strategic inflection point. This is not merely a technology procurement issue; it is a core business determination that dictates cost structures, intellectual property ownership, and long-term market positioning. For German industrial leaders navigating intense global competition and domestic economic pressures, a suboptimal decision can lead to significant capital misallocation, stalled innovation, and a loss of competitive standing.

Conversely, a well-executed decision aligns technology investment with core business objectives, ensuring every euro contributes to sustainable value creation. This process necessitates a rigorous examination of an organisation's core competencies: which capabilities are truly differentiating and must be owned internally? And where can strategic partnerships with specialised vendors accelerate progress? Before reaching this stage, it is crucial to identify high-value AI opportunities, a methodology we detail in our guide to developing an AI strategy with a prioritization framework for MVPs.

Core Differences Between Making and Buying AI

To begin, it is essential to delineate the operational and strategic implications of each path. The analysis must extend beyond a simple comparison of development costs versus licensing fees. For a broader perspective on sourcing decisions, the strategic insights on the pros and cons of offshore outsourcing offer a valuable complementary analysis.

| Decision Factor | Make (Internal Development) | Buy (External Procurement) |

|---|---|---|

| Control & IP | Absolute ownership of code, data, and resulting intellectual property. | The vendor retains IP; rights to data and derived insights can be complex. |

| Speed-to-Market | Slower initial deployment due to the nature of ground-up development. | Significantly faster implementation of a market-ready solution. |

| Customisation | Can be precisely tailored to unique, proprietary business processes. | Limited to the vendor's existing feature set and future product roadmap. |

| Resource Demand | Requires substantial internal commitment of talent, capital, and infrastructure. | Less immediate strain on internal teams; R&D is managed by the vendor. |

| Long-Term Cost | High initial capital expenditure, but potentially lower Total Cost of Ownership (TCO). | Lower initial cost, but entails perpetual subscription and licensing fees. |

The pivotal question is not "Can we build this?" but rather "Should we build this?" The answer hinges on whether the capability in question confers a durable competitive advantage that justifies the significant investment of time, capital, and strategic focus.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

This guide provides a robust, executive-level framework for navigating this critical decision. The objective is to equip leadership with a strategic lens to evaluate major technology investments, moving beyond rudimentary cost comparisons to a sophisticated assessment of strategic fit, operational readiness, and risk management.

A Four-Pillar Framework for Your AI Sourcing Decision

A rigorous make-vs-buy analysis for any major AI initiative must transcend a purely quantitative assessment. A cost-centric view is a common pitfall that overlooks the strategic dimensions of the decision. To achieve a sound outcome, leadership must evaluate the choice through four interconnected pillars, ensuring the final decision builds long-term enterprise value.

This framework facilitates a deeper analysis beyond surface-level metrics, providing a defensible rationale for either internal development or external procurement. Each pillar compels a thorough examination of a critical aspect of the business, from market positioning to internal capabilities.

Pillar 1: Strategic Alignment

The initial and most critical consideration is not financial. The fundamental question is: is this AI capability core to our competitive differentiation? If the technology directly enhances the company's unique value proposition or creates a proprietary advantage that commands a price premium, the argument for 'make' becomes compelling. Internal development ensures complete control over the intellectual property and yields a solution perfectly aligned with proprietary workflows.

Conversely, if the AI function is a non-differentiating utility—such as standard HR chatbots or predictive maintenance on non-critical assets—procurement is almost invariably the more prudent and efficient path. Mature, best-in-class solutions already exist for these applications. Attempting to replicate them internally offers minimal strategic upside while consuming valuable resources.

Pillar 2: Total Cost of Ownership

The financial model must extend far beyond the initial software license or the development team's budget. Total Cost of Ownership (TCO) provides the necessary financial discipline for a comprehensive make-vs-buy analysis.

- For 'Make': The TCO encompasses not only developer salaries but also the costs of infrastructure (cloud or on-premises), ongoing maintenance, security updates, data governance, and the significant expense of retaining top-tier talent in a highly competitive market.

- For 'Buy': The analysis must account for subscription fees, implementation and integration costs, potential customisation charges, user training, and the long-term risk of vendor lock-in.

