In executive circles, "innovation" is often treated as an abstract ambition rather than a strategic imperative. A robust business model for innovation, however, is not a suggestion box or a peripheral project. It is a dedicated engine—a formal framework that defines precisely how your company will create, deliver, and capture value from new strategic initiatives, particularly those enabled by Artificial Intelligence.

The objective is to transform sporadic brainstorming into a repeatable, systemic process engineered for velocity and definitive market impact.

Is Your Current Innovation Framework Obsolete?

In the current technological cycle, AI-driven innovation is not merely an avenue for growth; it is a fundamental requirement for survival. For many of Germany's established industrial leaders, traditional R&D departments, while proficient at incremental improvements, are often ill-equipped to capitalize on significant technological shifts. Legacy processes, optimized for efficiency and predictability, can inadvertently stifle the very ventures that hold the key to future market leadership.

This creates a strategic paradox. Corporations possess deep market knowledge and substantial capital, yet they are constrained by structures designed to protect the core business, not to build the next one. Consequently, they become vulnerable to smaller, more agile competitors who can bring novel solutions to market in a fraction of the time. We have documented this acceleration in our analysis of the new speed of AI implementation.

The Widening Innovation Gap in Germany

This is not a perception; it is a reality supported by data. Recent studies reveal a concerning trend among Germany's Mittelstand. Between 2021 and 2023, only 39% of all small and medium-sized enterprises (SMEs) qualified as innovators.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

While 76% of larger SMEs (with 50+ employees) introduced new products, this rate declines sharply for smaller firms, indicating a critical structural gap. A formal business model for innovation is designed to address this deficit. The detailed data is available in the full European Innovation Scoreboard country profile for Germany.

A formal business model for innovation provides the structure, governance, and accountability necessary to convert promising concepts into profitable business lines. It serves as the bridge between strategic vision and tangible market outcomes.

A dedicated innovation model resolves this corporate paralysis. It establishes a "safe-harbor" for exploration, complete with its own operational rules, funding mechanisms, and performance metrics. It provides a definitive answer to the critical question facing leadership: how do we build our future from within before an external force disrupts our market?

This framework enables three essential outcomes:

- Focused Execution: Resources are channeled effectively through a clear process for validating and scaling new ventures.

- Speed and Agility: Teams can operate outside conventional corporate bureaucracy, enabling rapid prototyping and market testing.

- Clear Accountability: It establishes unambiguous ownership of outcomes, defines how success is measured, and clarifies the criteria for either terminating or scaling a venture.

Five Strategic Models for Corporate Innovation

Selecting the appropriate vehicle to drive innovation is a critical leadership decision. A model that succeeds in a software firm may fail catastrophically in a hardware-centric industrial enterprise. The correct approach requires a deliberate choice of structure that aligns with strategic objectives, corporate culture, and risk appetite.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

This is not a theoretical exercise. Germany leads Europe in corporate innovation investment, at 143.4% of the EU average. With industry investing €88.7 billion in R&D in 2023, there is immense pressure to convert this capital into market impact. A structured business model for innovation ensures this investment yields returns—a crucial step for reversing the country's recent decline in global innovation rankings. The underlying data can be found in the full BDI Innovation Indicator report.

