For C-level executives in Germany, the term Tax Compliance Management System (TCMS) represents a critical shift from a technical concept to a cornerstone of corporate governance. A TCMS is not merely software; it is a structured framework of principles and controls engineered to ensure an organisation meets its fiscal obligations with precision and punctuality. It functions as the primary defense against significant legal and financial liabilities.

The Strategic Imperative for a Tax Compliance Management System

In Germany's rigorous regulatory landscape, managing tax compliance through manual processes is an unacceptable risk. Tax authorities are rapidly digitising enforcement, and the mandate for e-invoicing is imminent. For any large enterprise, reliance on spreadsheets and fragmented workflows is no longer merely inefficient—it poses a direct threat to financial stability and corporate reputation.

A modern TCMS transforms the tax function from a reactive cost center into a data-driven, strategic asset. It provides the C-suite with the requisite control and foresight to navigate complex regulations confidently, a vital component of operational resilience.

From Operational Burden to Strategic Asset

Implementing a robust TCMS delivers distinct strategic advantages that resonate at the board level. The benefits extend beyond automation to address core executive concerns:

- Mitigated Liability: It establishes a documented, auditable trail that demonstrates due diligence. In a tax audit, this can be the decisive factor in averting severe penalties.

- Enhanced Governance: A TCMS systematises all tax-related processes, embedding compliance within the corporate structure and aligning it with the broader strategy for effective risk management and compliance.

- Operational Resilience: By automating data collection, validation, and reporting, it reduces dependency on key individuals and minimises the risk of human error. Tax processes maintain continuity under any circumstances.

- Data-Driven Foresight: A centralised system provides executives with a real-time, consolidated view of the company's tax position, enhancing the accuracy of forecasting and the reliability of strategic financial planning.

The adoption of formal TCMS frameworks is a significant factor in audit outcomes for German corporations. Industry analysis reveals a marked increase in large German firms with documented TCMS programs. Crucially, German tax authorities now increasingly view such systems as a mitigating factor when assessing negligence.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

A well-implemented TCMS serves as the internal control system for all tax-related activities. It is management's definitive statement that the organisation takes its fiscal duties seriously, providing a strong, defensible position against accusations of gross negligence.

To fully grasp the available options, it is beneficial to explore the various top compliance management solutions that cater to diverse business requirements. Ultimately, a TCMS is an investment in stability, providing a framework to manage tax proactively, transparently, and with complete, demonstrable control.

The Architecture of a Modern TCMS

A modern Tax Compliance Management System (TCMS) is best understood not as standalone software, but as the central nervous system of an organisation's financial health. It is an interconnected architecture of specialised modules, each performing a critical role in delivering precision, control, and strategic foresight. For senior leadership, understanding this architecture is key to appreciating its strategic value beyond simple process automation.

The system's purpose is not merely technical; it is designed to translate functional capabilities into strategic business outcomes, enabling the organisation to shift from a reactive to a proactive stance on tax management.