A significant and often overlooked component of TCO is opportunity cost. What other high-impact strategic initiatives are deferred while your most capable engineers are dedicated to building a non-core AI tool? This hidden cost can fundamentally alter the financial calculus.

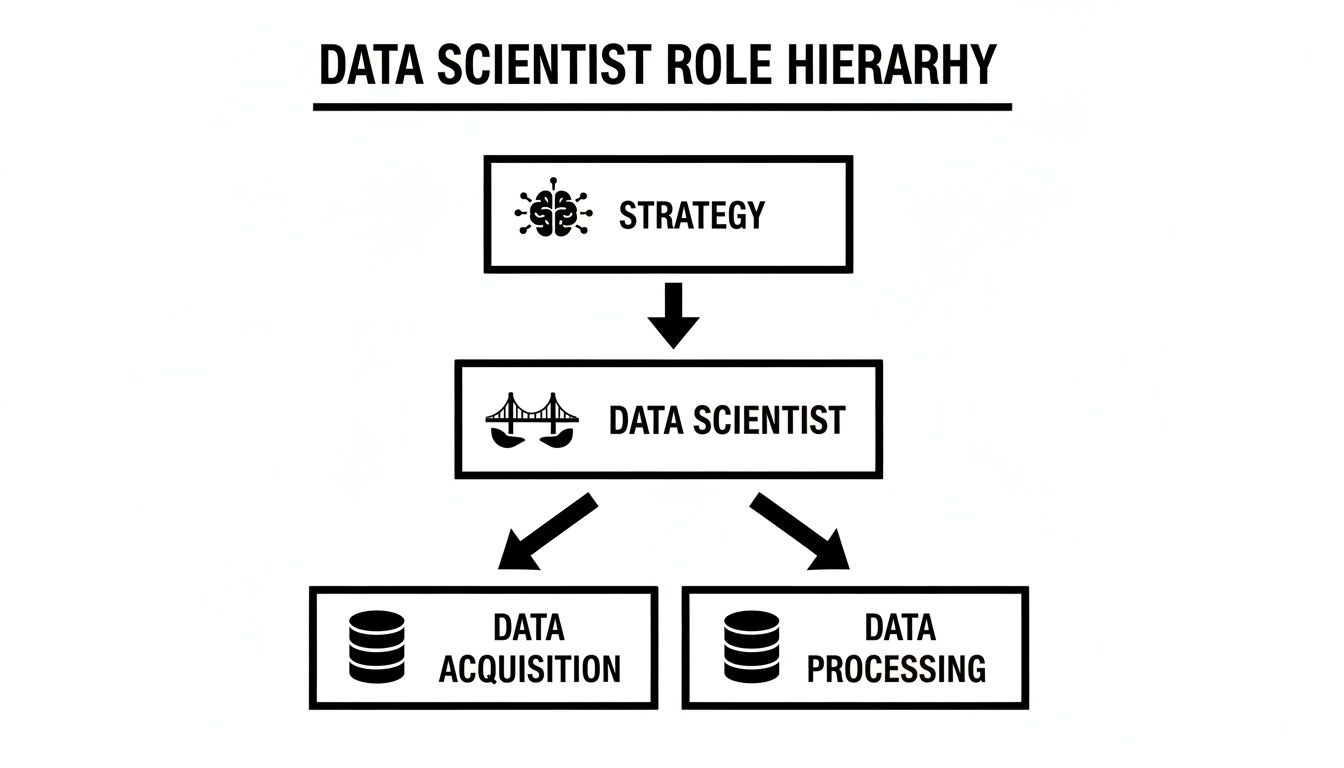

Pillar 3: Organisational Capability

An objective self-assessment is paramount. Does the organisation possess the requisite in-house talent—from machine learning engineers to data scientists—to successfully execute a complex AI project? Equally important, is the data infrastructure sufficiently mature and accessible to support the proposed solution?

This pillar also addresses corporate culture. Developing a proprietary AI solution is not a discrete project; it is a long-term commitment requiring an agile, experimental, and data-driven organisational mindset. A vendor, by contrast, provides immediate access to specialised expertise and a proven methodology, allowing the organisation to circumvent the protracted process of building these capabilities organically. Reviewing existing intelligent process automation software can help identify potential bridges for these capability gaps.