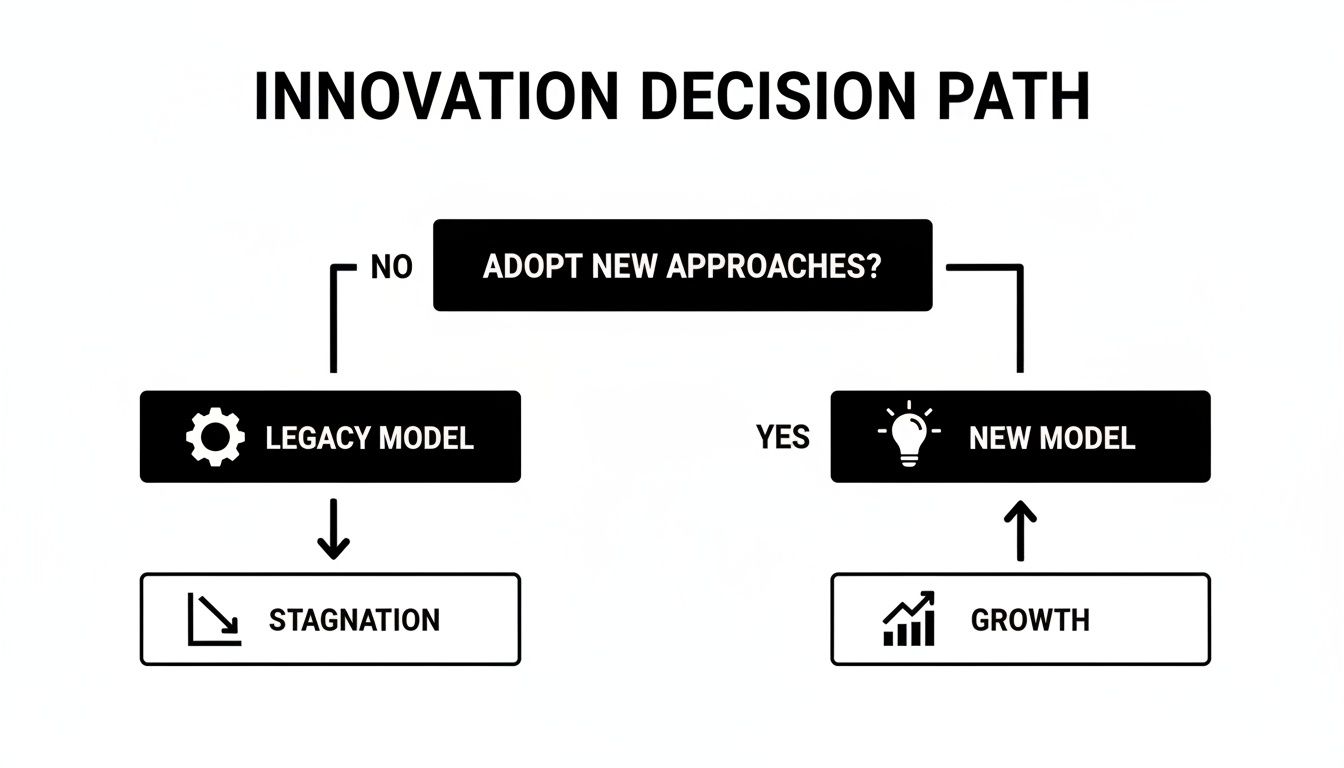

The flowchart below illustrates the strategic choice facing corporate leaders.

The implication is clear: adherence to legacy models leads to stagnation. The direct path to sustainable growth lies in adopting a new, structured model for innovation. Let's analyze five principal models to guide your strategic decision-making.

1. Corporate Venture Building

Corporate Venture Building involves the creation of an independent startup, funded and supported by a parent company. This model transcends simple investment; it is an act of co-creation. The parent corporation actively provides resources, market access, and strategic guidance to build the venture from inception.

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

This model is ideal for exploring new markets or disruptive technologies that are too radical for the core business to absorb. By operating as a separate entity, the venture gains the speed and agility of a startup while leveraging the parent's "unfair advantages," such as brand credibility and established customer relationships. We explore this concept in our guide on how corporate innovators can leverage their unfair advantages.

2. Strategic Spin-Offs

A strategic spin-off occurs when a mature internal project or business unit is established as a standalone company. This is a logical move when an innovation has proven its value but operates on a business model fundamentally different from the core organization.

This strategy is a powerful method for unlocking the full commercial potential of a non-core asset. A spin-off can attract specialized talent, secure external funding, and pursue a tailored market strategy without the constraints of corporate bureaucracy. Bosch executed this model effectively with its eBike systems division, enabling it to dominate a new market segment with agility.

3. Internal Productisation

Internal Productisation represents the classic approach: a new concept is developed and launched as a product or service from within an existing business unit. This is the preferred model for innovations that are adjacent or complementary to the company's current offerings.

Its primary advantage lies in leveraging existing assets. The new product can utilize established sales teams, distribution channels, and brand recognition, thereby reducing go-to-market costs and risks. A quintessential example is a manufacturing firm developing AI-powered predictive maintenance software for the machinery it produces.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

The objective is not to select a model from a template but to align the model with strategic intent. Are you defending your core business, entering an adjacent market, or creating an entirely new one? The answer dictates the appropriate structure.

4. Platform and Ecosystem Plays

In this model, the innovation is not a single product but a foundational technology or platform upon which other companies can build. Value is generated not just by the platform owner but by the entire ecosystem of partners, developers, and users who contribute to it.