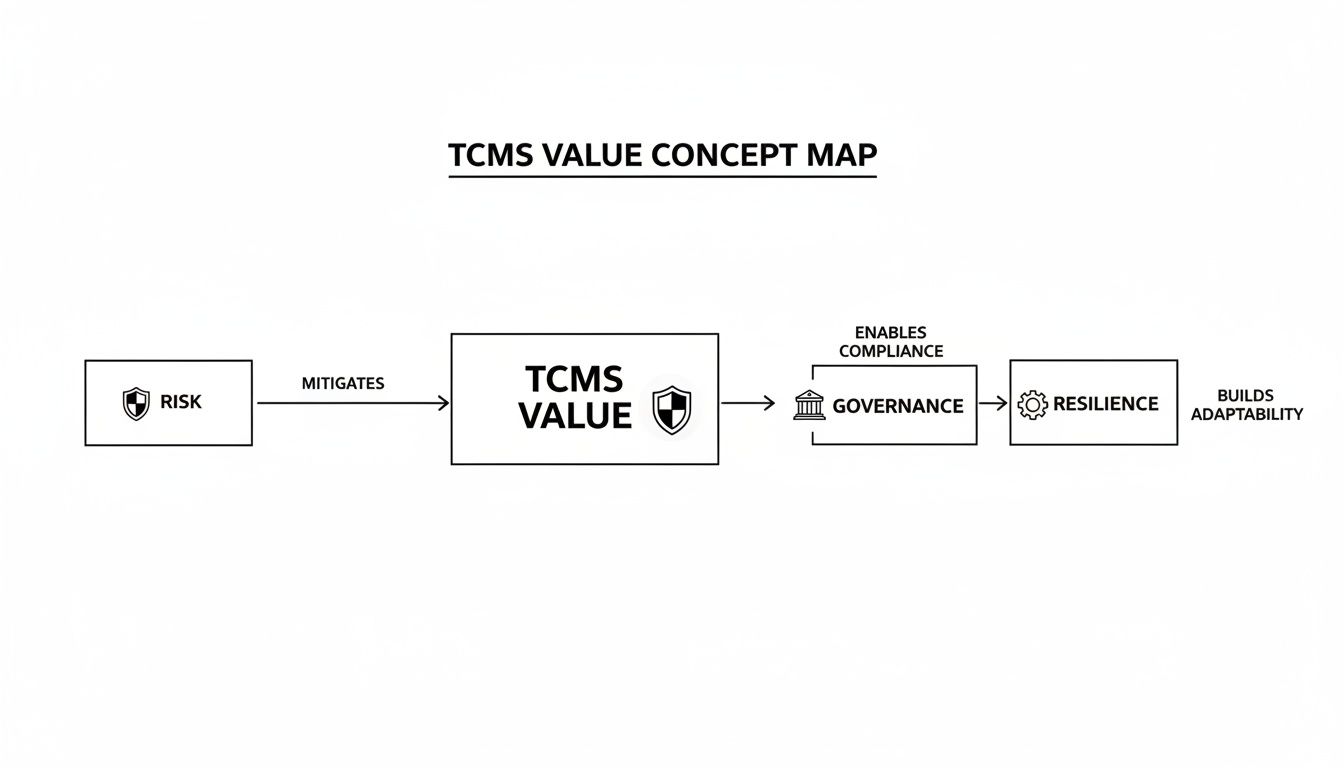

This conceptual map illustrates the core value proposition. It outlines a logical progression from risk management to enhanced governance, which ultimately fortifies enterprise-wide resilience.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

By systematically managing tax risks, an enterprise strengthens its entire governance framework. This, in turn, builds the operational resilience required to thrive in a dynamic regulatory environment.

The Core Components of a TCMS

At its core, a TCMS is constructed from four interdependent modules. These components function as a cohesive unit within the tax compliance lifecycle to create a single, auditable, and intelligent system.

The Rules Engine (The Cognitive Core): This is the system's central intelligence. It maintains a continuously updated repository of German and international tax laws, regulations, and thresholds. As transactional data enters the system, the engine interprets it against these rules, determining the correct tax treatment for thousands of transactions per second.

Data Integration Hub (The Connective Layer): This module ensures the TCMS is not an isolated data silo. It leverages robust APIs to connect directly with core business systems, most critically the ERP (e.g., SAP). This creates a seamless, real-time flow of financial data, establishing a single source of truth and eliminating the error-prone task of manual data uploads.

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

From Data Processing to Strategic Insight

While the initial components focus on data ingestion and interpretation, the strategic power of a modern tax compliance system is realised in its subsequent actions: leveraging that data to provide leadership with a clear, high-level perspective. Here, automation and analytics transform raw information into actionable intelligence.

This architecture ensures that a single invoice recorded in the ERP is correctly processed, filed, and reflected in executive-level risk reports—all without manual intervention. For any business managing multiple entities or complex supply chains, this level of integration is transformative. While legacy systems often required extensive customisation, modern approaches can avoid a complete overhaul. For further insight, one might explore strategies such as the lift and shift migration model, which focuses on migrating applications without fundamental redesign.

A TCMS provides an unassailable audit trail. Every calculation, data point, and rule application is logged, creating a transparent, chronological record. This documented proof of diligence is your strongest defense during a tax authority investigation.

The final two components complete the system:

Filing Automation Module (The Execution Engine): Once data is validated and tax liabilities are calculated, this module automates the preparation and submission of tax filings. It populates official forms and transmits them directly to the digital portals of tax authorities, ensuring all deadlines are met without exception.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

Executive Dashboards (The Strategic View): This is the C-suite's interface for monitoring the company's compliance health. It translates vast quantities of complex data into clear, visual reports on key metrics such as total tax liability, risk exposure by region, and process efficiency. It enables leadership to monitor the company’s tax position at a glance and make informed strategic decisions.

A Strategic Roadmap for TCMS Implementation

Implementing a Tax Compliance Management System (TCMS) is a significant corporate initiative, not merely an IT project. Success requires executive sponsorship from inception to ensure the final system aligns with overarching business objectives. A structured, phased roadmap enables leadership to navigate complexity, mitigate potential pitfalls, and maximise the return on this substantial investment. This serves as the C-level playbook for a value-driven rollout.