Pillar 4: Speed-to-Market

Finally, one must assess the required velocity of implementation. In-house development is inherently the more time-intensive path, often requiring many months or even years to progress from concept to a production-ready system. This timeline must be weighed against prevailing market dynamics.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

In a rapidly evolving industry, the immediate value and accelerated launch of a pre-built solution can provide a decisive advantage. If competitors are already leveraging similar AI tools, the delay associated with a 'make' decision could result in a permanent loss of market share. The strategic imperative is to determine if the long-term benefits of a custom build outweigh the immediate risk of falling behind. Defining these timelines is a central element of how we advise clients to structure an AI strategy with a prioritization framework for MVPs.

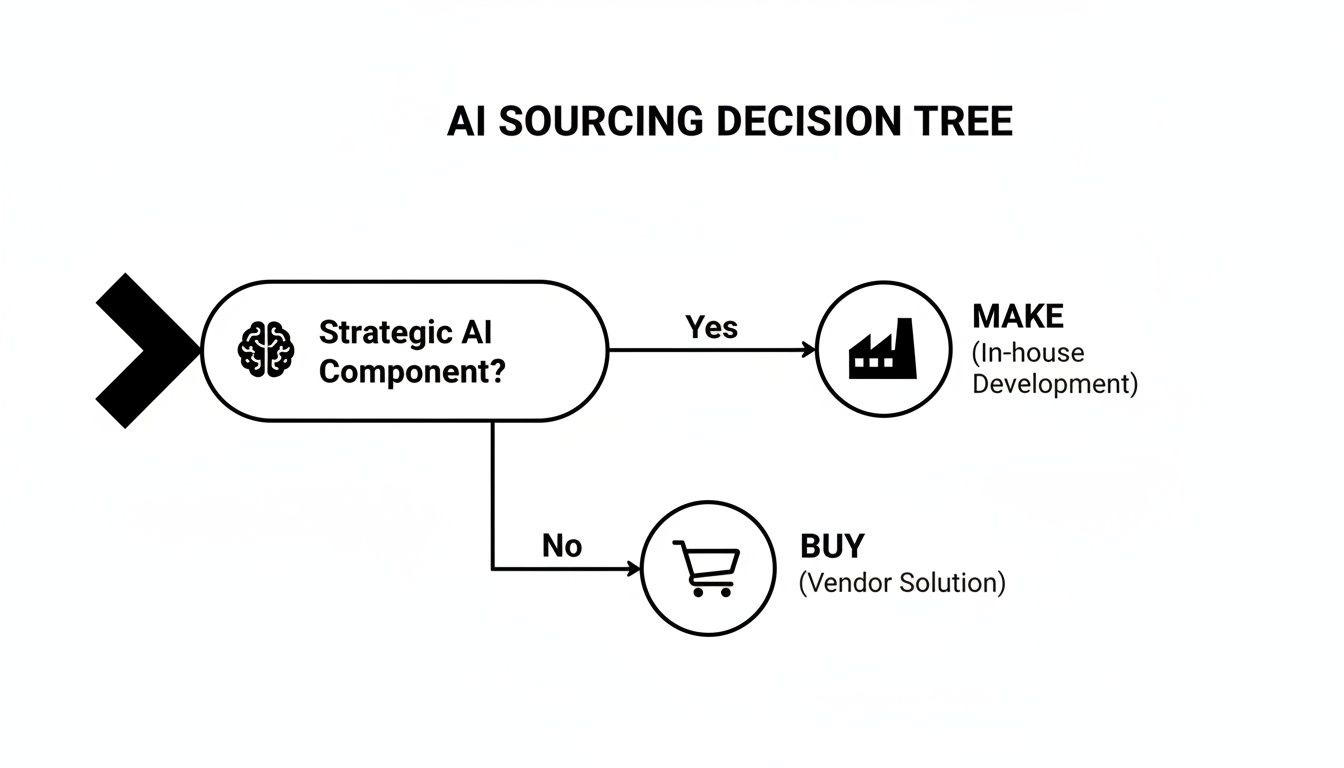

The decision tree below provides a visual representation of this initial, critical assessment, which begins with strategic importance.