This is a high-risk, high-reward strategy for companies aiming to establish market leadership in a new technological domain. It requires significant upfront investment and a long-term vision to cultivate a thriving community. We are observing this approach more frequently among German industrial giants for IoT and smart factory solutions, as they seek to create the standardized systems that will underpin entire industries.

5. Service and Subscription Models

The final model focuses on shifting from one-off product sales to offering recurring services or subscriptions. This is particularly potent for industrial and hardware companies seeking to create new, stable revenue streams by "servitising" their products.

Instead of selling a machine, a company sells "guaranteed machine uptime as a service," supported by AI-powered monitoring and maintenance. This approach fosters stronger customer relationships, generates predictable revenue, and builds a competitive moat based on service quality rather than product specifications alone.

Comparative Analysis of Innovation Models

To synthesize these concepts, the following table provides a side-by-side comparison of the five models across key criteria relevant to C-level decision-makers. It serves as a high-level guide for evaluating the trade-offs between speed, cost, and strategic alignment.

| Innovation Model | Best For | Speed to Market | Capital Intensity | Integration with Core |

|---|---|---|---|---|

| Corporate Venture | Exploring disruptive, non-core opportunities | High | High | Low |

| Strategic Spin-Off | Unlocking value from proven, non-core assets | Medium | Low (post-spin) | Low |

| Internal Productisation | Enhancing or extending core business offerings | Low | Medium | High |

| Platform/Ecosystem | Achieving market leadership in new domains | Low | Very High | Medium |

| Service/Subscription | Creating recurring revenue from core products | Medium | Medium-High | High |

Each model represents a distinct path with its own challenges and rewards. The optimal choice depends entirely on aligning the model's characteristics with your company's strategic ambition and operational reality.

Establishing Effective Governance and Funding

A brilliant innovation model on a whiteboard is destined to fail without a robust operational backbone. After selecting a strategic model, the critical work begins: constructing the governance and funding structures that enable it to function and grow. This is where the vision for a new business model for innovation confronts the reality of corporate budgets and decision-making processes.

Success requires a fundamental mindset shift. Innovation initiatives cannot be treated as standard cost centers, subject to conventional budget cycles. A venture capital mindset is required. This means protecting nascent ventures from corporate bureaucracy while holding them accountable to a new set of metrics—metrics focused on validated learning and risk mitigation, not immediate profitability.

Architecting the Right Funding Mechanisms

Funding an innovation project is not a singular event but an evolutionary process that must parallel the venture's development. The traditional annual budget cycle is too slow and rigid for the dynamic, iterative nature of innovation. A more entrepreneurial approach to funding is essential.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

Effective mechanisms are designed to fuel progress while managing financial exposure, ensuring capital is allocated based on demonstrated learning, not initial assumptions.

- Ring-Fenced Budgets: This entails setting aside a specific pool of capital exclusively for innovation. This fund is shielded from the quarterly pressures and budget reallocations of the core business, providing innovation teams with the stability required for long-term thinking.

- Milestone-Based Financing: This approach, borrowed from the venture capital industry, releases funds in tranches contingent upon the achievement of pre-agreed milestones. These are not revenue targets but learning objectives, such as validating a core customer problem, shipping a minimum viable product (MVP), or achieving initial user engagement.

- Dedicated Corporate Venture Capital (CVC): For companies serious about building an ecosystem, a formal CVC arm is a powerful instrument. It provides a structured vehicle for investing in external startups, serving as a valuable source of market intelligence and potential future acquisitions.

Viable ideas require a sound business model and appropriate financial backing. It is often beneficial to engage with specialized innovation management investors who understand this unique asset class.

Redefining P&L Accountability and Metrics

This is the point where most corporate innovation efforts falter. A new venture cannot be evaluated using the same financial metrics applied to a mature business unit. Applying standard ROI and P&L criteria to an early-stage concept is the most efficient way to terminate it, as it forces teams to prematurely chase revenue and stifles necessary experimentation.

The objective of early-stage innovation is not profit; it is validated learning. Accountability must shift from financial returns to the speed and effectiveness with which a team can prove or disprove its core hypotheses.

Instead of conventional KPIs, the governance board requires a new dashboard. We delve deeper into managing these operational challenges in our guide on risk, compliance, and governance for new ventures.