The implementation journey is best structured into four logical phases. Each phase demands specific leadership decisions and oversight to guide the project from concept to a fully operational asset that delivers tangible value. Expediting the initial stages almost invariably leads to costly rework and user dissatisfaction.

Phase 1: Strategic Scoping and Business Case Development

Before evaluating vendors or technologies, it is imperative to define the strategic intent. What specific business challenges will the TCMS address? Is the primary objective risk mitigation, operational efficiency, or enhanced data for strategic decision-making?

This initial phase focuses on building a strong internal coalition. Key stakeholders from finance, legal, IT, and operations must collaborate to define requirements and, critically, quantify the expected benefits. The deliverable is a robust business case that justifies the investment with a clear, measurable ROI, facilitating board approval and budget allocation.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

Key leadership actions:

- Champion the Vision: Articulate why a modern tax compliance management system is essential for the organisation's future, linking it directly to enhanced governance and risk management.

- Assemble a Cross-Functional Team: Appoint a project lead and ensure every impacted department is represented. This fosters a powerful sense of shared ownership.

- Define Success Metrics: Establish the key performance indicators (KPIs) that will be used to measure success, such as a reduction in audit penalties or accelerated financial closing cycles.

Phase 2: Vendor Selection and Architectural Design

With a clear mandate, the focus shifts to selecting the right technology partner and defining the system architecture. This process transcends a simple feature-to-feature comparison. The goal is to identify a strategic partner with deep expertise in German tax law and a proven track record of successful integrations with complex ERPs like SAP.

During this phase, technology and finance teams collaborate to map data flows and define how the new system will integrate with existing infrastructure. The objective is to create a single source of truth for all tax data, eliminating disparate spreadsheets and manual reconciliations. This ensures the TCMS strengthens, rather than disrupts, the financial architecture. To fully leverage system connectivity, leaders should also explore how to automate financial reporting to create a seamless data ecosystem.

Phase 3: Phased Deployment and Change Management

A "big bang" implementation is inherently risky. A phased rollout, commencing with a single business unit or a specific tax type (e.g., VAT), is the more prudent approach. This allows the team to secure early successes, learn from the initial deployment, and build momentum for the broader rollout.

This phase is also where change management becomes paramount. A technologically superior system is ineffective without user adoption. Leadership must proactively communicate the benefits of the new system, provide comprehensive training, and address the concerns of end-users.

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

Successful TCMS implementation depends as much on managing people as it does on managing technology. Executive communication that frames the system as a tool to empower employees, not replace them, is critical for driving enthusiastic adoption and realising the platform's full potential.

Phase 4: Ongoing Optimisation and Value Realisation

The system's launch is not the final milestone but the beginning of a continuous improvement cycle. This final phase centers on tracking the KPIs defined in Phase 1 to demonstrate the system's business impact.

Establish regular review meetings to analyse performance data, gather user feedback, and identify opportunities for optimisation. This may involve refining automated workflows, expanding the system to new jurisdictions, or exploring advanced features like AI-powered risk prediction. By demonstrating tangible ROI, the TCMS solidifies its position as an indispensable strategic asset.

How AI Elevates Your Tax Compliance Management System

A traditional Tax Compliance Management System (TCMS) is a meticulous record-keeper, invaluable for documenting processes and ensuring auditability. The integration of Artificial Intelligence (AI), however, transforms this system from a passive repository into a proactive, intelligent partner.

AI enables the tax function to move beyond historical reporting to predictive analysis, providing an early warning system for potential compliance risks.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

The objective is not to replace tax experts, but to augment their capabilities. AI acts as a force multiplier, automating high-volume, repetitive tasks and freeing specialists to focus on high-value strategic analysis and critical decision-making. This represents a fundamental shift from reactive problem-solving to proactive risk management.

From Manual Review to Predictive Analytics

The primary advantage of integrating AI into a TCMS lies in its capacity for data analysis at a scale unattainable by human teams. Machine learning models can analyse millions of transactions, identifying subtle patterns and anomalies that would otherwise go undetected.

This capability delivers several immediate strategic benefits:

- Predictive Risk Scoring: AI algorithms analyse historical audit data and current transaction flows to flag entities or transaction types with the highest risk of non-compliance. This enables the targeted allocation of internal audit resources.

- Automated Anomaly Detection: The system identifies red flags in real time. An invoice with a mismatched VAT rate or a potential duplicate payment, for example, is instantly quarantined for review, preventing errors from entering the financial records.