This graphic simplifies the initial filtering process. If an AI capability is not central to competitive differentiation, the default path should be to evaluate existing market solutions.

To synthesize these concepts, the following matrix outlines common scenarios.

Decision Matrix for AI Make-vs-Buy Scenarios

This table summarizes the primary drivers and recommended paths for typical AI implementation scenarios observed among our clients. It serves as a useful starting point for framing internal strategic discussions.

| Scenario | Primary Driver | Lean Towards 'Make' | Lean Towards 'Buy' |

|---|---|---|---|

| Proprietary Analytics Engine | Competitive Differentiation & IP | The unique data model itself is the core business asset. | IP risk is prohibitive; an off-the-shelf tool creates no competitive moat. |

| Internal Process Automation | Operational Efficiency | The process is highly unique and complex, requiring deep systems integration. | The process is standardized (e.g., invoice processing, HR onboarding). |

| Customer-Facing Chatbot | User Experience & Brand Voice | Requires a highly customized brand persona and deep product integration. | Fulfills general-purpose support, lead qualification, or FAQ functions. |

| First AI Pilot Project | Speed to Value & Learning | The objective is to build internal capability and test a unique hypothesis. | The objective is to prove business value rapidly with minimal technical risk. |

Ultimately, this matrix is a guide, not a rigid set of rules. The optimal decision will always emerge from a balanced and thoughtful debate across all four pillars, grounded in the specific context of your business and market environment.

Factoring German Economic Pressures into Your Analysis

A robust make-vs-buy analysis cannot be conducted in a vacuum; it must be firmly grounded in the prevailing economic reality. For enterprises in Germany, the current landscape is characterized by a specific set of pressures that directly influence strategic AI sourcing decisions.

High labour costs, supply chain fragility, and intense global competition create a challenging operating environment where every investment must be rigorously justified. These are not abstract economic concepts; they are tangible pressures impacting the bottom line and constraining strategic options. They compel leadership to critically reassess where and how value is created.

The analysis must therefore extend beyond a simple comparison of internal development costs versus a vendor's price. It is imperative to model how each path—make or buy—enables the organisation to navigate these specific German economic headwinds.

The Labour Cost Dilemma

Germany's high-wage economy is a significant variable in any make-vs-buy calculation. Historically a hallmark of quality and engineering prowess, it now presents a strategic challenge. When internal talent is a high-cost asset, the default inclination is often to explore external procurement.

This pressure is particularly acute in Germany's manufacturing heartland. In the automotive sector, for instance, the make-vs-buy analysis has become an instrument of survival. Average labour costs in this sector reached €62 per hour in 2023, positioning Germany as one of the most expensive manufacturing locations globally.

This figure stands in stark contrast to competitors such as Spain at €29 per hour or Portugal at €20 per hour. This substantial differential compels sourcing teams to rigorously model the viability of retaining certain production capabilities in-house versus outsourcing. For further context, see the drivers of distress in Germany's M&A landscape.

Given these economics, the 'buy' option for non-essential functions appears to be a clear path to cost reduction. Why develop an internal AI tool for predictive maintenance when a specialized vendor offers a mature solution for a fraction of the cost required to hire and retain a dedicated team in Germany?

AI as a Strategic Counterbalance

This, however, represents a short-term perspective. A more forward-looking analysis reveals a powerful counterargument. A strategic internal investment in AI-driven automation—the 'make' path—can serve as a formidable hedge against long-term labour cost volatility and skills shortages.

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

Consider the strategic implications:

- Mitigating Wage Inflation: Developing proprietary automation for core processes can decouple productivity from escalating wages. An automated quality control system powered by computer vision, for example, operates at a fixed capital cost, insulating a critical function from the outcomes of future collective bargaining agreements.

- Enhancing Supply Chain Resilience: Recent geopolitical events have exposed the fragility of global supply chains. Investing in proprietary AI to improve forecasting, optimize inventory, and enable near-shoring of key processes enhances operational autonomy.