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

Key innovation metrics to track include:

- Validation Speed: How quickly is the team testing its primary assumptions about the customer, the problem, and the solution? This is a direct measure of operational agility.

- Customer Discovery Milestones: Has the team conducted sufficient interviews with target users? Have they identified a clear, underserved segment with genuine interest?

- Prototype Efficacy: Does the prototype effectively solve the intended problem? This requires real user feedback and engagement data, not internal opinions.

Creating a Lean and Empowered Governance Board

The term "corporate governance" often evokes images of slow, bureaucratic committees—the antithesis of innovation. To counteract this, innovation ventures require their own dedicated, lean governance board, or "Innovation Council."

This council should be a small group of senior leaders empowered to make substantive decisions in days, not months. Their role is not micromanagement but to act as coaches and gatekeepers for milestone-based funding. They ask challenging questions, remove internal roadblocks, and ensure the project remains aligned with broader corporate strategy, all while protecting it from the corporate "immune system" that often rejects novel ideas.

This structure integrates speed, strategic alignment, and intelligent capital allocation.

Measuring Innovation Velocity Instead of ROI

Traditional corporate metrics are designed to optimize existing, predictable business models. While effective for the core business, applying these same metrics—Return on Investment (ROI), profit margins, five-year revenue forecasts—to a new venture is counterproductive. Promising concepts are often prematurely terminated before they have a chance to mature.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

An effective business model for innovation requires a fundamentally different approach to measuring progress. It necessitates replacing lagging financial indicators with leading indicators of learning and forward momentum.

This new approach centers on velocity—the speed at which a team can test its assumptions and reduce uncertainty. It provides executives with a real-time dashboard reflecting genuine progress, de-risking investment by focusing on tangible, evidence-based milestones rather than speculative financial models.

Shifting from Financial to Learning-Based Metrics

To be clear: the objective of an early-stage innovation unit is not to generate profit. It is to discover a repeatable and scalable business model. Its performance must be measured against this objective. This means tracking the speed and quality of learning, which are the most reliable predictors of future success.

Here are three essential velocity metrics to incorporate into your innovation dashboard, replacing outdated financial KPIs.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

- Time-to-First-Prototype: How long does it take to move from a concept to a tangible artifact that a user can interact with? This is a raw indicator of a team's ability to execute and concretize abstract ideas rapidly.

- Hypothesis-Validation Rate: This tracks the number of core assumptions—regarding the customer, problem, and solution—that the team tests each week or month. A high rate indicates the team is actively replacing speculation with market evidence. They are learning, not just building.

- Customer-Problem-Fit Score: This is a qualitative metric, typically captured through structured interviews and surveys. It answers the critical question: how acutely does our target customer experience the problem we aim to solve? A high score indicates you are addressing a genuine market need.

These metrics reframe the entire conversation. The focus shifts from "How much revenue will this generate?" to "What have we learned, and how quickly are we learning it?" This shift is fundamental to creating a culture where rapid experimentation is not merely tolerated but required. A structured process like our 21-Day AI Delivery Framework is architected around this principle of achieving tangible, validated outcomes with speed.

Putting Velocity Metrics into Practice

Consider a new venture within a large logistics firm tasked with developing an AI-powered route optimization system.

The Traditional Approach (and its inherent flaws):

The team would be required to generate a five-year revenue projection. Their performance would be judged against quarterly cost-saving targets, pressuring them to deploy an unproven, incomplete system. The project would likely fail to deliver and be terminated within a year.

The Velocity-Based Approach (designed for success):

Here, the team’s success is measured differently across distinct phases.

- Phase 1 Goal: Validate the core problem with dispatch managers.

- Metric: Complete 20 in-depth interviews within three weeks.

- Success Criteria: Achieve a Customer-Problem-Fit Score of 8/10 or higher.

- Phase 2 Goal: Build and test a functional prototype.

- Metric: Time-to-First-Prototype is under six weeks.

- Success Criteria: The AI model achieves 95% predictive accuracy in simulated environments.

- Phase 3 Goal: Onboard initial users.

- Metric: Onboard three pilot dispatch teams within one month.

- Success Criteria: Pilot teams voluntarily use the system for 80% of their daily tasks.

This milestone-driven approach fundamentally alters funding dynamics. Investment is tied to the successful validation of key assumptions, not to a calendar date. Governance transitions from a bureaucratic hurdle into a strategic partnership focused on learning.