- Tax Liability Forecasting: By analysing sales data, seasonal trends, and macroeconomic indicators, AI can generate highly accurate forecasts of future tax liabilities. This provides the C-suite with a clearer financial outlook for cash flow management and strategic planning.

A prerequisite for success is clean data ingestion. Understanding the principles of automating data entry with AI is essential for reducing manual effort and ensuring the AI models are trained on high-quality data.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

An AI-enhanced TCMS does not just follow rules; it actively learns from your data. The system becomes more intelligent over time, continually refining its risk detection models and improving predictive accuracy in a cycle of continuous improvement.

The following table illustrates the evolution of TCMS capabilities with the integration of AI, transforming it from a passive tool into an active strategic asset.

Evolution of TCMS Capabilities with AI Integration

| Core Functionality | Traditional TCMS Capability | AI-Enhanced TCMS Capability | Strategic Business Benefit |

|---|---|---|---|

| Data Validation | Manual spot-checks or rule-based scripts on data samples. | Real-time, continuous validation of 100% of transactions against complex rules and historical patterns. | Drastically reduces error rates and prevents compliance breaches before they occur. |

| Risk Identification | Relies on historical audit findings and manual expert reviews. | Predictive risk scoring models that dynamically flag high-risk transactions, vendors, or regions. | Enables proactive resource allocation; focuses expert attention on genuine threats. |

| Reporting | Generates static, historical reports for compliance filing. | Dynamic, forward-looking dashboards with liability forecasts and "what-if" scenario modeling. | Empowers strategic financial planning and provides leadership with actionable insights. |

| Audit Support | Provides a documented audit trail, requiring manual data retrieval. | Automatically generates comprehensive audit packages with flagged anomalies and suggested explanations. | Reduces audit preparation time by over 50% and lowers the risk of penalties. |

AI fundamentally elevates the value proposition of a TCMS, transforming a cost center into a source of competitive advantage.

Navigating Germany’s E-Invoicing Mandate with AI

The strategic value of an AI-enhanced TCMS is particularly evident in the context of new regulations such as Germany's mandatory e-invoicing. Driven by the Growth Opportunities Act, this reform represents a paradigm shift. From 1 January 2025, all German businesses must be capable of receiving structured e-invoices, with the requirement to issue them for B2B transactions being phased in through 2028.

This is not a minor update; it necessitates a significant overhaul of ERP and accounting systems.

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

AI is an essential tool for navigating this transition. AI-driven validation engines can instantly check incoming e-invoices against complex regulatory formats and internal purchasing data, flagging discrepancies immediately. Without this intelligent automation, the volume and complexity of structured data would create a significant operational bottleneck.

The use of AI for sensitive financial data raises critical security considerations. Protecting these systems from adversarial attacks and ensuring data integrity is a board-level responsibility. Leaders must implement a robust strategy for audit-proof enterprise AI security to safeguard these new critical assets.

When implemented correctly, an AI-powered tax compliance management system becomes more than a compliance tool—it becomes a strategic instrument, converting regulatory change into a competitive advantage through superior efficiency and control.

Building the Business Case for a TCMS Investment

Securing board approval for a major technology investment requires a compelling business case grounded in quantitative analysis. A Tax Compliance Management System (TCMS) is no exception. The discourse must focus on Return on Investment (ROI), articulated through direct cost savings, operational efficiencies, and strategic advantages.

A robust business case for a tax compliance management system is built on three pillars: direct cost savings, quantifiable operational improvements, and strategic benefits that enhance corporate resilience and competitiveness. This framework provides leadership with a comprehensive understanding of the investment's total value.

Quantifying the Financial Impact

Tangible cost savings are the most direct way to demonstrate financial value. These figures represent real capital preserved and risks averted.

Focus on these specific areas:

- Reduced Penalties and Interest: This is the primary financial driver. Quantify penalties paid for late filings, calculation errors, and audit adjustments over the past three to five years. A TCMS is engineered to eliminate these costs by ensuring accuracy and timeliness, converting an unpredictable expense into a controlled variable.

- Optimised Staffing and External Advisor Costs: Calculate the hours your most skilled tax experts spend on manual tasks such as data entry, reconciliation, and report generation. Automation frees these specialists for high-value strategic work, effectively increasing the productivity of the existing team without additional headcount.

Gaining Operational Excellence

Beyond direct savings, a TCMS delivers a level of efficiency that accelerates core financial operations and improves data integrity. These enhancements strengthen the finance function's operational backbone, making it faster and more reliable.