- Retaining Core Competencies: Outsourcing critical functions can lead to a gradual erosion of institutional knowledge. By choosing to 'make' strategic AI tools, an enterprise is not merely developing software; it is investing in upskilling its workforce and preserving deep process expertise. This is a crucial element for how AI will transform the German Mittelstand.

The decision shifts from a short-term cost-cutting exercise to a long-term strategic investment in operational resilience and competitive durability. The question evolves from "What does this cost?" to "What is the cost of not developing this capability in-house?"

Ultimately, incorporating Germany's economic pressures requires a dual-horizon perspective. The 'buy' decision can offer immediate relief from high domestic costs for non-core functions. However, the 'make' decision for processes that drive fundamental value represents a strategic investment to mitigate the impact of those same costs over the long term, securing a more resilient and competitive future. Your analysis must judiciously weigh today’s balance sheet against tomorrow’s market leadership.

Solving the Procurement Paradox with Intelligent Sourcing

German manufacturing is confronting a significant challenge. Rising material costs and stagnant output are compressing margins, rendering many traditional procurement methods inadequate for the current environment. This is the 'procurement paradox'—a new reality that demands a more intelligent approach to sourcing, beginning with a disciplined make-vs-buy analysis.

With producer prices remaining elevated and manufacturing sentiment subdued, leadership cannot afford to rely on outdated sourcing playbooks. AI provides the necessary supply chain visibility and predictive cost models to navigate this complexity, transforming procurement from a reactive cost centre into a proactive value-creation function.

This represents a fundamental shift. German make-vs-buy decisions are under immense pressure as material costs consume a large portion of turnover, while industrial output remains approximately 10% below pre-COVID levels as of early 2025. According to Roland Berger, more intelligent procurement, driven by methodical make-or-buy strategies, could yield savings of up to €100 billion for German industry.

Applying AI to Your Sourcing Decisions

An AI-powered analysis transcends simple cost comparison. It provides a dynamic, multi-faceted view of the entire supply chain by integrating vast datasets—from commodity price fluctuations and supplier performance metrics to geopolitical risk assessments—and transforming this information into actionable intelligence.

This capability allows organisations to model complex "what-if" scenarios with a degree of precision unattainable through manual methods. Instead of merely asking, "What is the cost to make versus buy today?", leadership can now ask, "What is the projected total cost of ownership over five years, factoring in potential supply disruptions, currency volatility, and rising labour costs?"

By integrating predictive analytics, the make-vs-buy analysis evolves from a retrospective accounting exercise into a forward-looking strategic instrument. It enables leadership to anticipate risks and capitalize on opportunities before they fully materialize.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

From Vendor Evaluation to Strategic Acquisition

Intelligent sourcing also fundamentally transforms the 'buy' side of the decision. While a traditional vendor evaluation might focus on price, quality, and delivery timelines, an AI-enhanced process can perform a much deeper assessment. It can evaluate a supplier's financial stability, compliance history, and even their cybersecurity posture, generating a comprehensive risk profile essential for building a resilient supply chain.

Furthermore, this analysis can identify scenarios where the optimal 'buy' decision is not the procurement of a component, but the acquisition of the supplier itself. If a critical supplier possesses unique intellectual property or a highly specialized workforce, an acquisition can secure a vital capability, eliminate a supply chain vulnerability, and preempt competitors. This level of strategic thinking is a core component of effective software and asset management strategies for any modern enterprise.

By adopting an intelligent, data-driven framework, German industrial leaders can resolve the procurement paradox. The make-vs-buy analysis ceases to be a simple tactical choice and becomes a powerful lever for unlocking savings, mitigating risk, and building a more robust and competitive organisation.

Integrating Compliance and Security into the Decision

When evaluating a significant AI initiative, it is easy to become focused on technology and features. However, governance, risk, and compliance (GRC) are not secondary considerations; they must be central to the decision-making process.

For German enterprises, particularly those adhering to stringent standards such as TISAX or ISO, a failure in this domain can lead to substantial fines, reputational damage, and major operational disruption. The make-vs-buy analysis must therefore include a granular assessment of the GRC implications of both potential paths.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

Developing an AI solution internally—the 'make' route—provides maximum control. The organisation defines every aspect of the security architecture, data governance policies, and access controls. This allows for perfect alignment with internal policies and regulatory mandates.