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

By adopting velocity metrics, leadership gains a far more accurate and forward-looking view of the innovation portfolio. You cease funding projects based on persuasive spreadsheets and instead back teams that demonstrate the ability to learn and adapt most rapidly. This is the only way to build a sustainable engine for growth.

Scaling Your Venture from Prototype to Profit

Successfully incubating an innovation is a significant achievement, but it is only the first stage. The true test lies in transitioning a validated prototype into a profitable, scalable business unit. This is a common point of failure.

Many promising ventures become trapped in 'pilot purgatory'—a state where a concept proves its value on a small scale but is never scaled to make a meaningful impact.

The critical question for leadership is: what is the next step? Should the venture be reintegrated into the parent company, or should it be spun out as a separate entity? There is no single correct answer. The decision depends on the venture's strategic objective. Is its purpose to defend the core business or to penetrate a new market?

A structured approach to this decision is key to navigating the next growth phase. Without it, even successful innovations risk becoming forgotten experiments rather than powerful new revenue streams.

Overcoming the Corporate Immune System

A primary obstacle for new ventures is the ‘corporate immune system’—the inherent tendency of a large organization to reject anything that deviates from established norms.

The very systems designed to protect the core business—rigid budgeting cycles, standardized HR policies, and cautious legal reviews—can suffocate a nascent venture.

A structured partnership, such as our Co-Preneur model, can act as a protective shield, helping the venture navigate internal politics, secure necessary resources, and maintain momentum. This is particularly crucial in the initial stages. You can read more about staying lean and agile in a corporate venture’s early years in our guide.

The objective is not to isolate the venture indefinitely, but to protect it long enough to build the strength and traction required for successful integration or independent operation.

Ready to Build Your AI Project?

Let's discuss how we can help you ship your AI project in weeks instead of months.

This protection is what enables a promising concept to mature into a market-ready product.

Securing Growth Capital and Building the Team

As a venture scales, its requirements evolve. The initial seed funding is no longer sufficient; significant growth capital is now required.

Whether this capital is sourced from an internal corporate fund or external VCs, the investment case must be built on hard evidence—the validated learnings and velocity metrics gathered during incubation—not on speculative projections.

The team composition must also evolve. The small, agile team that developed the prototype may not be the same group needed to lead a large-scale sales and marketing effort. Scaling requires a dedicated growth team with specialized skills.

- Market Entry: Experts in go-to-market strategy.

- Sales and Business Development: Professionals who can build a customer base and close commercial deals.

- Operations: Specialists who can establish robust processes required for consistent delivery at scale.

The transition from a "discovery" team to an "execution" team is a common failure point. It must be managed deliberately to preserve the original vision while integrating the commercial capabilities necessary for market success.

Creating a Repeatable Scaling Process

Ultimately, a mature innovation model requires a repeatable playbook for scaling. Germany's economic landscape reveals a significant scaling gap. Large SMEs innovate at a 76% rate, compared to just 35% for smaller firms. With €129 billion invested in national R&D, the issue is not a lack of ideas but a lack of a clear path to scale.

To bridge the gap from prototype to a thriving business, a deep understanding of the profitability of apps and effective monetization models is essential. This knowledge is fundamental for building a sustainable financial future for any digital venture.

By creating a clear, structured process for governance, follow-on funding, and team-building, companies can ensure their best ideas are not left to wither. They can cultivate them into future pillars of the business.

Your Checklist for AI Innovation Execution

Translating theory into practice requires deliberate action. An effective business model for innovation is not conceived in a single workshop; it is constructed through a series of intentional decisions that align strategy with execution. This checklist serves as a practical guide for senior leaders to initiate the process or audit an existing one.

It is structured around four pillars. Use them to assess your current position and determine your next move. Each point represents a critical question your leadership team must answer to build a system that transforms AI-driven concepts into tangible growth. This is not about launching disparate projects; it is about building a repeatable, accountable engine for your company's future.

Strategic Alignment: Is Leadership Unified?

The foundation of any successful innovation effort is unwavering strategic clarity. Without it, teams will pursue divergent objectives, resources will be squandered, and promising ideas will fail due to a lack of internal support. Before any development begins, leadership must establish the strategic framework.