Demonstrate this through process-based metrics. Measure the time required for the monthly financial close and the error rate identified in internal reviews. A TCMS can reduce closing cycles by several days and virtually eliminate manual errors by automating data extraction and validation. This translates to more accurate financial reporting, delivered faster. Further insights on integrating such critical systems can be found in our guide on software and asset management.

The strategic value of a TCMS lies in its ability to transform tax data from a historical record into a forward-looking asset. This provides leadership with enhanced foresight for financial planning and a demonstrable commitment to best-in-class corporate governance.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

Measuring Strategic and Governance Value

The third pillar is the strategic advantage, which, while more difficult to quantify, is often decisive. This involves positioning the TCMS as a cornerstone of the company’s governance, risk, and compliance (GRC) framework. The system creates a complete, immutable audit trail, demonstrating to tax authorities and stakeholders a commitment to regulatory adherence.

The regulatory environment, particularly in Germany, is digitising rapidly. The EU's DAC8 and the OECD's CRS 2.0 reforms are imposing substantial new reporting requirements. In 2023, over 8,000 German institutions managed data for accounts valued at approximately €850 billion. Forthcoming regulations for digital assets could add another €10–15 billion in reported assets annually. This volume of data is unmanageable through manual processes. For a detailed analysis, refer to the insights on Germany’s evolving digital tax compliance on taxdo.com.

A TCMS is no longer a discretionary tool but essential infrastructure for managing this complexity. It transforms a compliance challenge into a controlled, predictable process.

Key Performance Indicators for Measuring TCMS ROI

| Metric Category | Key Performance Indicator (KPI) | Measurement Method |

|---|---|---|

| Financial Savings | Reduction in Penalties & Interest | Compare pre- and post-TCMS annual costs related to tax non-compliance penalties and interest payments. |

| Financial Savings | Decrease in External Advisor Spend | Track consultancy and external audit fees before and after implementation. |

| Operational Efficiency | Time to Close Tax Books | Measure the average number of days required to finalise tax reporting each period. |

| Operational Efficiency | Reduction in Manual Error Rate | Quantify the percentage decrease in errors found during internal reviews and audits. |

| Risk & Governance | Audit Issue Resolution Time | Calculate the average time taken to respond to and resolve tax authority inquiries and audit findings. |

| Team Productivity | Hours Reallocated to Strategic Tasks | Survey the tax team to estimate the number of hours per week shifted from manual compliance to value-added analysis. |

By tracking these KPIs, you can build a living business case that not only justifies the initial investment but also demonstrates the ongoing value the TCMS delivers. It shifts the conversation from cost to strategic enablement.

The Boardroom Q&A: Your Top Questions Answered

As a leader, you require direct answers, not technical jargon. Here are the most common questions from the C-suite regarding the implementation of a Tax Compliance Management System.

Why Do We Need to Invest in a TCMS Right Now?

The regulatory landscape has fundamentally changed. German tax authorities are rapidly digitising, and with mandates like e-invoicing effective from 2025, legacy processes—spreadsheets, manual checks, and paper-based workflows—are obsolete and present a significant operational risk.

Attempting to maintain compliance manually is no longer viable. A TCMS automates the entire process, transforming a high-risk, labor-intensive function into a controlled and predictable component of corporate governance. This is about proactively adapting to the new environment, not merely reacting to it.

How Does This Integrate with Our Current ERP System?

A modern TCMS is designed as a natural extension of your existing infrastructure, not a disruptive standalone system. It connects directly with your current ERP, whether it is SAP or Oracle, using certified APIs to pull financial data in real-time.

Think of it as creating a closed-loop system. The ERP manages transactions, and the TCMS instantly analyses them, applies the correct tax rules, and feeds insights back. This eliminates manual data transfers and ensures data integrity.

This tight integration ensures your tax compliance management system operates from a single source of truth—your ERP—without disrupting core financial operations.

What Team is Required to Operate This System?

While a dedicated project team is necessary for the initial implementation, ongoing operation does not require a significant increase in headcount. The system's core purpose is automation. It manages routine tasks, freeing your tax experts to focus on strategic analysis and planning.

Typically, a small team of existing tax professionals will oversee the system, manage rule updates, and serve as the primary liaison with the vendor’s support team. The objective is not to add staff but to exponentially increase the effectiveness of your current team.

At Reruption GmbH, we act as co-preneurs to help you turn strategic ideas into enterprise-ready AI innovations. We specialise in building and securing AI-powered systems that deliver measurable business outcomes. Discover how we can de-risk and accelerate your journey to an intelligent tax compliance framework at https://www.reruption.com.