This control, however, is accompanied by total liability. The organisation assumes the full burden of securing the system, managing data residency, passing audits, and maintaining compliance with evolving legislation like the EU AI Act. This requires a deep bench of in-house experts with proficiency in AI engineering, cybersecurity, and legal compliance.

The Trade-Off Between Control and Third-Party Risk

Opting to 'buy' fundamentally alters the risk profile. By selecting a specialized vendor, an enterprise can leverage their pre-existing security posture and certifications. A partner that already holds an ISO 27001 or TISAX credential can significantly accelerate deployment by providing a compliant foundation.

This path, however, introduces a third party into the risk ecosystem. The organisation is entrusting a critical function, and potentially sensitive corporate data, to an external entity. A security breach at the vendor becomes a breach for the client. Consequently, due diligence must be exhaustive, extending beyond marketing materials to a deep audit of their security framework. Effective third-party risk management and compliance is non-negotiable.

A vendor's compliance certificate is a starting point, not a conclusion. Your analysis must validate that their security architecture and data handling practices truly align with your specific risk appetite and regulatory obligations, especially concerning EU data privacy laws.

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

Public procurement trends in Germany provide relevant context. The nation is ahead of the EU average in innovation procurement, with a benchmark of 33.5%. However, it only implements 42.97% of recommended policy measures. For Mittelstand firms, this suggests a potential gap between ambition and execution. The decision to build or buy an AI solution could hinge on whether compliance checks are rigorous enough to avoid becoming a negative statistic. The full country report on innovation procurement policy details these dynamics.

A Vendor Security and Compliance Checklist

To structure the evaluation, your due diligence on a potential AI vendor should methodically address several critical domains. This checklist provides a framework for determining whether a 'buy' option will enhance or compromise your organisation's integrity.

- Data Governance and Residency: Where will our data be stored, processed, and backed up? Can the vendor contractually guarantee data residency within the EU to comply with GDPR?

- Access Control and Authentication: What are their identity and access management (IAM) protocols? Do they support multi-factor authentication (MFA) and role-based access control (RBAC) that can integrate with our existing systems?

- Certifications and Audits: Can they provide current ISO 27001, SOC 2, or industry-specific certifications like TISAX? Are they willing to share third-party audit reports and penetration testing results?

- Incident Response and Business Continuity: What is their documented plan for security incidents? What are their stated recovery time objectives (RTO) and recovery point objectives (RPO) in the event of an outage?

- Contractual Liability and Data Ownership: Does the contract explicitly define data ownership, permissible uses of data, and liability in the event of a breach?

Ultimately, integrating GRC into your make-vs-buy analysis is an exercise in risk allocation. The 'make' choice internalizes risk but provides full control over its management. The 'buy' choice offloads development but necessitates continuous management and monitoring of third-party risk. The correct decision depends on which of these risk profiles your organisation is better equipped to manage.

Exploring Co-Creation as a Hybrid Sourcing Model

The traditional 'make' versus 'buy' dichotomy often presents a false choice. It overlooks a third, more strategic alternative that combines the benefits of both: co-creation. This model is best understood not as a vendor relationship, but as a strategic partnership.

This model is particularly effective when exploring novel, AI-first business concepts. It allows an enterprise to leverage the external expertise and agility of the 'buy' model while retaining the customisation, control, and intellectual property ownership associated with the 'make' model.

Defining the Co-Creation Partnership

A co-creation partner is distinct from a conventional supplier or consultant. They operate as a peer, sharing accountability for business outcomes and driving the project forward with entrepreneurial velocity.

This approach is transformative for large German enterprises that must innovate but cannot justify the significant overhead of establishing a dedicated internal venture. The right partner functions as an extension of the internal team, providing specialized AI engineering and product management capabilities that are not available in-house.

At its core, co-creation is about shared risk and shared reward. It transforms the make-vs-buy analysis from a simple procurement decision into a strategic alliance designed to de-risk innovation and accelerate time-to-market.