- What is Your Innovation Thesis? Have you explicitly defined where you will compete and, equally important, where you will not? A well-defined thesis concentrates resources on strategic priorities where you have a right to win.

- What is Your Primary Innovation Model? Based on this thesis, have you selected your primary vehicle for innovation? The decision to pursue a Corporate Venture, a Spin-Off, or an Internal Product dictates all subsequent choices regarding funding, governance, and team structure.

Execution Capability: Can You Build and Learn Rapidly?

In the current environment, speed is a critical competitive advantage. The primary differentiator between market leaders and others is the velocity at which they can progress from concept to a functional prototype for user validation. This requires an engineering culture that prioritizes learning over perfection. Your entire process must be designed around rapid feedback loops to validate or invalidate core assumptions quickly and efficiently.

Success in innovation is not about flawlessly executing a flawed plan. It is about rapidly discovering a plan that works.

This necessitates a clear methodology for rapid prototyping and developing a minimum viable product (MVP). Your teams must be empowered to test their riskiest hypotheses with real customers in weeks, not months.

Governance Framework: How Will You Govern Without Stifling Progress?

A new venture within a large corporation confronts unique challenges, from data privacy regulations to compliance requirements. Effective governance is not about adding bureaucracy; it is about de-risking the venture to enable it to move forward with confidence. You are essentially creating a "safe corridor" for innovation that protects both the new initiative and the parent company.

Want to Accelerate Your Innovation?

Our team of experts can help you turn ideas into production-ready solutions.

- What are the Data & Compliance Protocols? How will new AI ventures adhere to regulations like GDPR without being impeded by standard corporate processes?

- Who is the Decision-Making Body? Have you established a small, empowered group that can approve funding milestones and remove obstacles in days, not months?

Executive Sponsorship: Who Provides Top-Level Support?

Ultimately, even the most well-designed model will fail without dedicated champions within the business. Innovation requires visible, consistent support from senior leadership. This means more than passive approval; it requires active empowerment of teams and protection from the corporate immune system.

- Who is the Executive Sponsor? Which C-level leader is accountable for this initiative, advocating for its budget, and ensuring organizational support?

- Is the Venture Team Genuinely Empowered? What systems are in place to grant the team the autonomy it needs to operate like a startup while leveraging the parent company's assets?

Frequently Asked Questions

Adopting a dedicated innovation model inevitably raises critical questions. The following are common inquiries from leaders in medium to large German companies as they implement these new structures.

Where Should We Begin When Building a Business Model for Innovation?

The first prerequisite is a champion in the C-suite. With executive sponsorship secured, the foundational task is to articulate a clear ‘innovation thesis.’

This is not a mission statement but a strategic directive. It must specify precisely where the company will focus its innovation efforts—for example, entering new markets, enhancing operational efficiency, or launching AI-driven services. Critically, it must also define which opportunities will be intentionally ignored.

This strategic focus is paramount. Without it, innovation becomes a matter of guesswork. Only with this clarity can you select the appropriate vehicle, whether that is a corporate venture, a spin-off, or a new internal product line.

How Can We Justify Funding a Venture with No Guaranteed ROI?

The key is to shift from a departmental budget mindset to a venture capital mindset. The solution is milestone-based financing. Instead of allocating a large upfront budget, you release capital in smaller, strategic tranches as the venture demonstrates progress against predefined milestones.

This approach de-risks the company's investment. You are not funding a hypothesis; you are funding tangible progress. Each funding round is tied to validated learning—such as confirming a customer problem or securing initial pilot clients—not to a speculative financial projection.

This ensures that your financial commitment increases only as venture traction grows and uncertainty decreases.

Should Our Innovation Teams Be Kept Separate from the Main Business?

Initially, yes. A degree of separation is crucial for survival. It is necessary to create a ‘protected space’ for the new venture, shielding it from the parent company’s rigid processes, established metrics, and internal politics. The core business is optimized for execution, not for exploration and discovery.

This separation provides the team with the autonomy required to move quickly, conduct experiments, and pivot based on market feedback. The decision to reintegrate the venture into the core business or spin it out as an independent entity is a strategic choice to be made later—once the business model has been validated and you are prepared to scale.

Looking for AI Expertise?

Get in touch to explore how AI can transform your business.

At Reruption GmbH, we do not merely advise; we build alongside you as Co-Preneurs. We transform strategic concepts into market-ready innovations with the focus and velocity of a startup.