The organisation is not merely outsourcing a task; it is insourcing an entrepreneurial mindset and a highly specific skillset. It bridges the gap between a high-level strategic vision and a tangible, production-ready product.

The Strategic Advantages of Co-Creation

For innovation leaders, this hybrid model addresses several common challenges. It provides a mechanism for rapidly validating business cases, progressing from a conceptual model to a functional prototype in weeks, rather than quarters.

This velocity is a significant competitive advantage. It enables the testing of market assumptions with a real product before committing millions in capital to a full-scale internal build. The primary benefits include:

- Accelerated Time-to-Value: Drastically reduces the time required to test a hypothesis and launch a minimum viable product (MVP), enabling faster learning and iteration cycles.

- De-Risking Innovation: By sharing the development burden, the financial and operational exposure of ambitious new AI projects is minimized.

- Capability Building: The collaborative process facilitates knowledge transfer, upskilling internal teams throughout the engagement.

- IP Ownership: Unlike a standard 'buy' decision, a co-creation agreement can be structured to ensure the enterprise retains the intellectual property for the final product.

Ultimately, this collaborative approach reframes the make-vs-buy analysis for complex AI initiatives. It provides a structured, capital-efficient methodology for building new capabilities and business models. Instead of being constrained by the slow, capital-intensive 'make' option and the rigid 'buy' option, co-creation offers a dynamic third path. It blends external agility with internal strategic control, providing ambitious AI ventures with the optimal conditions for success.

Burning Questions on AI Sourcing

Embarking on AI initiatives invariably raises challenging strategic questions for the leadership team. A robust make vs. buy analysis provides a framework for answering them, but several key inquiries consistently arise in executive discussions. Addressing these upfront ensures the final decision is sound, defensible, and creates long-term enterprise value.

Here, we address the most common questions managers and C-level executives face when deciding between building a proprietary AI solution and procuring one. The answers are informed by our direct observations within the German corporate landscape.

What’s the Most Overlooked Factor in a Make vs. Buy Analysis?

The most frequently overlooked factor is rarely the initial cost. It is the long-term maintenance and evolution of the AI system. An AI model is not a static asset; it requires continuous monitoring, retraining with new data, and performance tuning to remain effective.

Under a 'make' scenario, this entire lifecycle is the responsibility of your team. The budget must account for these ongoing operational costs—managing data pipelines, monitoring for model drift, and retaining the specialized talent required to prevent performance degradation. This commitment extends far beyond the initial project scope and budget.

How Should We Really Evaluate the IP Risk of Buying an AI Solution?

When procuring an AI solution, the primary intellectual property risk pertains to your data. It is imperative to conduct a forensic review of the vendor’s contract to understand precisely how your corporate information will be utilized.

Clear answers to the following questions are essential:

- Data Usage: Is the vendor permitted to use your anonymized data to train their models for the benefit of other clients?

- Data Exclusivity: Do you retain exclusive ownership of the insights and models trained specifically on your proprietary data?

- Exit Strategy: What is the documented process for securely extracting your data and any custom models if you terminate the contract?

A vendor’s standard contract is designed to protect their interests, not yours. Securing contractual terms that protect your data as a core strategic asset is non-negotiable. This is a critical pass/fail criterion in the ‘buy’ evaluation.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

When Does a Hybrid or Co-Creation Model Actually Make Sense?

A hybrid or co-creation model is most appropriate when the objective is to create a new-to-world, AI-first business model where the path to market is not yet fully defined. It is the ideal structure for corporate ventures or innovation hubs tasked with developing new revenue streams.

This approach allows the enterprise to combine its deep domain expertise with a partner's specialized AI engineering capabilities. It is an intelligent methodology for de-risking the entire venture, enabling rapid prototyping and market testing while ensuring the enterprise retains ownership of the resulting intellectual property and builds internal competencies for the long term.

At Reruption GmbH, we act as "Co-Preneurs for the AI Era," partnering with German industrial leaders to turn ambitious ideas into market-ready innovations. We share accountability for business outcomes, blending entrepreneurial speed with methodical de-risking to build your next competitive advantage. Discover our approach at https://www.reruption.com.